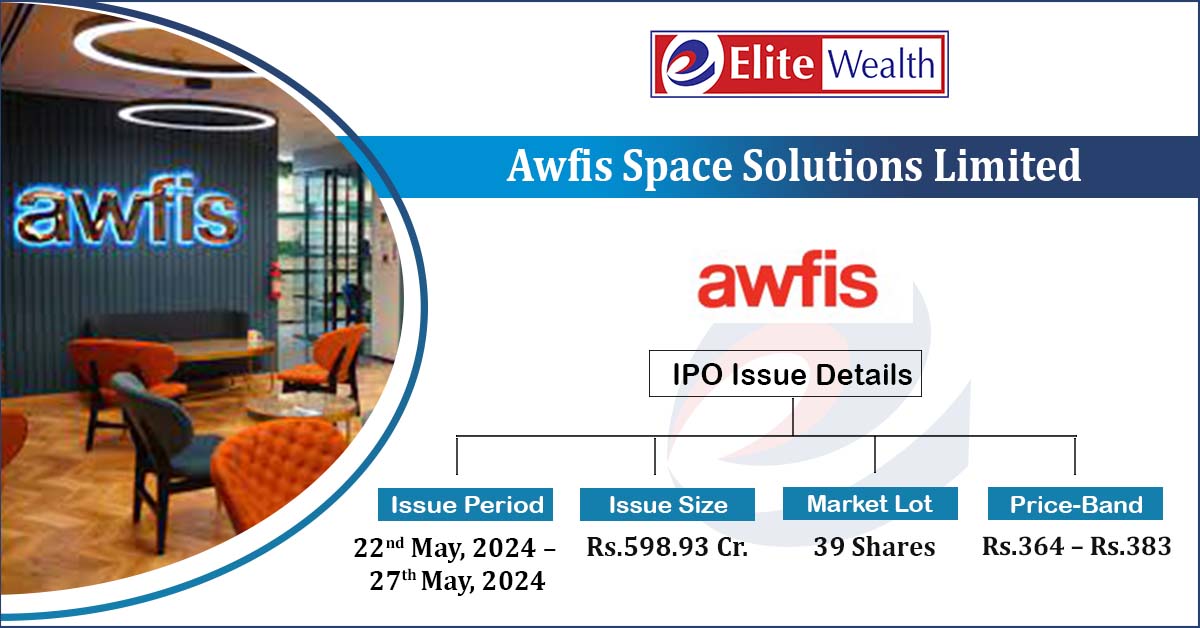

Awfis Space Solutions Limited IPO Company Profile :

Awfis Space Solutions Limited (ASSL) is the largest provider of flexible workspace solutions in India. With a presence in 16 Indian cities and the greatest number of micromarkets, the company is ranked first among the top 5 benchmarked players in the flexible workspace area. The company operates 169 locations spread throughout 16 cities in India, totaling 1.05 lakh seats spread over 5.33 million square feet. 31 centers and 25,312 seats—a total of 1.23 million square feet of billable area—of the 169 centers are now undergoing fit-out. Furthermore, it has executed signed letters of intent (or “LOI”) with space owners for 13 more centers, totaling 10,859 seats spread across 0.55 million square feet. ASSL has over 2,295 clients as of December 31, 2023, and it is present in 52 Indian micromarkets. The company offers a broad range of flexible workspace solutions for start-ups, small and medium-sized businesses (SMEs), major corporations, and multinational corporations, from individual flexible desk needs to bespoke office spaces. Its adaptable workspace solutions can be rented for an hour or for several years, and they accommodate a variety of seat cohorts, from one seat to several seats. ASSL began as a co-working space and has developed into an integrated workspace solutions platform over time. Co-working solutions, such as flexible workspaces, personalized office spaces, and mobility solutions, are its main offering.

| IPO-Note | Awfis Space Solutions Limited |

| Rs.364 – Rs.383 per Equity share | Recommendation: Apply For Listing Gains |

Awfis Space Solutions Limited IPO Details:

| Issue Details | |

| Objects of the issue | · To fund working capital requirements

· To fund capital expenditure requirement · To gain listing benefits |

| Issue Size | Total issue Size – Rs.598.93 Cr.

Fress Issue – Rs.128 Cr. Offer for Sale – Rs.470.93 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.364 – Rs.383 |

| Bid Lot | 36 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 22nd May, 2024 – 27th May, 2024 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

Awfis Space Solutions Limited IPO Strengths:

-

The company has a leadership in a large and growing, flexible workspace operators market.

-

The Company has a strong customer base of 2295 clients and has sold as many as 36,020 seats in FY23. The Top client of ASSL contributes to only 3% of its FY23 revenues and the Top 5 clients bring in only 13%.

-

It has strong customer acquisition & retention ratio.

-

ASSL has a strong and diverse range of office space owners like Prestige Estates Ltd, Nyati Projects Landmark, Vajram Holdings, and many others.

Awfis Space Solutions Limited IPO Risk Factors:

-

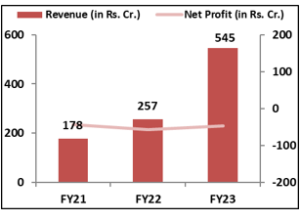

The company had been in loss and is still making losses, however it has doubled its revenue over the last few years.

-

Company’s results of operations are affected by the level of business activity of its clients, which in turn is affected by the macroeconomic conditions in the economy and the industries in which they operate.

-

The company enters into Space Owner Agreements to render operation and marketing services in relation to its managed aggregation (“MA”) centers. Inability to meet any obligation set under the agreement may impact company’s business.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Awfis Space Solutions Limited IPO Allotment Status

Awfis Space Solutions Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Awfis Space Solutions Limited IPO Financial Performance:

Awfis Space Solutions Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 41.53% | 32.38% |

| Others | 58.47% | 67.32% |

Source: RHP, EWL Research

Awfis Space Solutions Limited IPO Outlook:

ASSL is one of the leading and emerging office space solution provider in the country providing flexible workspaces, custom office setups, and mobility solutions along with allied services, including food and beverage, IT support, infrastructure services, and event hosting. The IPO of the ASSL looks attractive given its leading position in the industry, strong & diversified clientele, effective customer acquisition & retention strategies; however, the its inability to achieve profitability, negative cash flows are major weekness. Since the company has reported losses, the issue is at negative P/E. Considering all the factors, we recommend investors to apply for listing gains in the offering.

Awfis Space Solutions IPO FAQ:

Ans. Awfis Space Solutions IPO is a main-board IPO of 15,637,736 equity shares of the face value of ₹10 aggregating up to ₹598.93 Crores. The issue is priced at ₹364 to ₹383 per share. The minimum order quantity is 39 Shares.

The IPO opens on May 22, 2024, and closes on May 27, 2024.

Bigshare Services Pvt Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Awfis Space Solutions IPO opens on May 22, 2024 and closes on May 27, 2024.

Ans. Awfis Space Solutions IPO lot size is 39 Shares, and the minimum amount required is ₹14,937.

Ans. The Awfis Space Solutions IPO listing date is not yet announced. The tentative date of Awfis Space Solutions IPO listing is Thursday, May 30, 2024.

Ans. The minimum lot size for this upcoming IPO is 39 shares.