Arisinfra Solutions Limited IPO Company Profile:

Incorporated in 2021, ArisInfra Solutions Limited is a business-to-business (B2B) technology-enabled company operating within the rapidly expanding construction materials sector. The company is focused on transforming and streamlining the procurement process by offering an efficient, end-to-end digital solution. By integrating advanced technology with human expertise, ArisInfra simplifies the complex task of sourcing and purchasing bulk construction materials. Leveraging a robust network of vendors, the company supplies a wide range of materials to real estate developers, infrastructure companies, and contractors—positioning itself as a comprehensive, one-stop procurement partner for all construction material needs.

| IPO-Note | Arisinfra Solutions Limited |

| Rs. 210– Rs. 222 per Equity share | Recommendation: Avoid |

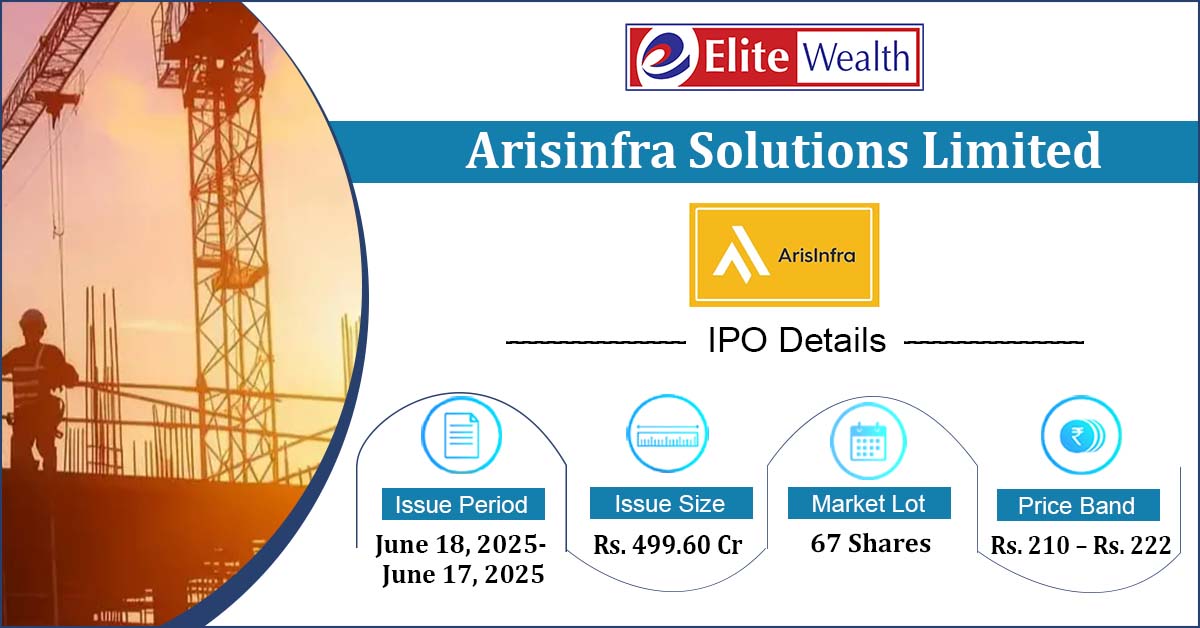

Arisinfra Solutions Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· Repayment of Borrowings · Funding Working Capital Requirement · Investment in Subsidiary · General Corporate Expenses |

| Issue Size | Total issue Size – Rs. 499.60 Cr

Fresh Issue – Rs. 499.60 Cr |

| Face value |

Rs . 2 |

| Issue Price | Rs. 210 – Rs. 222 per share |

| Bid Lot | 67 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | June 18, 2025- June 20, 2025 |

| QIB | Not Less than 75% of Net Issue Offer |

| HNI | Not More than 15% of Net Issue Offer |

| Retail | Not More than 10% of Net Issue Offer |

Arisinfra Solutions Limited IPO Strengths:

- Between April 1, 2021, and December 31, 2024, the company successfully delivered approximately 14.10 million metric tonnes of construction materials, including aggregates, ready-mix concrete (RMC), steel, cement, construction chemicals, and walling solutions.

- As on December 31, 2024, ArisInfra Solutions Limited expanded its operations significantly, utilizing 1,729 vendors and serving 2,659 customers across 1,075 pin codes in key cities such as Mumbai, Bengaluru, and Chennai. The registered customer base grew from 431 in March 2022 to 2,133 by March 2024.

- ArisInfra Solutions Limited’s customer base comprises prominent real estate and infrastructure developers and contractors, including Capacit’e Infraprojects Limited, J Kumar Infraprojects Limited, Afcons Infrastructure Limited, EMS Limited, S P Singla Constructions Private Limited, Real Gem Buildtech Private Limited, Wadhwa Group Holdings Private Limited, Casa Grande Civil Engineering Private Limited, Sheth Creators Private Limited, Puranik Builders Limited, and others.

- Indian government is pushing for large-scale infrastructure projects, including initiatives like the NIP, PMAY, Bharatmala Pariyojana, etc., which will result in infrastructure development. Increasing urbanisation nationwide is also driving significant growth in the construction sector.

- ArisInfra Solutions Limited intends to establish strategic partnerships with third-party manufacturers to leverage their underutilized capacities, enhance supply chain efficiency, and expand its portfolio of third-party manufactured construction materials. The company believes such collaborations will provide greater control over production and quality, streamline operations, increase revenue, improve profit margins, and extend market reach.

- According to the RedSeer Report, the infrastructure construction B2B market in India was estimated at approximately USD 105–115 billion in 2024 and is projected to grow at a CAGR of 10%–12%, reaching USD 175–200 billion by 2029. Additionally, the total B2B real estate construction market was valued at USD 170–180 billion in 2023 and is expected to grow at a CAGR of 6%–8% to reach USD 235–255 billion by 2029.

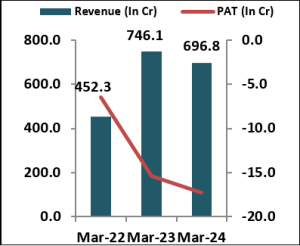

- In FY24, the company has reported revenue from operations of Rs 696.8 crore, reflecting a 6.6% decline from Rs 746.07 crore in FY23. The company reported net losses of Rs 17.3 crore in FY24 and Rs 15.4 crore in FY23. However, for the nine months ended December 31, 2024, the company recorded revenue from operations of Rs 546.5 crore and a PAT of Rs 6.5 crore, indicating a positive turnaround in its financial performance.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Arisinfra Solutions Limited IPO Allotment Status

Arisinfra Solutions Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Arisinfra Solutions Ltd IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Arisinfra Solutions Limited IPO Risk Factors:

- The company faces intense competition from established players like Hella Infra Market Pvt. Ltd., U OFB Tech Pvt. Ltd., Mogli Labs (India) Pvt. Ltd, IB Monotaro Pvt. Ltd and Zetwerk Manufacturing Businesses Pvt. Ltd. poses a significant risk to the market share of the company, pricing power, and ability to attract and retain customers in the highly competitive sector.

- Fluctuating raw material prices, like Steel, Aggregates, Cement, Concrete, Construction and chemicals with price spikes eroding profit margins. Manufacturers must absorb costs or pass them on, risking business loss. Additionally, changes in international trade policies, such as U.S. tariffs, further impact industry dynamics.

Arisinfra Solutions Limited IPO Financial Performance:

Arisinfra Solutions Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 52.51%

|

37.93% |

| Others | 47.49%

|

62.08% |

Arisinfra Solutions Limited IPO Outlook:

ArisInfra Solutions Limited reported a loss in the last fiscal year but turned a profit in the nine-month period, primarily due to deferred tax benefits and other income. The company currently has no directly listed peers in its segment, giving it a potential first-mover advantage. It is poised to benefit from the strong growth in India’s construction and infrastructure sectors, driven by rapid urbanization and government-led initiatives. ArisInfra’s technology-enabled platform, expanding network of vendors and customers, and planned strategic partnerships position it for improved scalability and operational efficiency. However, challenges such as intense market competition and raw material price volatility need to be addressed. At the upper price band of Rs 222 per share, the IPO is valued at a P/E of -75.13x based on FY24 earnings and 275.54x on nine-months earnings. Considering the high valuation and limited visibility on sustainable profitability, we recommend avoiding this issue.

Arisinfra Solutions Limited IPO FAQ:

Ans. Arisinfra Solutions IPO is a main-board IPO of 22504324 equity shares of the face value of ₹2 aggregating up to ₹499.60 Crores. The issue is priced at ₹210 to ₹222 per share. The minimum order quantity is 67.

The IPO opens on June 18, 2025, and closes on June 20, 2025.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The IPO opens on June 18, 2025, and closes on June 20, 2025.

Ans. Arisinfra Solutions IPO lot size is 67, and the minimum amount required is ₹14,874.

Ans. The Arisinfra Solutions IPO listing date is not yet announced. The tentative date of Arisinfra Solutions IPO listing is Wednesday, June 25, 2025.

Ans. The finalization of Basis of Allotment for Arisinfra Solutions IPO will be done on Monday, June 23, 2025, and the allotted shares will be credited to your demat account by Tuesday, June 24, 2025.