Ajax Engineering Limited IPO Company Profile:

Ajax Engineering is a leading company that manufactures concrete equipment. They offer a wide range of products and services for various concrete tasks, from production to transportation and placement. Over the past 32 years, they have developed more than 110 different types of concrete equipment. They have sold over 27,800 pieces of equipment in India alone. They also support their customers by providing spare parts and after-sales service through dealers, ensuring their equipment works well throughout its lifetime.

| IPO-Note | Ajax Engineering Limited |

| Rs.599– Rs.629 per Equity share | Recommendation: Apply |

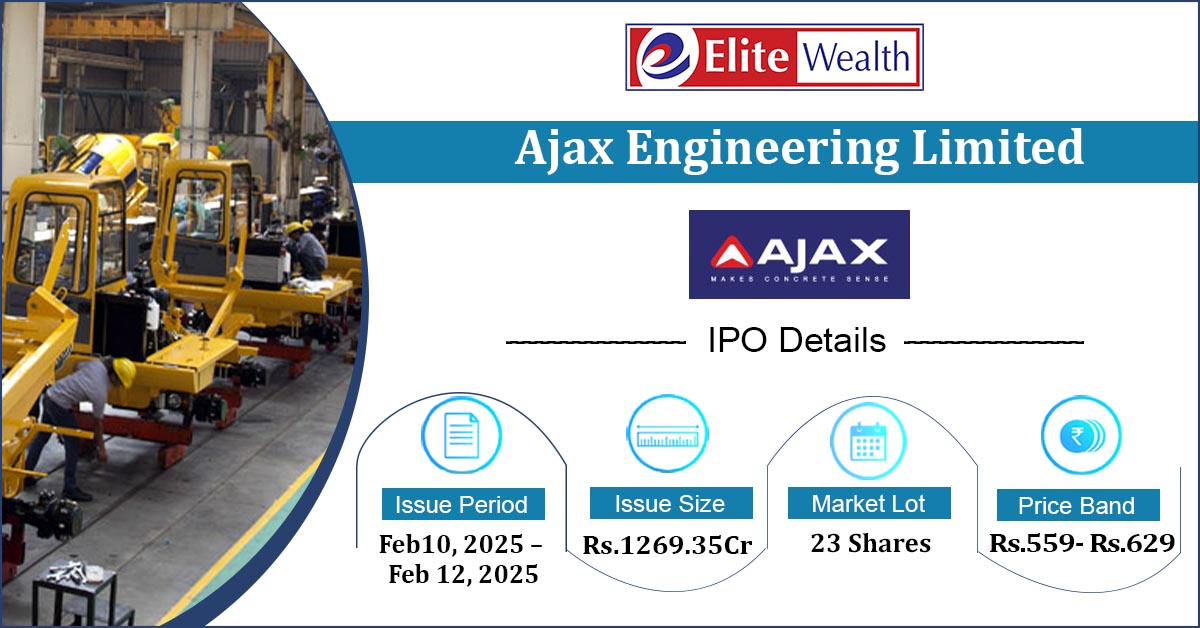

Ajax Engineering Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· Entirely offer for sale |

| Issue Size | Total issue Size – Rs.1269.35Cr

Offer for sale- Rs 1269.35 Cr |

| Face value |

Rs.1 |

| Issue Price | Rs.559- Rs.629 per share

Employee discount- Rs 59 per share |

| Bid Lot | 23 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | February 10, 2025 – February 12, 2025 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Ajax Engineering Limited IPO Strengths:

- The company offers wide array of products which include self-loading concrete mixers, 3D concrete printers, Transit mixers, Slip-form pavers for paving concrete roads etc.

- The company is one of the three largest manufactures of self-loading concrete mixers, with an approximately 75% market share in India in terms of SLCMs sold.

- Infrastructure development in India is expected to boost the demand for concrete equipment, growing the market from ₹61 billion in 2024 to ₹178 billion by 2029. This growth is driven by increased cement consumption and higher spending on infrastructure, housing, and irrigation. As a result demand for company products are expected to rise significantly.

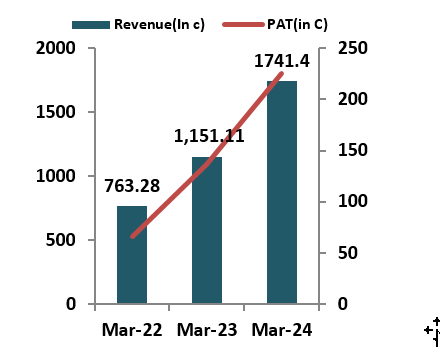

- The company reported revenue of ₹1,741.4 crore in FY24, reflecting a 51.2% increase compared to FY23. For the same period, the company reported a profit after tax (PAT) of ₹225.14 crore in FY24, showing a 65.6% growth from FY23.

- In FY24, the company achieved a Return on Equity (ROE) of 24.53% and a Return on Capital Employed (ROCE) of 32.82%. These figures highlight strong financial performance and efficient capital utilization.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Ajax Engineering Limited IPO Allotment Status

Ajax Engineering Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Ajax Engineering Limited IPO Risk Factors:

- The industry in which the company operates is highly competitive, with key competitor like Action Construction, BEML etc.

- The demand for the company’s products is seasonal, with peaks during the monsoon and festival seasons.

Ajax Engineering Limited IPO Financial Performance:

Ajax Engineering Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post issue |

| Promoters Group | 93.50% | 82.36% |

| Others | – | 17.64% |

Ajax Engineering Limited IPO Outlook:

Ajax Engineering has positioned itself as a key player in the concrete equipment sector, demonstrating growth in both revenue and profitability. With strong industry prospects driven by a focus on infrastructure development, the company’s shares are priced at a Post-IPO P/E of 31.96, based on an expected annualized EPS of Rs 19.68, which seems reasonably valued. We recommend that investors with a medium to long-term horizon apply for the issue, aiming for both listing gains and long-term value creation.

Ajax Engineering Limited IPO FAQ:

Ans. Ajax Engineering IPO is a main-board IPO of 20180446 equity shares of the face value of ₹1 aggregating up to ₹1,269.35 Crores. The issue is priced at ₹599 to ₹629 per share. The minimum order quantity is 23.

The IPO opens on February 10, 2025, and closes on February 12, 2025.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Ajax Engineering IPO opens on February 10, 2025 and closes on February 12, 2025.

Ans. Ajax Engineering IPO lot size is 23, and the minimum amount required is ₹14,467.

Ans. The Ajax Engineering IPO listing date is not yet announced. The tentative date of Ajax Engineering IPO listing is Monday, February 17, 2025.

Ans. The minimum lot size for this upcoming IPO is 23 shares.