Afcons Infrastructure IPO Company Profile:

Afcons Infrastructure is the premier engineering and construction firm of the Shapoorji Pallonji Group, a diverse Indian conglomerate with a legacy spanning over six decades. The company boasts an impressive record of successfully executing numerous complex and unique EPC projects both in India and abroad. As of September 30, they have completed 76 projects across 15 countries, with a total historic contract value of ₹522.20 billion. They are the only Indian infrastructure company to have won the MIKE Award six consecutive times and are also the only infrastructure construction firm with a Chief Knowledge Officer.

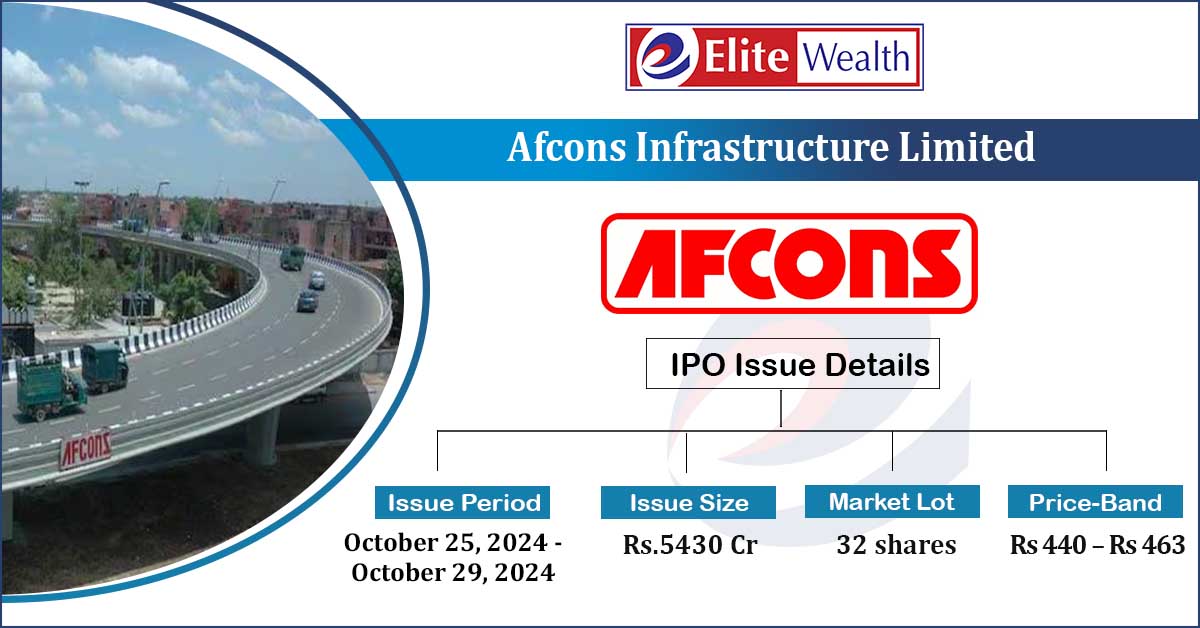

| IPO-Note | Afcons Infrastructure Limited |

| Rs 440- Rs 463 per equity share | Recommendation: Apply |

Afcons Infrastructure IPO Details:

| Issue Details | |

| Objects of the issue | · Purchase of construction equipment

· Funding long term working capital requirements · Prepayment of certain borrowings |

| Issue Size | Total issue Size – Rs.5430 Cr

Fresh Issue – Rs 1250 Cr Offer for sale- Rs 4180 cr |

| Face value |

Rs.10 |

| Issue Price | Rs 440 – Rs 463 |

| Bid Lot | 32 shares |

| Listing at | BSE,NSE |

| Issue Opens | October 25, 2024- October 29,2024 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Afcons Infrastructure IPO Strengths:

- The company gains significant advantages from the strong support of the Shapoorji Pallonji Group, which has a legacy of over 150 years. Its esteemed reputation, global presence, and extensive industry experience play a crucial role in business growth and operational excellence.

- Given the government’s current emphasis on infrastructure development across the country, the company stands to benefit from opportunities that could support its expansion.

- By the end of FY24, the company had a robust order book totaling ₹30,960.9 crores. As on 30 June, 2024 Company has order book Rs 31,747.4 crores.

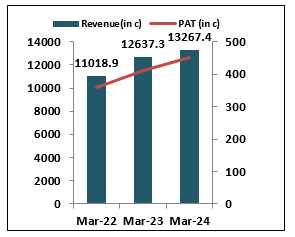

- For the year ended 2024, the company reported a revenue of ₹13267.4 crores, reflecting a 4% increase compared to FY23. The PAT for FY24 was ₹449.7 crores, also marking a 9.5% rise compared to FY23.

- According to the Fitch Report analyzing large infrastructure construction companies in India, company has achieved the highest ROCE and EBITDA margins which are 14.89% and 11.6% respectively.

Afcons Infrastructure IPO Risk Factors:

- The company operates in a competitive landscape, with notable competitors such as L&T Construction, KEC International, and Tata Projects, all of which have a strong presence both in India and internationally.

- The company relies significantly on government contracts, which accounted for 65.98% of its total contracts in FY24.

Afcons Infrastructure IPO Financial Performance:

Afcons Infrastructure IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post – issue | |

| Promoters Group | 99.48 | 67.18% | |

| Others | – | 32.82% |

Afcons Infrastructure IPO Outlook:

Afcons Infrastructure Limited is a prominent player in the Indian construction and engineering sector. The company has shown strong financial performance in terms of revenue and profitability, and it has a strong order book, indicating promising future prospects. Out of the total issue offer for sale is 77% which seems that parent company is offering shares to cut their higher debt while 23% will come in to Company’s balance sheet which will be used for the company’s growth. At the upper price band, the shares are offered at a P/E ratio of 46.48, which is slightly on higher side and asking high premium. Keeping in mind their performance of the company and its potential to do business in upcoming years, we recommend that investors with long term horizon can invest in the IPO, even investors looking for listing gain can also apply.

Afcons Infrastructure IPO FAQ:

Ans. Afcons Infrastructure IPO is a main-board IPO of 117,278,618 equity shares of the face value of ₹10 aggregating up to ₹5,430.00 Crores. The issue is priced at ₹440 to ₹463 per share. The minimum order quantity is 32 Shares.

The IPO opens on October 25, 2024, and closes on October 29, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Afcons Infrastructure IPO opens on October 25, 2024 and closes on October 29, 2024.

Ans. Afcons Infrastructure IPO lot size is 32 Shares, and the minimum amount required is ₹14,816.

Ans. The Afcons Infrastructure IPO listing date is not yet announced. The tentative date of Afcons Infrastructure IPO listing is Monday, November 4, 2024.

Ans. The minimum lot size for this upcoming IPO is 32 shares.