Aditya Infotech Limited IPO Company Profile:

Aditya Infotech Limited, based in Delhi, is one of India’s leading providers of CCTV and surveillance solutions. The company offers a wide range of advanced video security products and services under its flagship brand, ‘CP PLUS,’ known for strong brand recall across enterprise and consumer markets. Its offerings include integrated security systems and Security-as-a-Service, delivered through a robust distribution network. The business operates in two segments: (i) manufacturing and trading of CP PLUS products with after-sales support, and (ii) trading and distribution of Dahua products. CP PLUS’s product portfolio includes network and HD-analog cameras, DVRs, NVRs, mobile surveillance solutions, body-worn cameras, thermal cameras, and temperature screening devices, catering to sectors such as banking, defence, healthcare, education, and retail.

| IPO-Note | Aditya Infotech Limited |

| Rs. 640– Rs. 675 per Equity share | Recommendation: Apply |

Aditya Infotech Limited IPO Details:

| Issue Details | |

| Objects of the issue | · Repayment of Borrowings

· General Corporate Expenses |

| Issue Size | Total Issue Size-Rs. 1,300.00 Cr

Fresh Issue Size- Rs. 500.00 Cr Offer For Sale – Rs. 800.00 Cr |

| Face value |

Rs . 1 |

| Issue Price | Rs. 640 – Rs. 675 per share |

| Bid Lot | 22 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | July 29, 2025- July 31, 2025 |

| QIB | Not Less than 75% of Net Issue Offer |

| HNI | Not More than 15% of Net Issue Offer |

| Retail | Not More than 10% of Net Issue Offer |

| Employee Discount | Rs. 60 |

Aditya Infotech Limited IPO Strengths:

- The company provides field management services, including annual preventive maintenance, quick response services, electric vehicle station management, IoT automation, and door automation and access control systems. These services are delivered through a network of partners, system integrators, and system assemblers, enabling effective end-to-end support for their end customers.

- In Fiscal 2025, the company sold its products across more than 550 cities and towns in India, supported by a robust network of 41 branch offices and 13 RMA centres as of March 31, 2025. Its surveillance products were distributed through a wide network of over 1,000 distributors and more than 2,100 system integrators across Tier I, II, and III cities.

- As of March 31, 2025, the company’s manufacturing facility in Kadapa, Andhra Pradesh (“Kadapa Facility”) has an installed capacity of 17.20 million units per annum. Spanning 204,157.36 square feet, the facility is equipped with advanced manufacturing infrastructure, including high-speed Surface Mount Technology (SMT) lines, assembly lines, and state-of-the-art quality control systems to ensure stringent production standards.

- In 2017, the company entered into a joint venture agreement with Dixon Technologies (India) Limited (“Dixon”), a leading electronic manufacturing services provider in India, to establish a captive manufacturing facility and leverage Dixon’s expertise in manufacturing processes. Additionally, to enhance the breadth of its offerings, the company has a joint service arrangement with Dahua Technology (“Dahua”).

- It is one of the largest providers of video security and surveillance products, solutions, and services in India by revenue, holding a market share of 20.8% in Fiscal 2025, according to the F&S Report.

- The company focuses on brand building through its CP PLUS World Centres—branded experience centres designed to familiarize customers with its products. As of March 31, 2025, 69 dedicated CP PLUS Galaxy stores, operated by distributors, have been established across India. To enhance customer experience, the company offers comprehensive after-sales support via mobile apps, website, and multiple contact channels including phone, email, and social media.

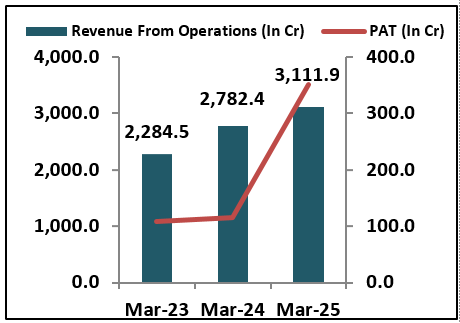

- It has reported revenue from operations of Rs 3,111.87 crore in FY25, registering a growth of 11.8% compared to Rs 2,782.43 crore in FY24. PAT stood at Rs 351.37 crore in FY25, a significant increase of 205.1% from Rs 115.17 crore in FY24. The sharp rise in PAT was primarily driven by a gain of Rs 248.63 crore on account of fair valuation of previously held equity interest.

- According to Frost & Sullivan, India’s video surveillance market was valued at Rs 106.2 billion in FY25 and is projected to grow at a CAGR of 16.46% to reach Rs 227.4 billion by FY30. The volume of surveillance units sold is also expected to rise significantly, from 39.7 million units in FY25 to 74.6 million units by FY30, reflecting strong market demand.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Aditya Infotech Limited IPO Allotment Status

Aditya Infotech Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Aditya Infotech Ltd IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Aditya Infotech Limited IPO Risk Factors:

- The company operates in a highly competitive market, facing intense competition from both listed and unlisted players. Key competitors include Prama Hikvision India Pvt. Ltd., Godrej Security Solutions, Zicom Electronic Security Systems Ltd., Secureye, Panasonic India, Bosch Ltd., TP-Link, Videocon WallCam, Sony, and Samsung. This competitive landscape may exert pressure on pricing and market share, requiring the company to consistently focus on innovation, operational efficiency, and differentiated service offerings to sustain and enhance its position in both domestic and international markets.

- The company requires various raw materials for manufacturing its products, including chips, lenses, printed circuit board components, sensors, and housings. Any fluctuation in the prices or availability of these materials may impact production costs, which in turn could affect the pricing and profitability of the company’s products.

Aditya Infotech Limited IPO Financial Performance:

Aditya Infotech Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 93.12% | 77.12% |

| Others | 6.88% | 22.88% |

Aditya Infotech Limited IPO Outlook:

Aditya Infotech Limited, a prominent provider of CCTV and surveillance solutions in India. the company has reported revenue growth of 11.8% in FY25. On the profit front, the company has reported a 205% increase, primarily due to the fair valuation of previously held equity interests. The company had a 20.8% market share in FY25 and operates through a broad distribution network across India. While the video surveillance industry is expected to grow steadily, factors such as competition and fluctuations in raw material prices may influence future margins. At the upper price band of Rs 675, the issue is valued at a P/E of 21.09x (pre-IPO) and 22.52x (post-IPO). Keeping in mind the listed factors and the company’s valuation, we recommend applying to the issue for potential listing gains as well as long-term growth prospects.

Aditya Infotech Limited IPO FAQ:

Ans. Aditya Infotech IPO is a main-board IPO of 1,92,59,258 equity shares of the face value of ₹1 aggregating up to ₹1,300.00 Crores. The issue is priced at ₹640 to ₹675 per share. The minimum order quantity is 22.

The IPO opens on July 29, 2025, and closes on July 31, 2025.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Aditya Infotech IPO opens on July 29, 2025 and closes on July 31, 2025.

Ans. Aditya Infotech IPO lot size is 22, and the minimum amount required for application is ₹14,850.

Ans. The Aditya Infotech IPO listing date is not yet announced. The tentative date of Aditya Infotech IPO listing is Tuesday, August 5, 2025.

Ans. The finalization of Basis of Allotment for Aditya Infotech IPO will be done on Friday, August 1, 2025, and the allotted shares will be credited to your demat account by Monday, August 4, 2025.