NIFTY:

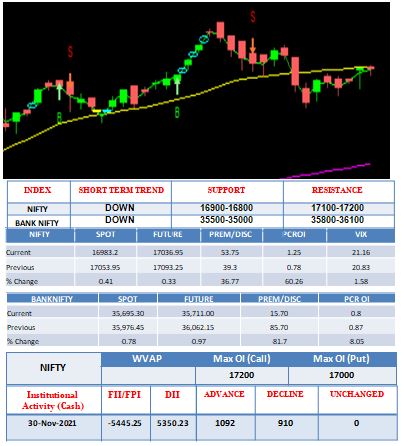

Nifty opened at 17051.15 without much of a gap,the index first moved up , rose more than 250 points within the first two our of trading and recorded its intraday high at 17324.64 prices found resistance there and started drifting downward a steep decline first erased all the gains and then prices moved in phase of consolidation , that consolidation broke on the downside. The index saw a steep decline in the last hour of trade recorded its intraday low at 16931.40 and finally closed at 16983.20 near its intraday low with a loss of 70.75 points. The metal led the decline today and ended nearly 2% lower

It is wise to stay away from the market for the time being and wait for the volatility to cool off as the short term trend Is down we should consider only shorting opportunity, for buying we now have to wait for a breakout above 17500 or wait for the price to consolidate .Below the support is visible around 16700, volatility is very high we should avoid trading the index.

BANK NIFTY:

Bank Nifty opened at 35958.80 without much of a gap, prices started moving up from the opening tick and recorded its intraday high at 36774.20, the index then tumbled and saw a steep decline to record its intraday low at 35526.35, prices saw consolidation in the afternoon and finally closed at 35600.90 with a loss of 342 points .PSU and Private Bank both performed same , saw a decline and closed at 0.73% and 0.58% low. Within the index in term of points Bandhan Bank contributed the highest while Kotak bank contributed the lowest

The Index continued making lower low suggest that the short term trend is still on the downside, as we have mentioned support is visible around 35000, the index is headed toward that level , volatility is very high so in such environment traders should avoid trading the index.

TECHNICAL PICKS

| COMPANY NAME | CMP | B/S | RATIONALE+ |

| SAIL | 100 | SELL | The stock is on the verge of giving the breakdown on the intraday as well as the daily chart. The stock can be sold with a stop loss of 102 and for the target of 95. |

| CADILAHC | 465 | BUY | The immediate trend of the script is bullish. There is a positive cross over of moving averages as well as of the indicators therefore it can be buy above 468 with a stop loss of 457and target of 485. |

DERIVATIVE PICKS

| Stock Name | Strike Price | Buy/Sell | CMP | Initiation | Stop Loss | Target | Remarks |

| JSWSTEEL | 600 PE | BUY | 23 | CMP | 17 | 35 | OI Increase |

| Long Buildup | Short Buildup | |||||||||

| Stocks | Price | Price% | OI % | OI | Stocks | Price | Price% | OI % | OI | |

| RECLTD.Dec 30 | 135.25 | 5.91 | 17.24 | 62424000 | MPHASIS.Dec 30 | 2848.15 | -5.18 | 77.58 | 2533050 | |

| NAVINFLUOR.Dec 30 | 3764.95 | 5.88 | 17.37 | 612675 | GODREJPROP.Dec 30 | 1969.95 | -4.93 | 90.17 | 3642275 | |

| METROPOLIS.Dec 30 | 3287.4 | 4.7 | 4.94 | 633400 | TATASTEEL.Dec 30 | 1073 | -4.04 | 4.68 | 51734400 | |

| INDHOTEL.Dec 30 | 180.95 | 4.63 | 4.62 | 18026604 | MINDTREE.Dec 30 | 4295.3 | -3.82 | 43.65 | 2872200 | |

| GSPL.Dec 30 | 314.35 | 4.19 | 14.79 | 1042100 | PIIND.Dec 30 | 2862.8 | -3.26 | 7.04 | 1725000 | |

| Short Covering | Long Unwinding | |||||||||

| TORNTPHARM.Dec 30 | 3054.95 | 0.24 | -1.71 | 775000 | HAL.Dec 30 | 1275 | -2.1 | -0.93 | 2721750 | |

| OFSS.Dec 30 | 4237.6 | 0.71 | -1.23 | 653750 | ZEEL.Dec 30 | 325.15 | -1.72 | -0.54 | 80943000 | |

| AMARAJABAT.Dec 30 | 617.6 | 0.95 | -0.83 | 9523000 | IBULHSGFIN.Dec 30 | 228.7 | -1.15 | -3.17 | 49482200 | |

| APLLTD.Dec 30 | 808.2 | 0.97 | -0.58 | 1877700 | ESCORTS.Dec 30 | 1853 | -0.48 | -0.66 | 5960350 | |

| SYNGENE.Dec 30 | 598 | 1.42 | -1.95 | 1065900 | SUNTV.Dec 30 | 521.4 | -0.17 | -1.19 | 11107500 | |

TOP DELIVERY PERCENTAGE

| Stocks | Price | %Chg | Total Qty | Delivery | Del % | % Change | ||||

| Sectors | Price | Change % | Quantity | |||||||

| Crompton Greaves Consume | 448.25 | 1.12 | 1829211 | 0 | 71.79 | Nifty 50 | 16983.2 | -0.41 | 84960 | |

| Whirlpool | 2041.8 | 0.38 | 953408 | 0 | 69.87 | Nifty it | 35043.75 | 0.5 | 84963 | |

| Hdfc Ltd. | 2673.1 | -1.5 | 7628539 | 0 | 67.52 | Nifty Fmcg | 37386.95 | 0.17 | 84963 | |

| Balkrishna Ind. Ltd | 2174.75 | 0.53 | 554262 | 0 | 65.63 | Nifty Pharma | 13662.8 | 0.1 | 84963 | |

| Icici Lombard General In | 1437.35 | 0.22 | 1428578 | 0 | 63.95 | Nifty Services Sector | 23997.3 | -0.23 | 84963 | |

| Hdfc Life Insurance Comp | 680.8 | -0.42 | 11535239 | 0 | 63.7 | Nifty Mnc | 18540.55 | -0.4 | 84963 | |

| Hindustan Unilever Ltd | 2317.55 | -0.51 | 3931035 | 0 | 63.36 | Nifty Financial Services | 17534.75 | -0.54 | 84966 | |

| Hdfc Bank Ltd. | 1493.55 | -0.51 | 12610771 | 0 | 61.6 | Nifty Bank | 35695.3 | -0.78 | 84963 | |

| Aarti Industries Ltd. | 937.3 | 1.21 | 898079 | 0 | 61.3 | Nifty Auto | 10603.55 | -0.94 | 84966 | |

| Jk Cement Limited | 3234.95 | 1.6 | 74084 | 0 | 61.29 | India Vix | 18.81 | -9.7 | 84960 | |

UPCOMING ECONOMIC DATA

| Domestic International | |

| INR: Nikkei Markit Manufacturing PMI (Nov) on 1st December, 2021

INR: Nikkei Services PMI (Nov) on 3rd December, 2021 |

•USD: ADP Nonfarm Employment Change (Nov) on 1st December, 2021

•USD: ISM Manufacturing PMI (Nov) on 1st December, 2021 |

NEWS UPDATES

•The central government’s fiscal deficit at end-October worked out to be 36.3 per cent of the annual budget target for 2021-22 due to an improvement in the revenue collection, according to official data released on Tuesday. Fiscal deficit or the gap between expenditure and revenue was 119.7 per cent of the budget estimate of 2020-21 during the corresponding period last year.

•The central government’s fiscal deficit at end-October worked out to be 36.3 per cent of the annual budget target for 2021-22 due to an improvement in the revenue collection, according to official data released on Tuesday. Fiscal deficit or the gap between expenditure and revenue was 119.7 per cent of the budget estimate of 2020-21 during the corresponding period last year.

•The JSW Group’s e-commerce business, JSW One Platforms has commenced its fulfillment operations for its JSW One MSME business division in Tamil Nadu. JSW One MSME, a platform which will offer an e-commerce marketplace for small and medium-size manufacturers and contractors, will offers the MSME customers a tech-based marketplace for buying raw materials and consumables in easy and convenient manner.

•State-owned Coal India Ltd on Tuesday said it will invest an estimated Rs 19,650 crore to strengthen its rail infrastructure. The move will increase coal evacuation capacity of the PSU through rail mode by an additional 330 million tonnes per annum (MTPA) by FY2023-24 when the production is expected to scale up significantly.

Source: Economic Times, Indian Express ,Business Today, Livemint, Business Standard, Bloomberg Quint

BOARD MEETINGS

| Company Name | Purpose | Ex-Date | Company Name | Purpose | Ex-Date |

| ARL | General | 01-Dec-21 | MADHAVIPL | General | 02-Dec-21 |

| HATSUN | General | 01-Dec-21 | NOVIS | A.G.M.;Audited Results | 02-Dec-21 |

| MANGIND | General | 01-Dec-21 | PACL | Stock Split | 02-Dec-21 |

| MEL | General | 01-Dec-21 | PATINTLOG | General;Rights Issue | 02-Dec-21 |

| MONEYBOXX | Preferential Issue of shares | 01-Dec-21 | TOYAMIND | General | 02-Dec-21 |

| RPIL | General;Scheme of Arrangement | 01-Dec-21 | XPROINDIA | General | 02-Dec-21 |

| RRMETAL | General | 01-Dec-21 | GVKPIL | Quarterly Results | 03-Dec-21 |

| STL | Half Yearly Results | 01-Dec-21 | ISTRNETWK | General | 03-Dec-21 |

| TILAK | Right Issue of Equity Shares | 01-Dec-21 | JJEXPO | A.G.M.;Audited Results | 03-Dec-21 |

| TTL | Interim Dividend | 01-Dec-21 | MRPL | General | 03-Dec-21 |

| VIRPOLY | General | 01-Dec-21 | NMDC | Interim Dividend | 03-Dec-21 |

| ANMOL | General | 02-Dec-21 | SDC | Half Yearly Results | 03-Dec-21 |

| CGPOWER | General | 02-Dec-21 | SHARP | Quarterly Results | 03-Dec-21 |

| JUBLINGREA | General | 02-Dec-21 | STDSFAC | General | 03-Dec-21 |

CORPORATE ACTION

| Company Name | Ex-Date | Purpose | Company Name | Ex-Date | Purpose |

| SHEETAL | 01-Dec-21 | E.G.M. | NCLRESE | 02-Dec-21 | Bonus issue 1:1 |

| TIGERLOGS | 01-Dec-21 | Interim Dividend – Rs. – 1.0000 | NOVAPUB | 02-Dec-21 | E.G.M. |

| VISVEN | 01-Dec-21 | Right Issue of Equity Shares | IEX | 03-Dec-21 | Bonus issue 2:1 |

| APOLLOPIPES | 02-Dec-21 | Bonus issue 2:1 | COALINDIA | 06-Dec-21 | Interim Dividend – Rs. – 9.0000 |

| BAJAJST | 02-Dec-21 | Final Dividend – Rs. – 3.0000 | PANCHSHEEL | 06-Dec-21 | Bonus issue 1:1 |

| GRATEXI | 02-Dec-21 | E.G.M. | CHLOGIST | 07-Dec-21 | E.G.M. |

| NCLRESE | 02-Dec-21 | Stock Split From Rs.2/- to Rs.1/- | GPL | 08-Dec-21 | Amalgamation |

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL