Diwali Samvat 2082 Recommendations:

Diwali Samvat 2082 Recommendations:

| Company | Sector | CMP(Rs) | Target(Rs) | Upside | Time Horizon |

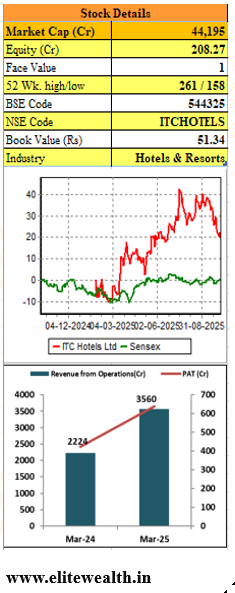

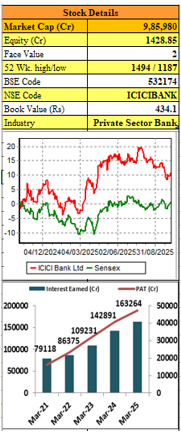

| ICICI BANK LTD | Private Sector Bank | 1381 | 1650 | 19% | 12 Months |

| RELIANCE INDUSTRIES LIMITED | Refineries | 1381 | 1750 | 27% | 12 Months |

| Larsen & Toubro | Construction | 3788 | 4550 | 20% | 12 Months |

| Bharti Airtel | Telecom | 1937 | 2300 | 19% | 12 Months |

| Central Depository Services (India) Ltd | Depositories & Clearing Houses | 1604 | 1900 | 18% | 12 Months |

| ITC Hotels | Hotels & Resorts | 216 | 270 | 25% | 12 Months |

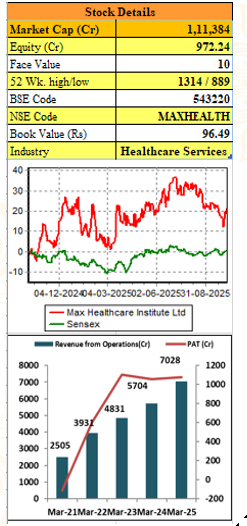

| Max Healthcare Institute Limited | Healthcare Services | 1157 | 1450 | 25% | 12 Months |

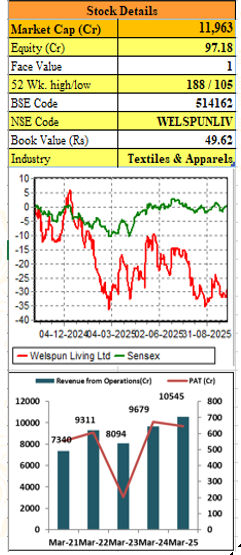

| Welspun Living Limited | Textiles & Apparels | 123 | 160 | 30% | 12 Months |

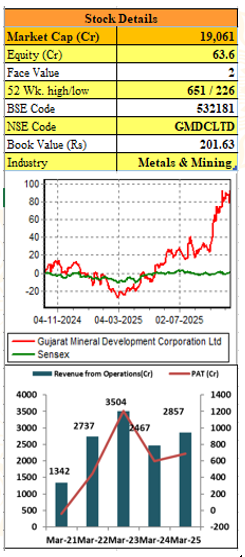

| Gujarat Mineral Development Corporation Ltd | Metals & Mining | 604 | 900 | 49% | 12 Months |

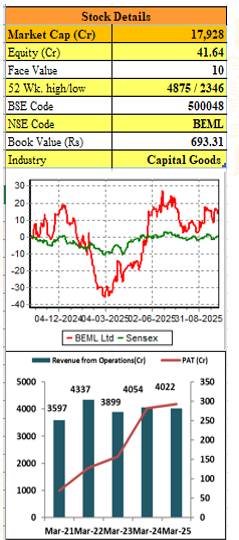

| BEML Ltd. | Capital Goods | 4363 | 5500 | 26% | 12 Months |

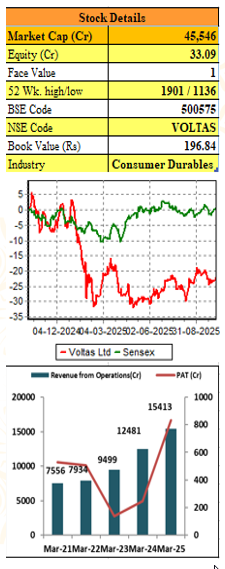

| Voltas Limited | Consumer Durables | 1418 | 1650 | 16% | 12 Months |

Economic Outlook

Over the past year, India’s economy and markets have demonstrated remarkable resilience despite a challenging global backdrop. In FY 2024-25, GDP growth stood around 6.5 %, supported by strong domestic consumption, record infrastructure spending, and manufacturing expansion. Global agencies like the OECD and S&P forecast growth of 6.3–6.5 % for FY 2025-26, reinforcing India’s position as the world’s fastest-growing major economy. However, elevated trade tariffs and protectionist policies in the US and EU have softened export momentum. In response, India is diversifying its export base toward emerging economies in the Middle East, Africa, and Southeast Asia, a move that will reduce dependency on Western markets and create more resilient, balanced trade growth over the long term.

Valuations & Investment Positioning:-

From a valuation standpoint, large-cap equities appear more attractive relative to mid and small caps. The Nifty 50 currently trades at ~22× earnings, marginally below its long-term median of ~20.7×, while the NIFTY MIDCAP 100 (~26.5) and Nifty SMALL CAP (~25×) indices remain well above their historical averages. This divergence indicates a better margin of safety in large-cap stocks, particularly given their stronger earnings visibility, balance-sheet strength, and ability to benefit from institutional inflows. The recent GST rationalisation is expected to enhance domestic demand by lowering product costs and improving supply-chain efficiency—helping corporates achieve scale with competitive pricing. As a result, India’s large-cap universe, spanning financials, manufacturing, infrastructure, and consumer sectors, stands positioned to capture the next phase of value-driven growth.

Economic Outlook

Structural Opportunities & Long-Term Growth Drivers:-

India’s structural strengths extend well beyond short-term economic cycles. With a median age of just 28 years, India has one of the youngest working populations globally, driving sustained consumption and attracting international corporations seeking growth markets and manufacturing hubs. Rising disposable incomes, rapid urbanisation, and policy reforms are creating a powerful demand engine for consumer goods, housing, and financial products. At the same time, India’s digital infrastructure boom—backed by government initiatives and private investment—is enabling new opportunities across data centres, artificial intelligence, semiconductor manufacturing, and the Internet of Things (IoT). The expanding digital economy is expected to add USD 1 trillion+ to GDP by 2030, positioning India as a global innovation and technology hub. In this environment, long-term investors have the opportunity to participate in India’s twin engines of industrial and digital growth, supported by strong macro fundamentals, attractive valuations in large caps, and deepening domestic capital markets.

ICICI Bank ( CMP – ₹1,381 Target – ₹1,650)

ICICI Bank Limited is the second largest private bank in India and also has a leading position in financial services businesses through its subsidiaries. The bank offers a wide range of banking and financial services including commercial banking, treasury operations, deposits etc to large set of customers viz. large and mid-corporates, MSME, agriculture and retail businesses. The ICICI bank is also involved life and general insurance, housing finance, and primary dealership, through its subsidiaries and affiliates.

Key Takeaways:

- With the addition of 83 branches during Q1FY26, ICICI Bank’s network expanded to 7,066 branches and 13,376 ATMs and cash recycling machines as of June 30, 2025. ICICI Bank showcased robust financial performance in Q1FY26, with interest income rising 10.1% YoY to ₹44,581.65 crore and Net Interest Income growing 11% YoY to ₹21,635 crore, while maintaining a strong NIM of 4.34%. Profit After Tax surged 15.5% YoY to ₹12,768.21 crore, reflecting the bank’s consistent growth, operational resilience, and ability to deliver strong, stable returns amid changing computation methods and market conditions.

- The Bank has reported total deposits of Rs 16,08,517 crore in Q1FY26, reflecting a 12.8% YoY increase from Rs 14,26,150 crore in Q1FY25 . Total advances stood at Rs 13,64,157 crore in Q1FY26, marking an 11.5% YoY growth from Rs 12,23,154 crore in Q1FY25.

- ICICI Bank demonstrated an improvement in asset quality on both a YoY and sequential basis. GNPA stood at 1.67% in Q1FY26, improving from 2.15% in Q1FY25 and stable compared to 1.67% in Q4FY25. Net NPA (NNPA) improved to 0.41% in Q1FY26, compared to 0.43% in Q1FY25, reflecting a continued strengthening of the bank’s credit quality.

Outlook:

ICICI Bank is a trusted brand in the private sector in India, offering a diversified portfolio of financial products and services to retail, SME, and corporate customers. Management expects further margin support in Q2 FY26 from the full impact of repo rate cuts and continued deposit repricing. The bank demonstrated strong financial performance in terms of loan outstanding and profit after tax, with expectations for continued growth. The bank has a TTM EPS of ₹74.04 and is trading at a TTM P/E of 18.65x. At CMP of Rs 1,381 bank is available at P/B of 3.18x , thus we recommend to buy ICICI Bank for a target price of Rs 1650 with investment horizon of next 12 months.

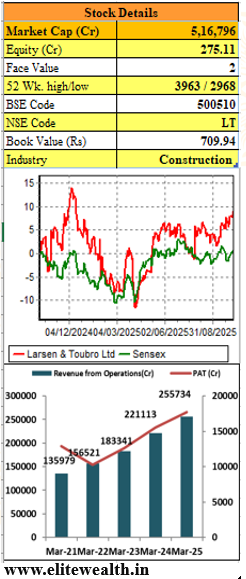

Larsen & Toubro (CMP – CMP – ₹ 3,788 Target – ₹ 4,550 )

Larsen & Toubro Limited (L&T) is one a leading private sector enterprise with expertise in technology, EPC, and manufacturing. The company has earned a strong reputation for its customer-centric approach and commitment to world-class quality, which has enabled it to lead across its core business areas. With a global presence, L&T is a USD 30 billion multinational engaged in Engineering, Procurement, and Construction (EPC) projects, hi-tech manufacturing, and various services. The company’s relentless pursuit of excellence, innovation, and quality has been central to its continued leadership in the industry, establishing it as a trusted partner in delivering large-scale projects and solutions across diverse sectors worldwide.

Key Takeaways:

- L&T’s Projects and Manufacturing order book crossed Rs.6.13 trillion, reflecting a 25% YoY growth, with 54% domestic and 46% international exposure. The international portion is heavily weighted toward the Middle East (82%), demonstrating L&T’s global footprint in infrastructure, energy, and industrial projects. Slow-moving orders remain minimal at 2%, indicating a healthy, executable order pipeline for future revenue growth.

- The government’s emphasis on public capital expenditure and private investments will create numerous opportunities for infrastructure companies like L&T.

- L&T’s Hydrocarbon Onshore (LTEH) has secured an ultra-mega order in the Middle East, in consortium with CCC, to build a Natural Gas Liquids plant and allied facilities. L&T leads engineering and procurement, while CCC handles construction. The plant will process Rich Associated Gas into value-added products like ethane, propane, and butane. This win reinforces L&T’s global energy expertise, execution capability, and strategic partnerships.

Outlook:

L&T is a global conglomerate specializing in engineering, procurement, and construction (EPC) solution . Larsen & Toubro is positioned for a positive outlook, supported by its order book and new expandable business verticals. The company’s focus on executing large-scale EPC projects and its presence in hi-tech manufacturing across eight countries enhance its growth potential.. Given these factors, L&T is an attractive option for investors looking for growth in the infrastructure and engineering sectors. It has a TTM EPS of ₹ 112.72 and is trading at a TTM P/E of 33.60x. We recommend buying shares at the current market price, with a target price of Rs 4550 over a 12-month time horizon.

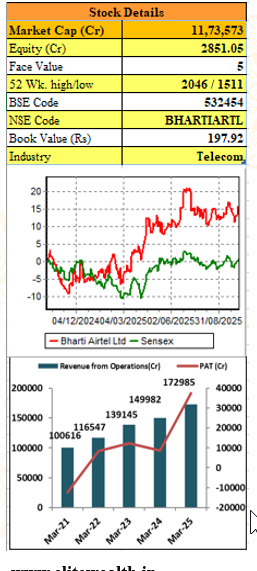

Bharti Airtel ( CMP – ₹ 1,937 Target – ₹ 2,300 )

Bharti Airtel is an India’s premier and among the most trusted ICT services provider, offering a comprehensive portfolio of cutting-edge solutions for enterprises, governments, global carriers, OTT platforms and SMEs. Renowned for its innovative integrated approach, superior customer experience and unparalleled global reach, Airtel Business continues to redefine the digital landscape. With an exceptional network, it serve businesses of all sizes across India, the US, Europe, Africa, the Middle East, Asia-Pacific and SAARC nations.

Key Takeaways:

- Average Revenue Per User (ARPU) improved to ₹210 in Q1FY26 from ₹203 in Q4FY25, reflecting improved customer mix, premium plan adoption, and continued 4G/5G migration. This steady ARPU expansion underscores Airtel’s pricing power and focus on high-value customers, ensuring stable revenue growth despite competitive market dynamics.

- Bharti carries highest ARPU in the industry and takes first mover advantageous, we expect it’s ARPU be in the range of Rs 250 to Rs 255 by 2026.

- Airtel’s 5G rollout now covers all major cities and 95% of districts, serving over 70 million users. The company focuses on monetization opportunities through enterprise 5G use-cases and fixed wireless access (FWA), positioning itself as a leader in next-generation connectivity services.

Outlook:

Bharti Airtel is well-positioned for sustained growth, driven by robust 4G/5G adoption, expanding enterprise services, and a diversified digital portfolio. Continued ARPU improvement reflects strong pricing power and a focus on high-value customers, while strategic partnerships in AI, cloud, and financial services are expected to enhance engagement and monetization. The widespread 5G rollout and enterprise use-case adoption offer significant long-term revenue potential. Airtel’s integrated digital platform, coupled with operational excellence and global reach, provides resilience against competitive pressures, positioning the company to deliver stable revenue growth, enhanced profitability, and value creation for shareholders over the coming quarters. It has shown a TTM EPS of Rs 50.91, and based on the TTM EPS, it is trading at a P/Ex of 38.04. We recommend buying shares at the current market price, with a target price of Rs 2300 over a 12-month time horizon.

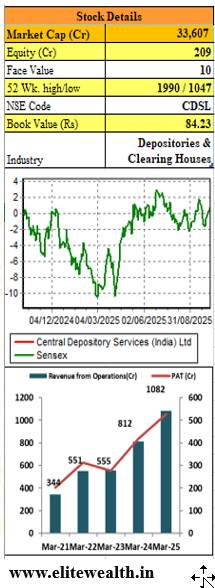

Central Depository Services (India) Ltd CMP – ₹ 1,604 Target – ₹ 1,900

Central Depository Services (India) Limited (CDSL) is one of India’s leading securities depositories, known for its steady growth in Beneficial Owner (BO) accounts. Established to provide secure, reliable, and cost-efficient depository services, CDSL plays a central role in the country’s capital market ecosystem. It enables investors to hold securities electronically and facilitates seamless transactions through book-entry systems. Depository Participants (DPs) act as intermediaries, delivering these services with transparency and regulatory compliance. As one of the two SEBI-recognized depositories, CDSL’s growth is driven by the digitalization of financial transactions and rising investor participation across India.

Key Takeaways:-

-

CDSL added over 56 lakh Demat accounts in Q1 FY26, bringing the total to 15.86 crore and maintaining a 79% market share. The industry is nearing 20 crore accounts. This demonstrates CDSL’s leadership and robust retail adoption, driven by increased investor awareness, digital onboarding, and participation in the Indian capital market.

-

CDSL launched the MyEasi app with proxy advisory recommendations for retail shareholders and a multilingual Investor Protection Fund portal. These initiatives enhance transparency, investor education, and participation, aligning with the company’s mission to empower retail investors and improve corporate governance standards across India’s capital markets.

-

CDSL’s insurance repository segment is growing, with 20 lakh e-insurance accounts and over 18 lakh policies. LIC integration is in progress, and CDSL is focused on increasing market share through online account openings and technology-enabled solutions. The repository aims to capture untapped opportunities while enhancing convenience and investor participation in insurance digitization.

Outlook:

CDSL is well-positioned for continued growth, driven by increasing retail participation, regulatory support, and digital adoption across India’s capital markets. The company is expected to expand its Demat account base as investor awareness rises and new investment avenues emerge. Technology-enabled services, such as MyEasi and insurance repositories, will further enhance convenience and customer engagement. With ongoing infrastructure investments and cost-efficient operations, CDSL is likely to maintain its market leadership, capture untapped opportunities, and deliver sustainable long-term value to both retail and institutional participants, reinforcing its role as a central pillar of India’s financial ecosystem. It has a TTM EPS of ₹ 24.35 and is trading at a TTM P/E of 65.87x. We recommend buying shares at the current market price, with a target price of Rs 1900 over a 12-month time horizon.

ITC Hotels CMP – ₹ 216 Target – ₹ 270

ITC Hotels Limited, is one of India’s leading hospitality companies, operating over 140 hotels across 90+ destinations. As a pioneer in luxury and heritage hospitality, it offers diverse brands catering to different market segments including luxury, boutique, premium, upper upscale, midscale, and heritage. Known for blending Indian tradition with world-class service and sustainability, ITC Hotels has built a strong presence in the Indian subcontinent, positioning itself for continued growth and value creation in the evolving hospitality sector.

Key Takeaways:

-

ITC Hotels aims to expand its footprint to 220 operational hotels with over 20,000 keys by 2030. This growth strategy underscores the company’s ambition to strengthen its presence across India, enhance market share in the hospitality sector, and cater to rising demand for premium and luxury accommodations.

-

The Company achieved a key milestone, crossing 200 hotels mark – with 143 operational and 58 hotels in pipeline. During the Q1FY26, the Company signed 8 hotels with appx. 700 keys in aggregate; at key locations viz. Bodhgaya, Dehradun, Goa, Lucknow, Manesar, Mysore, Ranthambore and Vrindavan.

-

ITC Hotel has launched its first international property ITC Ratnadipa in April 2024 at Colombo, Sri Lanka. The hotel, providing discerning business and leisure travellers the ultimate luxury hospitality experience, is scaling up well. Within a short span of time, the hotel has acquired market leadership.

-

It continues to make progress towards scaling its portfolio of Owned hotel rooms with investments in greenfield hotel projects at Puri and Vishakhapatnam and addition of a new block at its existing hotel at Bhubaneshwar.

Outlook:

ITC Hotels is well-positioned for robust growth in the Indian and emerging international hospitality markets. With a strong operational base of 143 hotels and 58 in the pipeline, the company is expanding strategically into high-demand locations while scaling owned hotel assets. The international ventures like ITC Ratnadipa, reinforce ITC Hotels’ potential to capture market share, drive revenue growth, and deliver sustainable long-term value. It has a TTM EPS of ₹ 3.27 and is trading at a TTM P/E of 66.05x. We recommend buying shares at the current market price, with a target price of Rs 270 within a 12-month time horizon.

Max Healthcare Institute Limited CMP – ₹1,157 Target – ₹ 1,450

Max Healthcare Institute Limited is a prominent Indian healthcare provider operating primary care clinics, multi-speciality hospitals, and super-speciality medical centres. The company offers comprehensive services including clinical care, radiology, pathology, and advanced medical treatments, alongside hospital operations and management. Focused on patient-centric care and clinical excellence, Max Healthcare leverages cutting-edge technology and experienced professionals to deliver high-quality healthcare.

Key Takeaways:

-

Max Healthcare currently operates a total bed capacity of 5,000 beds and is planning to add approximately 1,500 beds in FY26, comprising 1,000 brownfield and 500 greenfield beds. Key expansion projects include Nanavati, Max Smart Saket, Lucknow, Sector 56 Gurgaon, and Nagpur, all progressing as scheduled, with phased commissioning expected throughout the year. These additions will enhance capacity, expand specialty services, and contribute to incremental revenue growth across the healthcare network.

-

India’s healthcare sector is projected to grow at 13–15% CAGR, supported by rising lifestyle diseases, increasing insurance penetration, and higher healthcare spending. Max Healthcare’s strong brand, network, and quality of care position it to capture a significant share of this growth.

-

Max Healthcare’s digital initiatives, including AI diagnostics and remote care, enhance efficiency, reduce costs, and expand patient reach. With strong tech integration, the company is well-positioned to capitalize on India’s growing digital healthcare transformation.

Outlook:

Max Healthcare is well-placed to benefit from structural growth in India’s healthcare sector, driven by capacity expansion, digital integration, and high-margin specialty services. EBITDA per bed and ROCE metrics are expected to remain robust, supporting long-term profitability and shareholder value. Strategic brownfield/greenfield projects and oncology expansion provide visibility for FY26–28 growth, making it a compelling investment in the organized healthcare space. It has a TTM EPS of ₹ 12.34and is trading at a TTM P/E of 93.53x. We recommend buying shares at the current market price, with a target price of Rs 1450 over a 12-month time horizon.

Welspun Living Limited CMP – ₹ 123 Target – ₹ 160

Welspun Living Limited, with over 30 years of expertise, is one a global player in home textiles, offering end-to-end solutions across bed, bath, and flooring segments. Its vertically integrated operations—from farm to shelf—ensure superior quality, sustainability, and innovation. Serving customers in over 60 countries, the company operates four advanced manufacturing facilities in India and the US. With proprietary technologies like Hygrocotton and Wel-Trak 2.0, Welspun continues to drive product excellence and supply chain efficiency.

Key Takeaways:-

-

Revenue share from non-US markets, including UK, EU, GCC, ANZ, and Japan, rose to 40%. Management is actively expanding presence in these markets to reduce dependency on the US and leverage new trade agreements like India-UK FTA.

-

Q1 capex of Rs 83 crores was incurred out of Rs 200 crores planned for the year. The Nevada pillow facility is an additional Rs 112 crores. Investments focus on scaling production, enhancing automation, and supporting geographic diversification.

-

Welspun Living’s net debt stood at Rs 1,401 crores, reflecting a sequential reduction of Rs 202 crores. For FY26, the company targets a net debt range of Rs 1,300–1,400 crores. Management remains committed to achieving zero net debt by FY28, underscoring a disciplined approach to financial management while ensuring sustainable growth and operational flexibility.

-

Welspun targets 100% renewable energy and 100% sustainable cotton by 2030. Commissioned 18 MW solar plant at Vapi and 4 MW at Hyderabad; targeting 47 MW round-the-clock green power by year-end, reflecting ESG as a strategic differentiator.

Outlook:

Welspun Living is navigating near-term headwinds from US-India tariff uncertainties and cautious retailer demand. However, strategic initiatives such as geographic diversification, expansion of the pillow business in the US, and growth in branded and domestic segments provide a strong growth trajectory. The India-UK Free Trade Agreement and other trade opportunities position the company to capture incremental market share. Focused cost management, operational efficiency, and prudent financial discipline underpin a positive medium-to-long-term outlook for sustainable value creation. It has a TTM EPS of ₹ 5.57 and is trading at a TTM P/E of 22.08x. We recommend buying shares at the current market price, with a target price of Rs 160 within a 12-month time horizon.

Gujarat Mineral Development Corporation Ltd CMP- ₹ 604 Target – ₹ 900

Gujarat Mineral Development Corporation Ltd. (GMDC) is one a leading Indian mining and mineral processing company with over five decades of expertise in harnessing Gujarat’s rich mineral resources. It is India’s second-largest lignite producer, supplying high-growth industries such as textiles, chemicals, ceramics, bricks, and captive power. GMDC also explores Bauxite, Fluorspar, Manganese, Silica Sand, Limestone, Bentonite, and Ball Clay, serving diverse industrial applications including glass, ceramics, water purification, and oil drilling. The company maintains a strong presence in energy, with thermal, wind, and solar projects, having generated over 2.5 million MWh of green energy, reflecting its commitment to a sustainable future.

Key Takeaways:

-

GMDC is developing six new lignite mines, including Lakhpat, Walia, and Damlai. While these projects have long gestation, volumes from these mines are expected from FY’27 onwards, highlighting the company’s future growth pipeline and long-term production visibility.

-

GMDC’s Baitarani West coal block is progressing well, with groundbreaking expected in FY’26. Initial production is projected at approx. 1 MTPA, ramping rapidly to 3–5 MTPA. With large-scale volumes and a favorable low stripping ratio, this coal block is set to become a significant long-term revenue driver for the company.

-

Management of the company targets 10%-15% growth from lignite and auxiliary minerals in FY’26. Coal and new mineral projects are expected to accelerate revenue growth, indicating steady topline expansion for investors.

Outlook:

GMDC is well-positioned for steady growth, supported by a diversified portfolio spanning lignite, coal, copper, and rare earth projects. Near-term revenues are driven by its established lignite operations, while upcoming mines and the Odisha coal blocks are expected to contribute significantly to volume and revenue growth from FY’27 onwards. Strategic investments in renewable energy and critical minerals further strengthen long-term sustainability. Robust CAPEX planning, a strong balance sheet with low debt, and a phased production expansion strategy provide confidence in GMDC’s ability to deliver strong financial performance and enhance shareholder value over the medium to long term. The company has a TTM EPS of ₹28.85 and is currently trading at a TTM P/E of 30.11x. We recommend a Buy on the stock at current levels, with a target price of ₹900 over a 12-month horizon.

BEML Ltd. CMP – ₹ 4,363 Target – ₹ 5,500

BEML Limited, a key public sector enterprise under the Ministry of Defence, engaged in manufacturing equipment for defence, mining & construction, and rail & metro sectors. With a diversified portfolio and strong government support through initiatives like Make in India and Atmanirbhar Bharat, BEML is positioned to benefit from rising defence spending and infrastructure development.

Key Takeaways:

-

BEML’s Bangalore and Bhopal facilities are being ramped up to produce about 700–800 rail cars annually within the next 2–3 years. This expansion will help the company cater to upcoming MRVC and RRTS projects, positioning it to benefit from increasing demand in Metro and Rail segments, including opportunities in high-speed and aluminium train technologies.

-

Total Capex of ₹1,800 crore planned in five phases, including ₹225 crore in the first phase. Strategic investment supports expansion of train manufacturing lines, Defence systems, and technological modernization, ensuring timely delivery, enhanced capacity, and positive cash flows from operational execution.

-

As of FY25-end, BEML’s order book stood at approximately ₹22,000–23,000 crore, supported by an order inflow of ₹6,800 crore, reflecting 28% growth over FY24. For FY26, the company expects at least double the FY24 inflow, driven by Mining, Defense, Rail & Metro orders, including emergency procurements.

Outlook:

BEML is positioned for robust growth across Mining, Defense, Rail, and Metro segments. Key projects include Bangalore Metro train deliveries and execution of high-mobility defense platforms, supported by a strong sustenance business. Margins are expected to improve through material cost optimization, enhanced product mix, and system-level solutions. Strategic Capex is underway to expand manufacturing capacity, improve operational efficiency, and strengthen readiness for high-end rail and defense projects. The company has a TTM EPS of ₹71.77 and trades at a TTM P/E of 60.79x. We recommend buying at the current market price, targeting Rs 5,500 over a 12-month horizon.

Voltas Limited CMP -₹ 1,418 Target – ₹ 1,650

Voltas Limited, a Tata Group company established over six decades ago through a collaboration between Tata Sons and Switzerland’s Volkart Brothers, is a leading Indian engineering solutions provider. The company operates in air conditioning, refrigeration, and electro-mechanical projects (as an EPC contractor) across domestic and international markets, including the Middle East and Singapore. Voltas also offers engineering product services for sectors such as mining, water management, construction equipment, and textiles. Managing over 5,000 customer sites across India, Voltas is recognized for its excellence in project management and innovative, energy-efficient engineering solutions.

Key Takeaways:

-

Voltas retained market leadership in room air conditioners and cooling appliances, with a 19.3% June 2025 share and 17.8% YTD. Despite weaker demand and seasonal challenges, strong brand equity, efficient distribution, and effective channel management enabled Voltas to outperform competitors, reinforcing its dominant position in a highly competitive market.

-

As of 30 June 2025, Voltas’ consolidated order book stood at ₹6,200 crores, comprising ₹4,500 crores in domestic projects and ₹1,600 crores internationally, ensuring strong revenue visibility for upcoming quarters. The company maintains a strategic focus on cost discipline, robust project governance, and execution efficiency, enabling sustainable performance, timely delivery, and continued growth across its project business segment.

-

Voltas aims for mid-teen revenue growth and margin normalization in FY26. Leveraging robust Voltbek performance and a healthy EMPS order pipeline, management remains confident in restoring profitability levels as channel inventory normalizes. Strategic focus on operational efficiency, market leadership, and targeted investments supports sustainable growth across both consumer appliances and project segments.

-

Company management remains committed to long term EBIT margins in the range of 26-28.% for fy25 and beyond.

Outlook:

Voltas expects a gradual recovery in FY26, driven by festive season demand, potential “second summer” in select regions, and improved product availability. The company targets mid-teen revenue growth and margin normalization as channel inventories stabilize. Focus on cost optimization, operational efficiency, and strategic investments across segments will help maintain market leadership in cooling products and appliances, while selectively pursuing profitable projects, ensuring resilient growth and long-term shareholder value. It has a TTM EPS of ₹ 19.57 and is trading at a TTM P/E of 72.45x. We recommend buying shares at the current market price, with a target price of Rs 1650 within a 12-month time horizon.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 214

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India. (SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Vindhyachal Prasad, Elite Wealth Limited, vindhyachal@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

- all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

- No part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale. Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

- EWL or its associates or relatives, have no actual/beneficial ownership of one %. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

- EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

-

-

-

-

- Compensation

-

-

-

-

- EWL or its associates have not received any compensation from the subject company in the past twelve months;

- EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

- EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

- EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

- EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research

- In respect of Public Appearances

- EWL or its associates have not received any compensation from the subject company in the past twelve months;

- The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL