Dev Accelerator Limited IPO Company Profile:

Euro Pratik Sales Limited is one of a leading player in India’s decorative wall panel market, specializing in the sale and marketing of decorative wall panels and laminates that align with evolving consumer preferences. The company develops differentiated design templates tailored to contemporary architectural and interior design trends, earning recognition as a product innovator for offerings such as Louvres, Chisel, and Auris at the India Coverings Expo from 2019 to 2022. Its growth has been driven by a consistent focus on delivering a wide assortment of high-quality products. Over the past seven years, the company has built a diversified product portfolio that has established a distinct presence in the decorative wall panel and laminate industry, catering to both residential and commercial segments.

| IPO-Note | Euro Pratik Sales Limited |

| Rs. 235 – Rs. 247 per Equity share | Recommendation: May Apply |

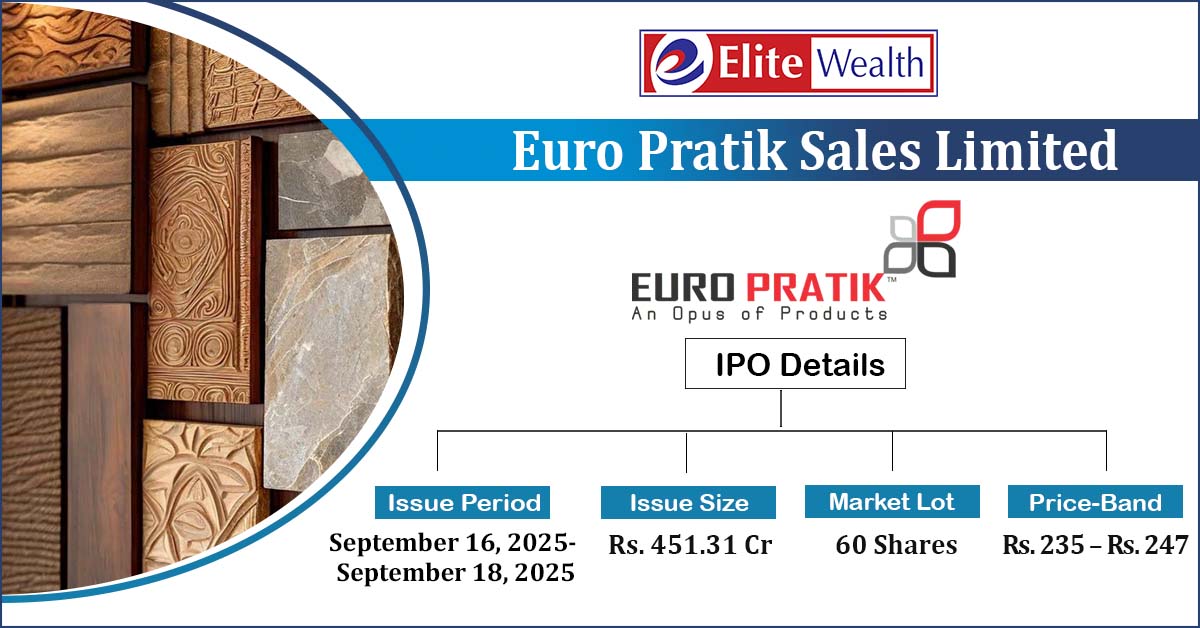

Euro Pratik Sales Limited IPO Details:

| Issue Details | |

| Objects of the issue | · For Listing Benefits

|

| Issue Size | Total Issue Size-Rs. 451.31 Cr

Offer for Sale Size- Rs. 451.31 Cr |

| Face value |

Rs . 1 |

| Issue Price | Rs. 235 – Rs. 247 per share |

| Bid Lot | 60 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | September 16, 2025- September 18, 2025 |

| QIB | Not More than 50% of Net Issue Offer |

| HNI | Not Less than 15% of Net Issue Offer |

| Retail | Not Less than 35% of Net Issue Offer |

Euro Pratik Sales Limited IPO Strengths:

- As of March 31, 2025, the company offered a diverse portfolio of over 30 product categories and more than 3,000 designs in India. Positioned as a fast-fashion brand in the decorative wall panels and laminates industry, it focuses on delivering trend-led, innovative solutions. In the last four years, the company launched 113 product catalogues, combining products and designs, demonstrating its ability to adapt swiftly to changing consumer preferences and maintain a strong market presence.

- The company is among India’s leading decorative wall panel brands and has established itself as one of the largest organized players in the industry, with a market share of 15.87%.

- As of March 31, 2025, the company managed product distribution through a robust and extensive network covering 116 cities across India, spanning metros, mini-metros, Tier-I, Tier-II, and Tier-III locations. This well-diversified reach enables the company to serve a broad spectrum of consumers and markets nationwide. The distribution network comprises 180 distributors across 25 states and five union territories, who connect the company with numerous retail touchpoints, ensuring effective market penetration and strong brand presence.

- The company aims to expand its footprint in international markets and will continue to evaluate growth opportunities through both organic and inorganic routes. Expansion decisions are guided by key criteria, including favorable demographics, market size and growth potential, competitive landscape within relevant product categories, and the scalability of operations. The company also prioritizes creating a robust multi-channel experience to effectively engage consumers and strengthen its presence in targeted global markets.

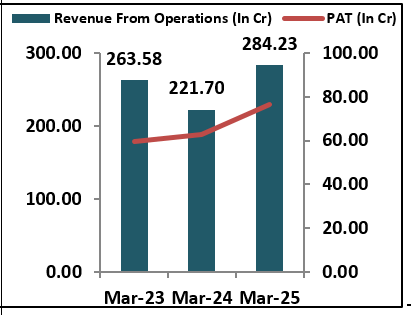

- In Fiscal 2025, the company reported revenue from operations of Rs 284.23 crore, reflecting a growth rate of 28.20% compared to Rs 221.70 crore in Fiscal 2024. Profit after tax stood at Rs 76.44 crore in Fiscal 2025, marking an increase of 22% over Rs 62.91 crore in the previous fiscal year.

- The decorative wall industry in India was valued at Rs 19,563 crore in Fiscal 2018 and expanded at a CAGR of 10.1% to reach Rs 3,16,98.2 crore by Fiscal 2023. In Fiscal 2024, the market grew by 8.1% to Rs 3,42,72.8 crore and further increased at a CAGR of 6.9% to Rs 3,66,21.9 crore in Fiscal 2025. Looking ahead, the industry is projected to grow at a robust CAGR of 12.9% over the next five years, reaching Rs 6,28,90.2 crore by Fiscal 2029.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Euro Pratik Sales Limited IPO Allotment Status

Euro Pratik Sales Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Euro Pratik Sales Limited IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Euro Pratik Sales Limited IPO Risk Factors:

- The company faces intense competition from direct and indirect players and offline players. Key competitors include Asian Paints, Berger Paints, Vivre Panels, Meraki Laminates, Elementto Life Styles, Marshalls Enterprise, Mystic Mann, Greenlam, Merino, and Stylam. This competitive landscape may impact pricing and market share, necessitating continuous innovation, operational efficiency, and differentiated service offerings to maintain and strengthen the company’s position in both domestic and global markets.

- The company’s key raw materials include acrylic, polyvinyl chloride (PVC), stone powder, and adhesives & resins, among others. Any fluctuations in the prices of these materials may adversely affect the company’s profitability.

Euro Pratik Sales Limited IPO Financial Performance:

Euro Pratik Sales Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 87.97% | 70.10% |

| Others | 12.03% | 29.90% |

Sources: Company Website, RHP.

Euro Pratik Sales Limited IPO Outlook:

Euro Pratik Sales Limited is one a leading player in India’s decorative wall panel market, specializing in the sale and marketing of wall panels and laminates that cater to evolving consumer preferences. In FY25, the company reported revenue growth of 28.20% and a 22% increase in profit after tax. With a diverse portfolio of over 30 product categories and 3,000+ designs, it has built strong brand recognition. The company operates through an extensive distribution network of 180 distributors across 116 cities, 25 states, and five union territories, while selectively expanding into international markets. However, it faces competition from established players, offline players and exposure to raw material price fluctuations. At the upper price band of Rs 247, the issue is priced at a P/E of 32.02x based on FY25 earnings, both pre- and post-IPO. Considering the valuations and other relevant factors, the issue is recommended primarily for aggressive investors seeking potential listing gains as well as medium- to long-term investment opportunities.

Euro Pratik Sales Limited IPO FAQ:

Ans. Euro Pratik Sales IPO is a main-board IPO of 1,82,71,862 equity shares of the face value of ₹1 aggregating up to ₹451.31 Crores. The issue is priced at . The minimum order quantity is 60.

The IPO opens on September 16, 2025, and closes on September 18, 2025.

MUFG Intime India Pvt.Ltd. is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Euro Pratik Sales IPO opens on September 16, 2025 and closes on September 18, 2025.

Ans. Euro Pratik Sales IPO lot size is 60

, and the minimum amount required for application is ₹14,820.

Ans. The Euro Pratik Sales IPO listing date is not yet announced. The tentative date of Euro Pratik Sales IPO listing is Tuesday, September 23, 2025.