Dev Accelerator Limited IPO Company Profile:

Dev Accelerator Ltd (DevX) is provider of flexible workspace solutions, offering a wide spectrum of options ranging from individual desks to fully customized office spaces with exclusive client access. Positioned as a one-stop integrated platform, the company caters to diverse workplace needs by sourcing and managing spaces through multiple models, including the Straight Lease Model, Revenue Share Model, Furnished by Landlord Model, and the OpCo–PropCo Model. With a focus on scalability and client-centric solutions, DevX has established a strong presence across both Tier 1 and Tier 2 markets in India. Its operations span key metropolitan hubs such as Delhi NCR, Hyderabad, Mumbai, Pune, and Ahmedabad, alongside fast-growing cities including Gandhinagar, Indore, Jaipur, Udaipur, Rajkot, and Vadodara.

| IPO-Note | Dev Accelerator Limited |

| Rs. 56 – Rs. 61 per Equity share | Recommendation: May Apply |

Dev Accelerator Limited IPO Details:

| Issue Details | |

| Objects of the issue | · Capital Expenditure for new Centre

· Repayment of Borrowings · General Corporate Expenses |

| Issue Size | Total Issue Size-Rs. 143.35 Cr

Fresh Issue Size- Rs. 143.35 Cr |

| Face value |

Rs . 2 |

| Issue Price | Rs. 56 – Rs. 61 per share |

| Bid Lot | 235 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | September 10, 2025- September 12, 2025 |

| QIB | Not Less than 75% of Net Issue Offer |

| HNI | Not More than 15% of Net Issue Offer |

| Retail | Not More than 10% of Net Issue Offer |

Dev Accelerator Limited IPO Strengths:

- The company offers comprehensive office space solutions encompassing space sourcing, customized design, development, technology integration, and complete asset management.

- The company engages real estate brokers and third-party aggregators, including independent property consultants, to identify and acquire clients for its centers.

- As on May 31, 2025, it has over 250 clients and 28 centers across 11 cities in India, with 14,144 seats covering a total area under management of SBA 860,522 square feet.

- The company’s clientele includes large corporates, MNCs, and SMEs, to whom it provides a diverse range of flexible workspace solutions, including managed office spaces, coworking spaces, and end-to-end design and execution services through its subsidiary, Needle and Thread Designs LLP.

- As of May 31, 2025, the company operated 28 centers, of which 21 function under the Straight Lease Model, where landlords lease space to operators at a fixed rental. Additionally, 6 centers operate under the Furnished by Landlord Model, wherein landlords provide fully furnished and equipped office spaces to the company for flexible workspace operations.

- The company has consistently maintained high occupancy levels across its centers, driven by superior service quality and the strategic location of its office spaces. As of May 31, 2025, the occupancy rate stood at 87.19%, while the rates for Fiscals 2025, 2024, and 2023 were 87.61%, 83.09%, and 80.85%, respectively.

- The company primarily focuses on serving large corporates by providing managed office solutions, with average lease tenures ranging from 5 to 9 years and lock-in periods between 3.5 and 5 years.

- In FY25, the company reported revenue from operations of Rs 158.88 crore, reflecting a growth of 47% compared to Rs 108.19 crore in FY24. Profit after tax stood at Rs 1.77 crore in FY25, marking a 305% increase from Rs 0.44 crore in FY24.

- Flex space operators are playing an increasingly vital role in India’s office market. In 2024, flex spaces contributed 20% of gross leasing, growing from 18.6 mn sq. ft. in 2018 to 74.0 mn sq. ft., reflecting a 26% CAGR. The segment has consistently accounted for 17–18% of annual gross leasing, with operational stock projected to nearly double to ~129 mn sq. ft. by 2028.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Dev Accelerator Limited IPO Allotment Status

Dev Accelerator Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Dev Accelerator Limited IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Dev Accelerator Limited IPO Risk Factors:

- The company faces intense competition from both listed and unlisted players, including Awfis Space Solutions Ltd, Smartworks Coworking Spaces Limited, Indiqube Spaces Limited, WeWork India, 91Springboard, and Workafella. The presence of these established competitors poses challenges that may impact the company’s market share, pricing flexibility, and overall growth potential.

- The flex space industry is highly dependent on the availability of suitable real estate. Fluctuations in the real estate market—such as rising rental costs, limited access to prime locations, or changes in property ownership—pose challenges for operators seeking to expand or establish centers. Aligning supply with dynamic demand further necessitates robust market analysis and accurate forecasting.

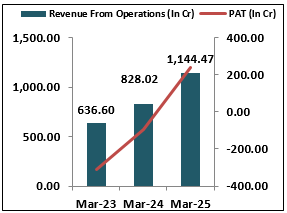

Dev Accelerator Limited IPO Financial Performance:

Dev Accelerator Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 49.79% | 36.81% |

| Others | 50.21% | 63.19% |

Sources: Company Website, RHP.

Dev Accelerator Limited IPO Outlook:

individual desks to fully customized office spaces with exclusive client access. The company reported robust financial growth in FY25, with revenue from operations rising 47% and profit after tax increasing 305%. As of May 31, 2025, DevX served over 250 clients across 28 centers in 11 cities, managing 14,144 seats over 860,522 sq. ft. of space. Occupancy rates remain strong at 87.19%. While industry growth supports expansion opportunities, but competition and pricing pressures pose challenges that could impact the company’s market positioning and profitability. At the upper price band of Rs 61, the issue is priced at a P/E of 229.83x pre-IPO and 310.82x post-IPO based on FY25 earnings. The valuations of the company are on the higher side; therefore, keeping in mind the valuations and listed factors, we recommend that only aggressive investors apply for the issue for listing gains and medium- to long-term investment.

Dev Accelerator Limited IPO FAQ:

Ans. Dev Accelerator IPO is a main-board IPO of 2,35,00,000 equity shares of the face value of ₹2 aggregating up to ₹143.35 Crores. The issue is priced at . The minimum order quantity is 235.

The IPO opens on September 10, 2025, and closes on September 12, 2025.

Kfin Technologies Ltd. is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Dev Accelerator IPO opens on September 10, 2025 and closes on September 12, 2025.

Ans. Dev Accelerator IPO lot size is 235, and the minimum amount required for application is ₹14,335.

Ans. The Dev Accelerator IPO listing date is not yet announced. The tentative date of Dev Accelerator IPO listing is Wednesday, September 17, 2025.