Mangal Electrical Industries Limited IPO Company Profile:

Mangal Electrical Industries Limited specializes in manufacturing and processing transformer components, including transformer laminations, CRGO slit coils, amorphous cores, coil and core assemblies, wound and toroidal cores, and oil-immersed circuit breakers. The company also trades in CRGO and CRNO coils, along with amorphous ribbons. In addition, it manufactures transformers and customized solutions for the power infrastructure industry, offering a product range from single-phase 5 KVA to three-phase 10 MVA units. The company further provides EPC services for establishing electrical substations, catering comprehensively to the needs of the power sector.

| IPO-Note | Mangal Electrical Industries Limited |

| Rs. 533 – Rs. 561 per Equity share | Recommendation: May Apply |

Mangal Electrical Industries Limited IPO Details:

| Issue Details | |

| Objects of the issue | · Capital expenditure for Unlit IV

· Repayment of Borrowings. · Working Capital Requirement · General Corporate Expenses. |

| Issue Size | Total Issue Size-Rs. 400.00 Cr

Fresh Issue Size- Rs. 400.00 Cr |

| Face value |

Rs . 10 |

| Issue Price | Rs. 533 – Rs. 561 per share |

| Bid Lot | 26 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | August 20, 2025- August 22, 2025 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not Less than 15% of Net Issue Offer |

| Retail | Not Less than 35% of Net Issue Offer |

Mangal Electrical Industries Limited IPO Strengths:

- The Company operates five manufacturing facilities in Rajasthan with an aggregate annual production capacity of (i) 16,200 MT of CRGO, (ii) 10,22,500 KVA of transformers, (iii) 75,000 units of oil-immersed circuit breakers, and (iv) 2,400 MT of amorphous units.

- As of June 30, 2025, the Company reported a strong order book of Rs 294.2 crore across all business segments. This robust pipeline underscores healthy demand for its products and services, providing revenue visibility and reinforcing its position in the power infrastructure sector.

- As of June 30, 2025, the Company had a well-diversified customer base, serving 128 clients across domestic and international markets. Domestically, its key markets include Rajasthan, Gujarat, and Uttar Pradesh, while internationally it caters to the United States of America, UAE, Netherlands, Oman, Nepal, Malaysia, and Egypt.

- As part of its commitment to growth and innovation, the Company is strategically enhancing its operational capacity by securing 765 kV class approval from PGCIL. This milestone positions it at the forefront of the power infrastructure sector, enabling it to meet the rising demand for high-capacity transmission solutions.

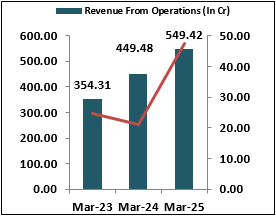

- It has reported revenue from operations of Rs 549.42 crore in FY25, a growth of 22.23% compared to Rs 449.48 crore in FY24. Profit after tax stood at Rs 47.31 crore in FY25, reflecting a robust increase of 126% from Rs 20.95 crore in FY24.

- The Government of India has introduced several flagship initiatives, including the Pradhan Mantri Sahaj Bijli Har Ghar Yojana (Saubhagya), Deen Dayal Upadhyaya Gram Jyoti Yojana, and the Revamped Distribution Sector Scheme, aimed at ensuring universal electricity access. These programs prioritize rural electrification and household connectivity, thereby driving substantial demand for reliable transmission and distribution (T&D) infrastructure, particularly in underserved regions.

- The Indian transformer industry is poised for strong growth, with the market expected to expand from Rs 353.9 billion in FY2025 to Rs 522.98 billion by FY2030, reflecting a CAGR of approximately 8.1%. This upward trajectory is fueled by rising electricity demand, driven by rapid urbanization, accelerating industrialization, and sustained economic growth.

- The company are committed to diversifying it’s existing product portfolio by introducing a broader range of innovative transformer solutions tailored to meet the diverse needs of the customers across various sectors, including renewable energy, infrastructure, and industrial applications. This strategic expansion will position us as a one-stop solution provider, enabling us to better serve the clients and address the growing demand for high-efficiency transformers.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Mangal Electrical Industries Limited IPO Allotment Status

Mangal Electrical Industries Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Mangal Electrical Industries Limited IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Mangal Electrical Industries Limited IPO Risk Factors:

- The Company operates in a highly competitive industry, facing significant competition from both established and emerging players, including listed and unlisted entities such as Transformers & Rectifiers India Ltd. (TRIL), Kirloskar Electric Company Ltd ,Mahindra Intertrade Ltd, Voltamp Transformers Ltd, Amod Stampings Pvt Ltd, Vardhaman Stampings Pvt Ltd, Jaybee Laminations Pvt Ltd, and Vilas Transcore Ltd. This competitive environment may exert pressure on pricing, margins, and market share, thereby posing a potential risk to the Company’s business performance.

- Fluctuations in the prices of key raw materials such as steel, aluminum, copper, galvanized iron, packing materials, insulation paper, pressboard, insulating oil, and polythene compounds may adversely impact the Company’s profitability.

Mangal Electrical Industries Limited IPO Financial Performance:

Mangal Electrical Industries Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 100.00% | 74.19% |

| Others | 00.00% | 25.81% |

Sources: Company Website, RHP.

Mangal Electrical Industries Limited IPO Outlook:

Mangal Electrical Industries Limited specializes in transformer components and solutions, supported by five modern facilities and a diversified product portfolio. In FY25, it delivered strong financial performance with 22.23% revenue growth and 126% PAT growth, supported by an order book of Rs 294.2 crore. Government initiatives to expand electrification, along with industry growth projections from Rs 353.9 billion in FY2025 to Rs 522.98 billion by FY2030, provide a favorable demand outlook. With 128 clients across domestic and international markets, the Company benefits from a diversified base. However, competition and fluctuations in raw material prices remain key challenges to profitability. At the upper price band of Rs 561, the issue is priced at a P/E of 24.31x on a pre-IPO basis and 32.76x on a post-IPO basis, based on FY25 earnings. Keeping in mind the valuations and listed factors, we recommend the issue only for aggressive investors to apply, both for listing gains and for medium to long-term investment.

Mangal Electrical Industries Limited IPO FAQ:

Ans. Mangal Electrical IPO is a main board IPO of 71,30,124 equity shares of the face value of ₹10 aggregating up to ₹400.00 Crores. The issue is priced at ₹533 to ₹561 per share. The minimum order quantity is 26.

The IPO opens on August 20, 2025, and closes on August 22, 2025.

Bigshare Services Pvt.Ltd. is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Mangal Electrical IPO opens on August 20, 2025 and closes on August 22, 2025.

Ans. Mangal Electrical IPO lot size is 26, and the minimum amount required for application is ₹14,586.

Ans. The Mangal Electrical IPO listing date is not yet announced. The tentative date of Mangal Electrical IPO listing is Thursday, August 28, 2025.