Vikram Solar Limited IPO Company Profile:

Vikram Solar Limited is one of India’s largest solar photovoltaic (PV) module manufacturers, with over 17 years of experience in the solar energy industry. The Company operates state-of-the-art manufacturing facilities at Falta SEZ, Kolkata, West Bengal, and Oragadam, Chennai, Tamil Nadu, strategically located to enable efficient domestic and international distribution through ports, rail, and road networks. Its diversified product portfolio comprises high-efficiency PV modules, including p-Type Monocrystalline Silicon Passivated Emitter and Rear Contact (PERC) modules, N-Type Monocrystalline Silicon modules, and n-Type Monocrystalline Silicon Heterojunction Technology (HJT) modules, available in bifacial (glass-to-glass / glass-to-transparent back sheet) and monofacial (glass-to-white / black back sheet) configurations, with variations based on cell size. The Company has supplied solar PV modules to customers across 39 countries, leveraging technology, quality, and scale to serve both domestic and global renewable energy markets.

| IPO-Note | Vikram Solar Limited |

| Rs. 315 – Rs. 332 per Equity share | Recommendation: Apply |

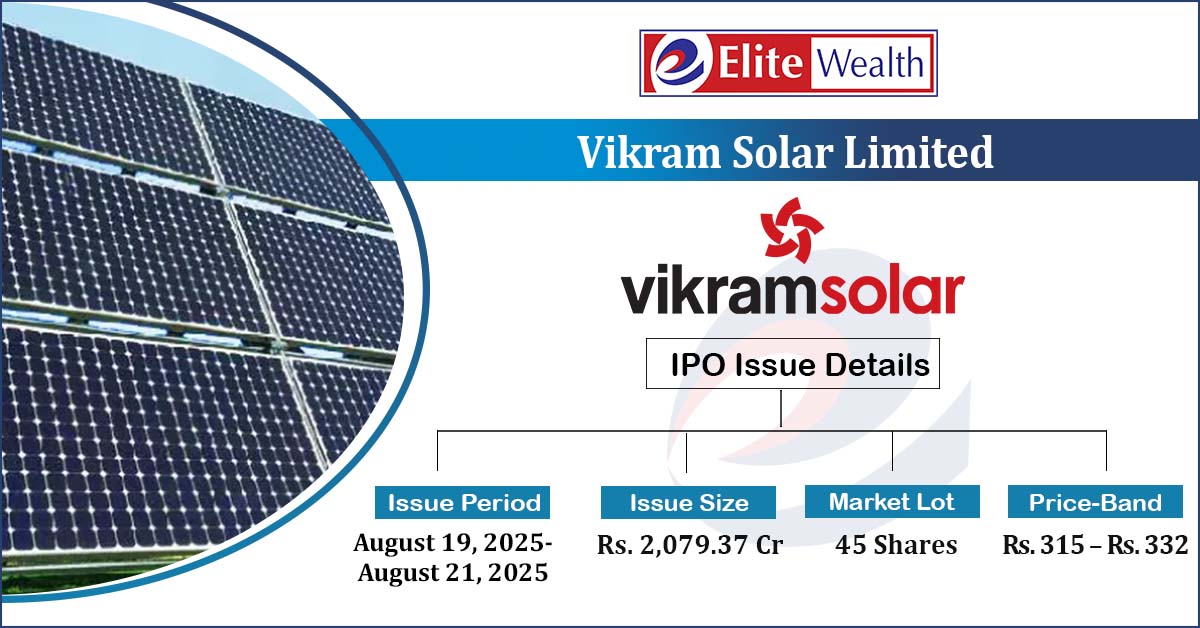

Vikram Solar Limited IPO Details:

| Issue Details | |

| Objects of the issue | · Funding for capital expenditure for phase – I and II projects.

· General Corporate Expenses |

| Issue Size | Total Issue Size-Rs. 2,079.37 Cr

Fresh Issue Size- Rs. 1,500.00 Cr Offer For Sale – Rs. 579.37 Cr |

| Face value |

Rs . 10 |

| Issue Price | Rs. 315 – Rs. 332 per share |

| Bid Lot | 45 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | August 19, 2025- August 21, 2025 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not Less than 15% of Net Issue Offer |

| Retail | Not Less than 35% of Net Issue Offer |

Vikram Solar Limited IPO Strengths:

- As of March 31, 2025, the Company’s Order Book stood at 10,340.82 MW, representing 30 times its total rated capacity in Fiscal 2025. Of this, 6,424.93 MW relates to projects and operations already under execution, while 3,915.89 MW pertains to projects yet to be executed.

- The Company has established a strong pan-India presence, catering to 19 states and two union territories through an extensive distribution network. The number of authorized distributors increased from 41 as of September 30, 2024, to 83 as of August 12, 2025, while the dealer network expanded from 64 to over 250 during the same period, reflecting the Company’s focused efforts to enhance market reach and penetration.

- With an installed manufacturing capacity of 50 GW for solar PV modules, the Company is one of the largest pure-play module manufacturers in India. As of June 30, 2025, its enlisted capacity under the Ministry of New & Renewable Energy’s (MNRE) Approved List of Modules and Manufacturers (ALMM) stood at 2.85 GW, as per CRISIL.

- To meet the growing demand, the Company is undertaking substantial greenfield and brownfield expansion initiatives, aimed at increasing its installed solar PV module manufacturing capacity to 50 GW by Fiscal 2026 and further to 20.50 GW by Fiscal 2027.

- The Company is strategically backward integrating into the solar value chain by establishing a solar cell manufacturing facility in Gangaikondan, Tamil Nadu, comprising two units of 00 GW and 9.00 GW, targeted for completion by Fiscal 2027. Additionally, it is developing a greenfield Battery Energy Storage System (BESS) project in Tamil Nadu with an initial 1.00 GWh capacity, expandable to 5.00 GWh by Fiscal 2027, enhancing leadership in energy generation, storage, and profitability.

- India’s push to expand PV manufacturing, supported by the Production Linked Incentive (PLI) scheme with a total outlay of Rs 240 billion, is expected to drive capacity to 175–185 GW by Fiscal 2030, with approx 25% fully integrated units post-Fiscal 2025. Gujarat will account for 55–60% of additions over the next five fiscals. This rapid industry expansion, backed by significant investments, presents a strong growth opportunity for the Company to leverage its scale, technology, and manufacturing capabilities to meet rising domestic and global demand.

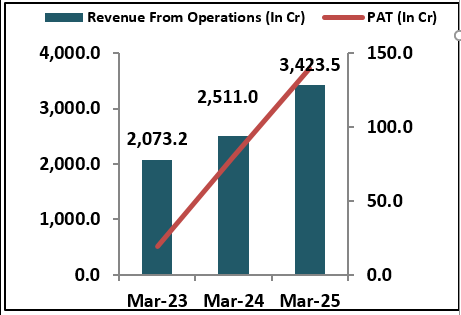

- It has achieved strong financial performance in FY25, with revenue from operations rising 33% to Rs 3,423.45 crore from Rs 2,510.99 crore in FY24. Profit after tax grew by 75.40%, reaching Rs 139.83 crore in FY25, compared to Rs 79.72 crore in the previous fiscal, reflecting improved operational efficiency and business growth.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Vikram Solar Limited IPO Allotment Status

Vikram Solar Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Vikram Solar Limited IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Vikram Solar Limited IPO Risk Factors:

- The Company operates in a highly competitive industry, facing significant competition from both established and emerging players, including listed and unlisted entities such as Waaree Energies Limited, Premier Energies Limited, Websol Energy System Limited, Adani Solar, Tata Power Solar Systems Limited, Swelect Energy Systems Limited, and Bluebird Solar Private Limited. This competitive environment may exert pressure on pricing, margins, and market share, thereby posing a potential risk to the Company’s business performance.

- Any increase in the prices of key raw materials, such as solar cells, back sheet/EVA, glass, frames, and other components, could adversely affect the Company’s cost structure, thereby impacting profitability and overall financial performance.

Vikram Solar Limited IPO Financial Performance:

Vikram Solar Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 77.64% | 63.12% |

| Others | 22.36% | 36.88% |

Sources: Company Website, RHP.

Vikram Solar Limited IPO Outlook:

Vikram Solar Limited, one of India’s largest solar PV module manufacturers, delivered strong FY25 results with 36.33% growth in revenue from operations and a 75.40% rise in profit after tax. With 4.50 GW installed capacity, it is pursuing significant greenfield and brownfield expansions, including a greenfield BESS project in Tamil Nadu (1.00 GWh, scalable to 5.00 GWh by FY27). Its robust 10,340.82 MW order book, coupled with the Government of India’s PLI scheme, supports growth prospects. However, the company faces competition, raw material price volatility, and potential tariff risk, as 96.60% of FY25 export revenue was derived from the U.S. market. At the upper price band of Rs 332, the issue is valued at a P/E of 85.88 based on FY25 post-IPO earnings, indicating higher valuations. We recommend applying only for potential listing gains and reconsidering post-listing for more attractive valuation opportunities in the secondary market.

Vikram Solar Limited IPO FAQ:

Ans. Vikram Solar IPO is a mainboard IPO of 6,26,31,604 equity shares of the face value of ₹10 aggregating up to ₹2,079.37 Crores. The issue is priced at ₹315 to ₹332 per share. The minimum order quantity is 45.

The IPO opens on August 19, 2025, and closes on August 21, 2025.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Vikram Solar IPO opens on August 19, 2025 and closes on August 21, 2025.

Ans. Vikram Solar IPO lot size is 45, and the minimum amount required for application is ₹14,940.

Ans. The Vikram Solar IPO listing date is not yet announced. The tentative date of Vikram Solar IPO listing is Tuesday, August 26, 2025.