Highway Infrastructure Limited (HIL) IPO Company Profile:

Highway Infrastructure Limited (HIL) is a diversified infrastructure development and management company engaged in toll collection, EPC infrastructure, and real estate activities. Tollway collection forms a significant part of its revenue, supported by its EPC operations involving construction of roads, bridges, irrigation systems, and civil structures. HIL is among the select toll operators implementing ANPR-based toll collection on the Delhi-Meerut Expressway. The company has managed toll operations across key inter-state and intra-state expressways in 11 states and one Union Territory. Leveraging advanced Electronic Toll Collection (ETC) systems with RFID and digital payment integration, HIL ensures seamless, contactless toll transactions. This technology-driven model enhances operational efficiency, minimizes congestion, and supports effective toll management across its project portfolio.

| IPO-Note | Highway Infrastructure Limited (HIL) |

| Rs. 65– Rs. 70 per Equity share | Recommendation: Apply |

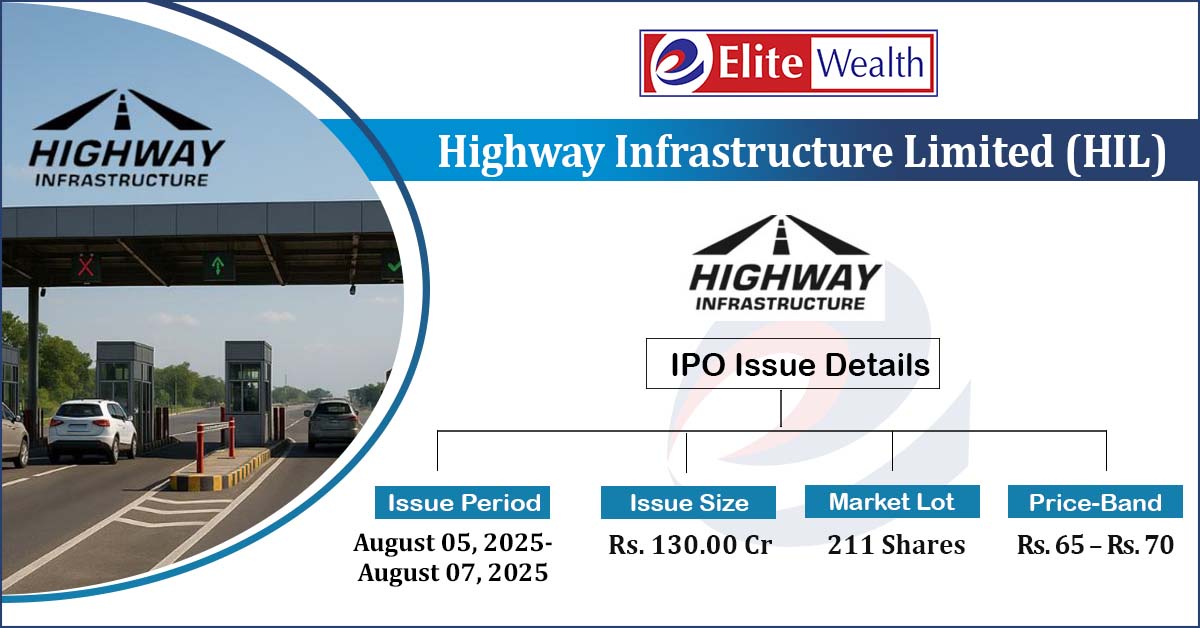

Highway Infrastructure Limited (HIL) IPO Details:

| Issue Details | |

| Objects of the issue | · Working Capital Requirement

· General Corporate Expenses |

| Issue Size | Total Issue Size-Rs. 130.00 Cr

Fresh Issue Size- Rs. 97.52 Cr Offer For Sale – Rs. 32.48 Cr |

| Face value |

Rs . 5 |

| Issue Price | Rs. 65 – Rs. 70 per share |

| Bid Lot | 211 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | August 05, 2025- August 07, 2025 |

| QIB | Not more than 30% of Net Issue Offer |

| HNI | Not Less than 30% of Net Issue Offer |

| Retail | Not Less than 40% of Net Issue Offer |

Highway Infrastructure Limited (HIL) IPO Strengths:

- The Company’s consolidated order book, as of May 31, 2025, stands at Rs 666.31 crore, comprising Rs 606.78 crore from the EPC infrastructure business and Rs 59.53 crore from the tollway collection segment, reflecting a strong project pipeline and robust execution capabilities across its core operational verticals.

- The Company, as of May 31, 2025, has successfully completed 27 tollway collection projects and is currently operating 4 active projects, underscoring its strong presence in toll operations. In the EPC infrastructure segment, it has completed 66 projects (with completion certificates pending for 4) and is executing 24 ongoing projects, demonstrating robust execution capabilities across a wide range of infrastructure domains.

- The company has executed projects across Madhya Pradesh, Gujarat, Andhra Pradesh, Punjab, Maharashtra, Telangana, Chhattisgarh, Haryana, Uttar Pradesh, Rajasthan, Odisha, and Delhi. As part of its growth strategy, the company intends to expand into additional states across India, subject to business and financial viability. This strategic expansion is expected to reduce regional concentration risk and enhance operational experience across diverse geographies.

- The government’s infrastructure push through the National Infrastructure Pipeline (NIP), supported by ‘Make in India’ and the PLI scheme, offers strong growth prospects. With over 9,000 projects across 34 sectors as per CareEdge, these initiatives are expected to help infrastructure companies expand operations and strengthen their presence across the country.

- The outlook for the toll industry remains positive, supported by expanding road infrastructure and rising traffic volumes. According to PIB and CareEdge, around 5,100 km of toll roads are expected to be completed by FY25, potentially generating Rs 4,200 crore in toll revenue during FY25–FY26. Increasing vehicle movement will further drive collections. Vision 2047 targets the development of 50,000 km of access-controlled expressways, while the Bharatmala Pariyojana aims to boost connectivity through economic corridors and feeder roads.

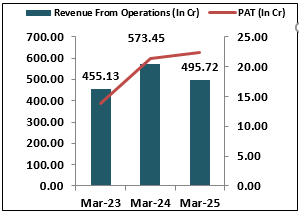

- The company reported revenue from operations of Rs 495.72 crore in FY25, marking a decline of 13.5% compared to Rs 573.45 crore in FY24. Despite the drop in revenue, profit after tax rose by 4.5% to Rs 22.40 crore in FY25 from ₹21.41 crore in FY24, reflecting improved profitability and operational efficiency.

- In FY25, the company derived 77.14% of its total revenue from the tollway collection segment, making it the primary revenue contributor. The EPC infrastructure segment accounted for 21.28%, while the real estate segment contributed 1.58%.

- A key strength of the company lies in its strong presence in the public sector, which contributed approximately 92% of its total revenue in FY25. This reflects the company’s established relationships and consistent order flow from government and public sector clients.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Highway Infrastructure Limited (HIL) IPO Allotment Status

Highway Infrastructure Limited (HIL) IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Highway Infrastructure Limited (HIL) IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Highway Infrastructure Limited (HIL) IPO Risk Factors:

- The company operates in a highly competitive industry, facing significant competition from both established and emerging players such as Udayshivakumar Infra Limited, IRB Infrastructure Developers Limited, H.G. Infra Engineering Limited, Larsen & Toubro, KEC International, Techno Electric & Engineering Company Ltd., and Kalpataru Projects International Ltd. This intense competitive landscape may exert pressure on pricing, margins, and market share, posing a potential risk to the company’s business performance.

- The company relies on the procurement of key construction materials such as cement, and, metal bars, construction chemicals, and other inputs for its operations. Any significant fluctuation in the prices or availability of these materials may adversely impact the company’s cost structure and profit margins, posing a risk to its financial performance.

Highway Infrastructure Limited (HIL) IPO Financial Performance:

Highway Infrastructure Limited (HIL) IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 94.95% | 70.04% |

| Others | 5.05% | 29.96% |

Sources: Company Website, RHP.

Highway Infrastructure Limited (HIL) IPO Outlook:

HIL reported a 13.5% decline in revenue from operations in FY25, while PAT rose by 4.5%. The company holds an order book of Rs 666.31 crore, with Rs 606.78 crore from toll collection its core focus. Around 92% of its revenue comes from the public sector, indicating strong government ties. HIL plans to expand operations into new states. It is well-positioned to benefit from infrastructure growth. Volatility in raw material costs, coupled with increasing competitive intensity, may pose challenges to the Company’s profitability and margin stability in the foreseeable future. At the upper price band of Rs 70, the issue is valued at a P/E of 18.06x (pre-IPO) and 22.41x (post-IPO) based on FY25 earnings. We recommend applying for potential listing gains and medium to long term investment.

Highway Infrastructure Limited (HIL) IPO FAQ:

Ans. Highway Infrastructure IPO is a main-board IPO of 1,85,71,428 equity shares of the face value of ₹5 aggregating up to ₹130.00 Crores. The issue is priced at ₹65 to ₹70 per share. The minimum order quantity is 211.

The IPO opens on August 5, 2025, and closes on August 7, 2025.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Highway Infrastructure IPO opens on August 5, 2025 and closes on August 7, 2025.

Ans. Highway Infrastructure IPO lot size is 211, and the minimum amount required for application is ₹14,770.

Ans. The Highway Infrastructure IPO listing date is not yet announced. The tentative date of Highway Infrastructure IPO listing is Tuesday, August 12, 2025.

Ans. The finalization of Basis of Allotment for Highway Infrastructure IPO will be done on Friday, August 8, 2025, and the allotted shares will be credited to your demat account by Monday, August 11, 2025.