HDB Financial Services Limited IPO Company Profile:

HDB Financial Services Limited, a subsidiary of HDFC Bank Limited, was established in 2007 and is classified as an Upper Layer NBFC (NBFC-UL) by the Reserve Bank of India. The company provides a wide range of lending solutions through an extensive omni-channel network, serving a growing and diverse customer base across India. Its business is structured into three verticals: Enterprise Lending, Asset Finance, and Consumer Finance. The company also offer business process outsourcing (“BPO”) services such as back-office support services, collection and sales support services to the Promoter as well as fee-based products such as distribution of insurance products primarily to the lending customers.

| IPO-Note | HDB Financial Services Limited |

| Rs. 700– Rs. 740 per Equity share | Recommendation: Apply |

HDB Financial Services Limited IPO Details:

| Issue Details | |

| Objects of the issue |

Strengthening Tier-I Capital Base for Future Growth and Lending Expansion

|

| Issue Size | Total issue Size – Rs. 12,500.00 Cr

Fresh Issue – Rs. 2,500.00 Cr Offer For Sale – Rs. 10,000.00 Cr |

| Face value |

Rs . 10 |

| Issue Price | Rs. 700 – Rs. 740 per share |

| Bid Lot | 20 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | June 25, 2025- June 27, 2025 |

| QIB | Not More than 50% of Net Issue Offer |

| HNI | Not Less than 15% of Net Issue Offer |

| Retail | Not Less than 35% of Net Issue Offer |

| Employee Reservation | Rs. – 20 Cr |

| HDFC Bank Shareholders Reservation | Rs. – 1,250 Cr |

HDB Financial Services Limited IPO Strengths:

- HDB Financial Services Limited is the seventh-largest diversified, retail-focused Non-Banking Financial Company (NBFC) in India, based on Total Gross Loan Book, which stood at Rs 90,220 crore as of March 31, 2024, according to the CRISIL Report. Among its NBFC peers, HDB has established a strong market position through its wide-ranging retail lending portfolio, disciplined credit practices, and scalable operations.

- For Fiscal 2025, 54% of the total revenue from operations was generated from the lending business, while 7.46% was contributed by the Business Process Outsourcing (BPO) services segment. This reflects the company’s continued strategic focus on its core lending operations as the primary driver of revenue.

- As of March 31, 2025, over 95% of the company’s customers were sourced and onboarded digitally, with support from its sales team or channel partners. Additionally, more than 95% of collections were conducted through digital and banking channels. This digital-first approach has streamlined operations, reduced turnaround times, and contributed to improved operational efficiency and a better cost-to-income ratio. And total number of customers of 19.2 million as at and for FY25.

- As of March 31, 2025, the company operates a pan-India network of 1,771 branches across 1,170 towns and cities in various States and Union Territories. Notably, over 80% of its branches are located outside the 20 most populous cities in India, reflecting a strong focus on expanding reach in underpenetrated and non-metro markets.

- As of March 31, 2025, the company’s branch network is supported by partnerships with over 80 brands and OEMs, along with an extensive external distribution network comprising over 140,000 retailers and dealer touchpoints. Its well-diversified loan portfolio spans across states, backed by a deep understanding of micro-markets in India across each business vertical, enabling targeted growth and effective risk management.

- NBFCs have significantly evolved in size, operations, and technology, with AUM rising from under Rs 2 trillion in FY2000 to Rs 48 trillion in FY2025. From FY2019 to FY2025, NBFC credit grew at a CAGR of 13.2%. CRISIL Intelligence projects 15–17% credit growth between FY2025 and FY2028, driven by robust expansion in the retail, MSME, and corporate lending segments.

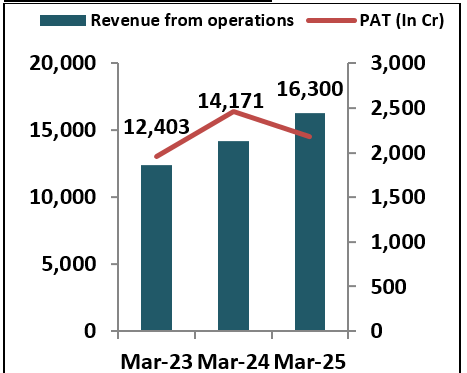

- In FY25, the company reported total revenue from operations of Rs 16,300.3 crore, reflecting a 15% increase compared to Rs 14,171.12 crore in FY24. However, profit after tax declined by 11.5%, from Rs 2,460.84 crore in FY24 to Rs 2,175.92 crore in FY25.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check HDB Financial Services Limited IPO Allotment Status

HDB Financial Services Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select HDB Financial Services Ltd IPO

-

Enter your PAN Number or Application Id or DP Client Id.

HDB Financial Services Limited IPO Risk Factors:

- The company faces intense competition from established players like Bajaj Finance Limited, Sundaram Finance Limited., L&T Finance Limited, IB Monotaro Pvt. Ltd , Mahindra & Mahindra Financial Services Limite, Cholamandalam Investment and Finance Company Limited, and Shriram Finance Limited. poses a significant risk to the market share of the company, pricing power, and ability to attract and retain customers in the highly competitive sector.

- Regulatory changes in the sector may adversely impact the company, potentially leading to increased compliance costs, operational adjustments, and a reduction in revenue and profitability due to changes in lending norms or capital requirements.

HDB Financial Services Limited IPO Financial Performance:

HDB Financial Services Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 94.32%

|

74.19% |

| Others | 5.68%

|

25.81% |

HDB Financial Services Limited IPO Outlook:

HDB Financial Services Limited is well-positioned for long-term growth, supported by its strong market presence, diversified lending portfolio, and expansive pan-India distribution network. Its continued investment in digital infrastructure and operational efficiency enhances scalability and customer reach, particularly in underpenetrated markets. Favorable industry trends, including projected NBFC credit growth of 15–17% between FY2025 and FY2028, offer a supportive environment. However, increasing regulatory alignment with banks and heightened competition from peers may impact margins and market share. Additionally, rising provisioning requirements could pressure profitability. At the upper price band of Rs 740 per share, the issue is priced at a P/E of 27.06x based on FY25 earnings before the IPO and 28.15x based on post-IPO earnings. Considering the company’s strong fundamentals, robust growth potential, and reasonable valuation, the offering presents an attractive opportunity. We recommend subscribing to the issue, both for potential listing gains and from a long-term investment perspective.

HDB Financial Services Limited IPO FAQ:

Ans. HDB Financial IPO is a main-board IPO of 16,89,18,919 equity shares of the face value of ₹10 aggregating up to ₹12,500.00 Crores. The issue is priced at ₹700 to ₹740 per share. The minimum order quantity is 20.

The IPO opens on June 25, 2025, and closes on June 27, 2025.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The HDB Financial IPO opens on June 25, 2025 and closes on June 27, 2025.

Ans. HDB Financial IPO lot size is 20, and the minimum amount required is ₹14,800.

Ans. The HDB Financial IPO listing date is not yet announced. The tentative date of HDB Financial IPO listing is Wednesday, July 2, 2025.

Ans. The finalization of Basis of Allotment for HDB Financial IPO will be done on Monday, June 30, 2025, and the allotted shares will be credited to your demat account by Tuesday, July 1, 2025.