Globe Civil Projects Limited IPO Company Profile:

Globe Civil Projects Limited, was incorporated in 2002 as an integrated Engineering, Procurement, and Construction (EPC) company. Operating across 11 Indian states, including Uttar Pradesh, Maharashtra, Karnataka, and Delhi, the company specializes in the execution of infrastructure and non-infrastructure projects. Its portfolio spans transport and logistics, social and commercial infrastructure, and residential and commercial buildings. Initially focused on educational institution construction, the company has successfully diversified into specialized projects such as railway bridges, airport terminals, elevated railway stations, and hospitals. In addition to construction services, Globe Civil Projects Limited is also engaged in the trading of goods, particularly TMT steel, further strengthening its presence in the infrastructure development sector.

| IPO-Note | Globe Civil Projects Limited |

| Rs. 67– Rs. 71 per Equity share | Recommendation: Apply |

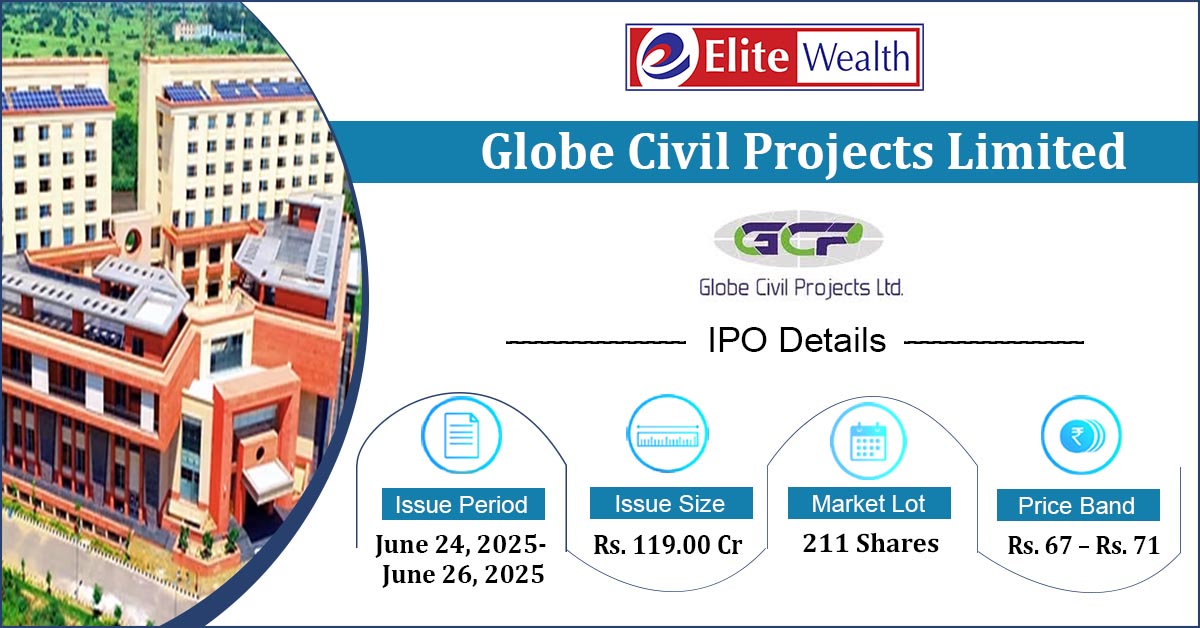

Globe Civil Projects Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· Funding Working Capital Requirement · Capital Expenditure · General Corporate Expenses |

| Issue Size | Total issue Size – Rs. 119.00 Cr

Fresh Issue – Rs. 119.00 Cr |

| Face value |

Rs . 10 |

| Issue Price | Rs. 67 – Rs. 71 per share |

| Bid Lot | 211 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | June 24, 2025- June 26, 2025 |

| QIB | Not More than 50% of Net Issue Offer |

| HNI | Not Less than 15% of Net Issue Offer |

| Retail | Not Less than 35% of Net Issue Offer |

Globe Civil Projects Limited IPO Strengths:

- As of March 31, 2025, the company’s Order Book stood at RS 669.1 crore, reflecting a strong and diversified project pipeline. Over the past two decades, Globe Civil Projects Limited has successfully completed 37 projects across various sectors. As of now, the company is executing 13 ongoing projects, which include 5 Social and Commercial Infrastructure projects, 3 Transport and Logistics projects, 4 Residential Building projects, and 1 Office Building project.

- As on 31th Dec 2024, The company’s key clients include prominent government and private sector entities such as Telecommunications Consultants India Limited, Swadeshi Civil Infrastructure Pvt. Ltd., NBCC (India) Limited, Central Public Works Department (CPWD), Rail Land Development Authority (RLDA), and South Central Railway. These longstanding relationships reflect the company’s strong track record, reliability, and credibility in delivering large-scale infrastructure projects.

- The company aims to expand its business by increasing project engagements within its existing operational footprint across 11 states. Additionally, it plans to broaden its geographical presence by entering new markets, with an initial focus on West Bengal and Odisha. This strategic expansion is intended to enhance the company’s market reach and strengthen its position in the infrastructure and construction sector.

- The company is accredited as a Class I Super Contractor with the Central Public Works Department (CPWD), Government of India. This accreditation qualifies the company to independently bid for single projects with a tender value of up to Rs 650 crore, underscoring its technical capability and compliance with stringent regulatory standards.

- India’s construction market is projected to become the second largest globally by 2030, with the sector’s Gross Value Added (GVA) expected to reach Rs 21.8 trillion. The industry is anticipated to grow at a CAGR of 7.2% during the period FY2024 to FY2030.

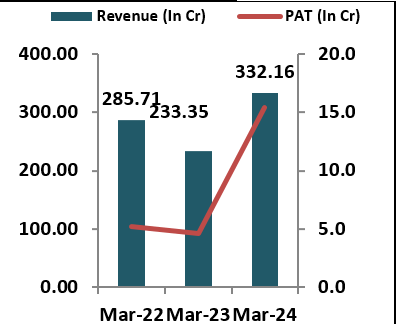

- The company reported revenue from operations of Rs 332.2 crore in FY24, representing a 42.4% increase compared to Rs 233.35 crore in FY23. Profit after tax for FY24 stood at Rs 15.38 crore, reflecting a significant growth of 217.11% over Rs 4.85 crore in FY23. For the nine-month period ended December 31, 2024, the company recorded revenue from operations of Rs 254.66 crore and a PAT of Rs 17.79 crore.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Globe Civil Projects Limited IPO Allotment Status

Globe Civil Projects Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Globe Civil Projects Ltd IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Globe Civil Projects Limited IPO Risk Factors:

- The company faces intense competition from established players like B L Kashyap and Sons Limited., Ceigall India Limited., PSP Projects Limited, Capacit’e Infraprojects Limited and Ahluwalia Contracts (India) Limited. poses a significant risk to the market share of the company, pricing power, and ability to attract and retain customers in the highly competitive sector.

- Fluctuating raw material prices, like TMT bars, cement, concrete and electrical items with price spikes eroding profit margins. Manufacturers must absorb costs or pass them on, risking business loss. Additionally, changes in international trade policies, such as U.S. tariffs, further impact industry dynamics.

Globe Civil Projects Limited IPO Financial Performance:

Globe Civil Projects Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 88.14%

|

63.41% |

| Others | 11.86%

|

36.59% |

Globe Civil Projects Limited IPO Outlook:

Globe Civil Projects Limited has demonstrated strong financial and operational performance, supported by a robust order book and diversified project portfolio across multiple states. Its accreditation as a Class I Super Contractor and focus on geographic expansion may improve its competitiveness. Additionally, the broader growth of India’s construction sector offers favourable macroeconomic tailwinds. However, the company operates in a highly competitive and price-sensitive industry, facing risks from established peers and input cost volatility. While recent financial results are encouraging, sustainability will depend on consistent execution, cost control, and successful market expansion. At the upper price band of Rs 71 per share, the IPO is valued at a P/E of 19.83x based on FY24 earnings and 17.88x on projected FY25 earnings. Keeping in mind the valuations and fundamental of the company we recommend for the issue for both listing gain and Medium to Long term time horizon.

Globe Civil Projects Limited IPO FAQ:

Ans. Globe Civil Projects IPO is a main-board IPO of 1,67,60,560 equity shares of the face value of ₹10 aggregating up to ₹119.00 Crores. The issue is priced at ₹67 to ₹71 per share. The minimum order quantity is 211.

The IPO opens on June 24, 2025, and closes on June 26, 2025.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Globe Civil Projects IPO opens on June 24, 2025 and closes on June 26, 2025.

Ans. The Globe Civil Projects IPO opens on June 24, 2025 and closes on June 26, 2025.

Ans. The finalization of Basis of Allotment for Globe Civil Projects IPO will be done on Friday, June 27, 2025, and the allotted shares will be credited to your demat account by Monday, June 30, 2025.

Ans. The finalization of Basis of Allotment for Arisinfra Solutions IPO will be done on Monday, June 23, 2025, and the allotted shares will be credited to your demat account by Tuesday, June 24, 2025.