Stallion India Fluorochemicals Limited IPO Company Profile:

Stallion India Fluorochemicals Limited was incorporated in 2002 and is in the business of selling refrigerant and industrial gases, as well as related products. The primary activities involve debulking (transferring gases from large containers to smaller ones), blending different gases to create custom formulations, and processing them for distribution.

| IPO-Note | Stallion India Fluorochemicals Limited |

| Rs.85– Rs.90 per Equity share | Recommendation: Apply |

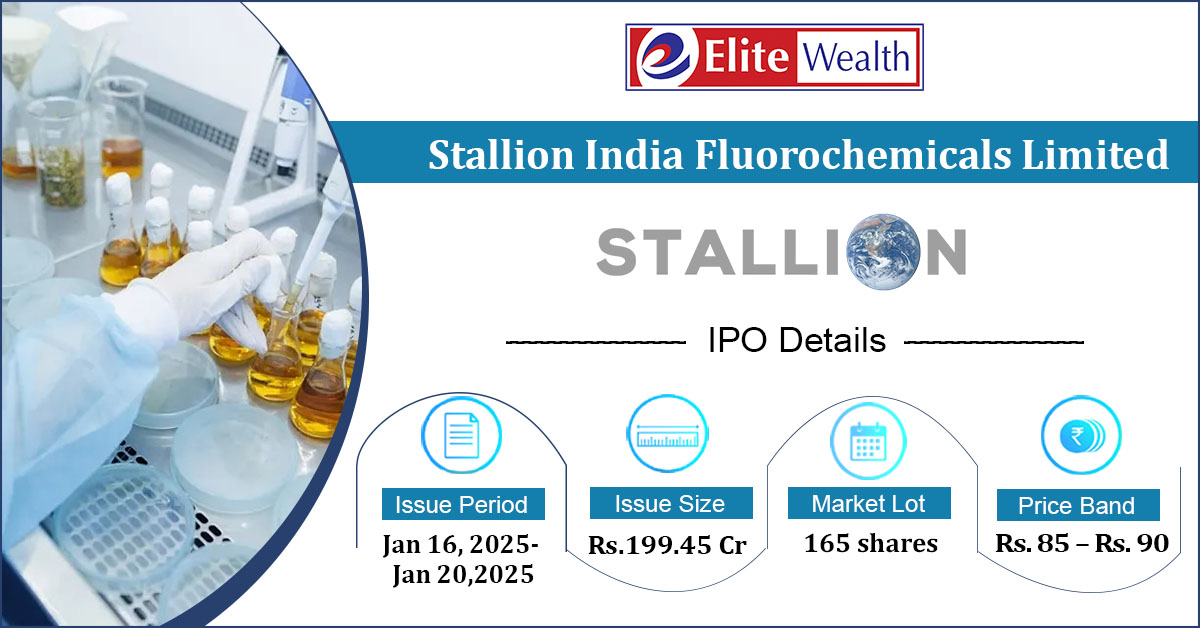

Stallion India Fluorochemicals Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· Funding capital Expenditure · General Corporate Purposes |

| Issue Size |

Total issue Size – Rs.199.45 Cr Offer for sale- Rs 38.72 Cr Fresh Issue- Rs 160.73 Cr |

| Face value |

Rs.10 |

| Issue Price | Rs.85 – Rs.90 per share |

| Bid Lot | 165 shares |

| Listing at |

BSE, NSE |

| Issue Opens | January 16 ,2025 – January 20, 2025 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Stallion India Fluorochemicals Limited IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Stallion India Fluorochemicals Limited IPO Allotment Status

Stallion India Fluorochemicals Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Stallion India Fluorochemicals Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post issue |

| Promoters Group | 94.63% | 67.90% |

| Others | 5.37% | 32.10% |

Stallion India Fluorochemicals Limited IPO Strengths:

- The company has diverse range of portfolio which satisfies need of high growth industries like Air conditioners & Refrigerators, Fire Fighting, Semiconductor manufacturing, Automobile Manufacturing, Pharma and Medicals, Glass bottle manufacturing, Aerosols and Spay foam.

- With more than 20 years of expertise, Stallion has established a strong reputation in the refrigerant gases industry.

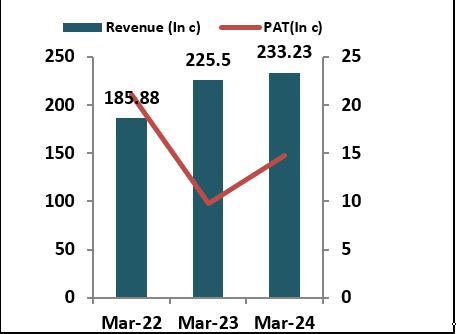

- The company reported revenue of Rs 233.23 crores in FY24 which was 3.42% higher from FY23. Company reported PAT of Rs 14.78 crores in FY24 which is 51.58% higher from FY23. In H1FY25 2024 company already had PAT of Rs 16.57 crores.

- The Indian fluorochemicals and specialty gases market is projected to grow at a CAGR of 16-18% from 2024 to 2029, reaching a market size of $675-725 million. The increasing demand for industrial gases across key sectors such as electronics, healthcare, and manufacturing presents a significant opportunity for Stallion India to strengthen its market presence. By offering essential fluorochemicals and specialty gases, Stallion is well-positioned to meet industry demands and align with evolving government initiatives.

Stallion India Fluorochemicals Limited IPO Risk Factors:

- The industry in which the company operates is highly competitive, with key competitor SRF Limited, Gujarat Fluorochemicals Limited, and Navin Fluorine International Limited.

- The company reported negative cash flow from operations in FY24, with an operational cash flow of Rs -73.44 crores, and also experienced negative cash flow in FY23.

- The company had lowest PAT margin among its competitors which was 6.26%.

- The company’s revenue is primarily driven by refrigerant gas sales in key regions such as Maharashtra and Delhi, which accounted for 69.82% of total sales in FY24.

- Approximately 96.4% of the company’s raw materials are imported from China. Any changes in government policies regarding imports from China could impact its financial performance.

Stallion India Fluorochemicals Limited IPO Outlook:

Stallion India Fluorochemicals Limited has established itself as a strong player in refrigerant gases industry with over 20 years of experience. The company has shown growth both in revenue and profitability and industry prospects also looks strong which will help the company to further grow. On the valuation front, on upper price band of Rs 90 company shares are offered at post issue P/E of 21.54/- based on FY25 expected annualized EPS of Rs 4.17 which appears reasonably valued. We recommend investors to apply for the issue for listing gains.

Stallion India Fluorochemicals Limited IPO FAQ:

Ans. Stallion India IPO is a main-board IPO of 22161396 equity shares of the face value of ₹10 aggregating up to ₹199.45 Crores. The issue is priced at ₹85 to ₹90 per share. The minimum order quantity is 165.

The IPO opens on January 16, 2025, and closes on January 20, 2025.

Bigshare Services Pvt Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Stallion India IPO opens on January 16, 2025 and closes on January 20, 2025.

Ans. Stallion India IPO lot size is 165, and the minimum amount required is ₹14,850.

Ans. The Stallion India IPO listing date is not yet announced. The tentative date of Stallion India IPO listing is Thursday, January 23, 2025.

Ans. The minimum lot size for this upcoming IPO is 165 shares.