Inventurus Knowledge Solutions Limited Company Profile:

Incorporated in 2006, Inventurus Knowledge Solutions Limited is a technology-driven healthcare solutions provider focused on supporting physician enterprises in the US, Canada, and Australia, with a primary emphasis on the US market. The company’s care enablement platform partners with outpatient and inpatient care organizations, enabling them to deliver superior clinical care, improve health outcomes, and transition to a “fee-for-value” model. By optimizing revenue and reducing operating costs, the company allows healthcare organizations to focus on patient care. Inventurus leverages advanced technology and global human capital to streamline essential tasks, ensuring safer, more effective, and cost-efficient healthcare delivery across both outpatient and inpatient settings.

| IPO-Note | Inventurus Knowledge Solutions Limited |

| Rs.1265– Rs.1329 per Equity share | Recommendation: Apply |

Inventurus Knowledge Solutions Limited IPO Details :

| Issue Details | |

| Objects of the issue |

· Entirely for offer for sale |

| Issue Size | Total issue Size – Rs.2,497.92 Cr

Offer for sale- Rs.2,497.92 Cr |

| Face value |

Rs.1 |

| Issue Price | Rs.1265 – Rs.1329 per share |

| Bid Lot | 11 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | December 12, 2024- December16, 2024 |

| QIB | Not less than 75% of Net Issue Offer |

| HNI | Not more than 15% of Net Issue Offer |

| Retail | Not more than 10% of Net Issue Offer |

Inventurus Knowledge Solutions Limited IPO Strengths:

-

The U.S. healthcare spending is expected to reach $6,216 billion by 2028. IKS is well-positioned to benefit from the growing U.S. provider enablement technology market, projected to be worth U.S.$323 billion.

-

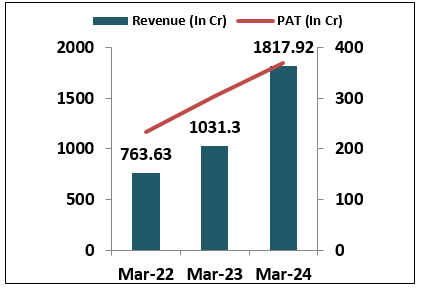

In FY24, the company reported a 76.26% increase in revenue to Rs 1,817.8 crore, compared to FY23, with profit after tax rising 21.37% to Rs 370.48 crore from FY23. In Q2FY25 revenue stood at Rs 1,282.84 crore, up 103.34% from Q2FY24.

-

As of September 30, 2024, the company serves 778 healthcare organizations, including health systems, academic medical centres, multi-specialty medical groups, single-specialty medical groups, ancillary healthcare organizations and 231 other outpatient healthcare delivery organizations.

-

In October 2023, IKS Health acquired Aquity Holdings, enhancing its capabilities and solidifying its position in both inpatient and outpatient care, creating a powerful healthcare technology powerhouse under the IKS Health brand.

-

Inventurus Knowledge Solutions leverages its scalable platform and expertise to address the growing demand for healthcare enablement solutions, driven by labor shortages, consumerism, and the shift to value-based care.

Inventurus Knowledge Solutions Limited IPO Risk Factors:

The company faces Intense competition from established players like Conifer Health Solutions, PatientsLikeMe, and Optum, poses a significant risk to the company’s market share, pricing power, and ability to attract and retain customers in the highly competitive sector

Inventurus Knowledge Solutions Limited IPO Financial Performance :

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Inventurus Knowledge Solutions Limited IPO Allotment Status

Inventurus Knowledge Solutions Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Inventurus Knowledge Solutions Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 69.73% | 60.61% |

| Others | 27.53% | 39.9% |

Inventurus Knowledge Solutions Limited IPO Outlook:

Inventurus Knowledge Solutions Limited is a technology-driven healthcare solutions provider, strategically positioned for substantial growth. The company has demonstrated strong financial performance, with notable revenue growth and profitability. On the upper price band, the company shares are offered at P/E of Rs 54.66/- based on eFY25 EPS of Rs 24.31. We recommend investors to apply for the issue for both listing gains and long-term gains.

Inventurus Knowledge Solutions Limited IPO FAQ:

Ans. Inventurus Knowledge Solutions IPO is a main-board IPO of 18,795,510 equity shares of the face value of ₹1 aggregating up to ₹2,497.92 Crores. The issue is priced at ₹1265 to ₹1329 per share. The minimum order quantity is 11 Shares.

The IPO opens on December 12, 2024, and closes on December 16, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Inventurus Knowledge Solutions IPO opens on December 12, 2024 and closes on December 16, 2024.

Ans. Inventurus Knowledge Solutions IPO lot size is 11 Shares, and the minimum amount required is ₹14,619.

Ans. The Inventurus Knowledge Solutions IPO listing date is not yet announced. The tentative date of Inventurus Knowledge Solutions IPO listing is Thursday, December 19, 2024.

Ans. The minimum lot size for this upcoming IPO is 11 shares.