Axis CRISIL-IBX AAA Bond Financial Services – Sep 2027 Index Fund:

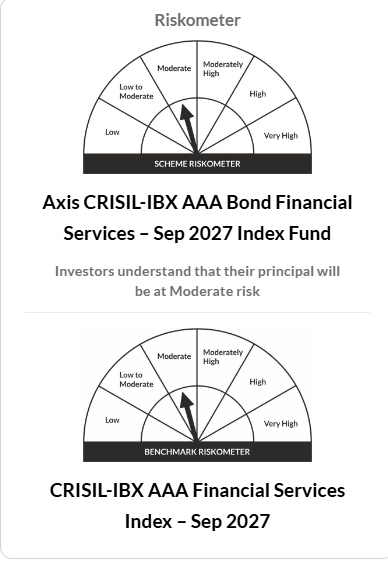

An open-ended Target Maturity Index Fund investing in constituents of CRISIL-IBX AAA Financial Services Index – Sep 2027. A moderate interest rate risk and relatively low credit risk

Investment Objective:

The investment objective of the scheme is to provide investment returns before fees and expenses that closely corresponding to the total returns of the securities as represented by the CRISIL-IBX AAA Financial Services Index –Sep 2027, subject to tracking error/ tracking difference. There is no assurance that the investment objective of the Scheme will be achieved.

(source:axismf.com)

Axis CRISIL-IBX AAA Bond Financial Services – Sep 2027 Index Fund NFO Details:

| Mutual Fund | Axis Mutual Fund |

| Scheme Name | Axis CRISIL-IBX AAA Bond Financial Services – Sep 2027 Index Fund |

| Objective of Scheme | The investment objective of the scheme is to provide investment returns before fees and expenses that closely corresponding to the total returns of the securities as represented by the CRISIL-IBX AAA Financial Services Index – Sep 2027, subject to tracking error/ tracking difference. There is no assurance that the investment objective of the Scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Other Scheme – Index Funds |

| New Fund Launch Date | 08-Nov-2024 |

| New Fund Earliest Closure Date | 21-Nov-2024 |

| New Fund Offer Closure Date | 21-Nov-2024 |

| Indicate Load Seperately | NIL |

| Minimum Subscription Amount | Rs. 5,000 and in multiples of Re. 1/- thereof |

(source:amfiindia)

Scheme Documents

(source:axismf.com)

Axis CRISIL-IBX AAA Bond Financial Services – Sep 2027 Index Fund:

An open-ended Target Maturity Index Fund investing in constituents of CRISIL-IBX AAA Financial Services Index – Sep 2027. A moderate interest rate risk and relatively low credit risk

- Income over the target maturity period

- An open ended target maturity index fund tracking CRISILIBX AAA Financial Services Index – Sep 2027, subject to tracking error/tracking difference.

The above product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or model portfolio and the same may vary post NFO when actual investments are made