Swiggy limited IPO Company Profile:

Swiggy limited is an Indian online food ordering and delivery service company (QSR) established in 2014, with its headquarters in Bangalore. As a modern, consumer-focused technology company, it provides an intuitive platform via a unified app. Users can easily browse, select, order, and pay for food (“Food Delivery”), groceries, and household essentials (Instamart), with deliveries made directly to their doorstep through a network of on-demand delivery partners. The platform also supports restaurant reservations (Dineout), event bookings (SteppinOut), product pick-up and drop-off services (Genie), and various hyperlocal commerce activities (such as Swiggy Minis). According to the Kantar BrandZ Most Valuable Indian Brands Report 2024, Swiggy is the most valuable brand in the Consumer Technology & Services Platforms category and is among the Top 25 most valuable brands in India overall.

| IPO-Note |

Swiggy limited |

| Rs 371 to Rs 390 per share | Recommendation: Avoid |

Swiggy limited IPO Details:

| Issue Details | |

| Objects of the issue | · Investment in subsidiary, Scootsy for repayment of debt and expansion of dark store.

· Investment in technology and cloud infrastructure. |

| Issue Size | Total issue size- Rs 11327.43 Cr

Fresh issue- Rs 4499 Cr Offer for sale- 6828.43 Cr |

| Face value | Rs 1 |

| Issue Price | Rs 371 to Rs 390 per share

Employee discount- Rs 25 per share |

| Bid Lot | 38 shares |

| Listing at | BSE,NSE |

| Issue Opens | November 6 ,2024 to November 8, 2024 |

| QIB | Not less than 75% of Net issue |

| HNI | Not more than 15.00% of Net Issue |

| Retail | Not more than 10% of the Net Issue |

Swiggy limited IPO Strengths:

- Swiggy has established itself as a key competitor in the online food delivery industry. As of FY24, average monthly transacting users were 1.27 crores, which were 10.43% more than FY23.

- The “Swiggy One” plan experienced significant growth in membership, rising to 53 lakh in FY24, a 283% increase compared to FY23.

- The online food delivery market has experienced strong growth over the past five years, with a CAGR of 41%. As per Redseer research, it is projected to reach a value of Rs 1,400 to 1,700 billion, with a CAGR of 17% to 22%. This expanding market presents significant opportunities for the company to further increase its revenue and pursue expansion.

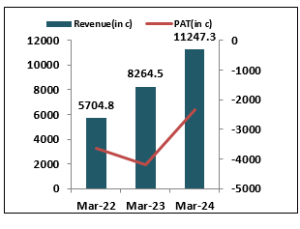

- For FY24, the company reported revenue of 11,247.3 crores, representing a 36.1% increase compared to FY23. The compound annual growth rate (CAGR) of revenue from FY22 to FY24 was 40.1%.

- As of FY24, the company operated 557 dark stores, reflecting a 32% increase compared to FY23. This growth will support the company’s future expansion plan.

Swiggy limited IPO Risk Factors:

- The company has incurred losses, every year since inception, loss for FY24 was Rs 2350.2 crores.

- Company has negative cash flow from operations. CFO for the period FY24 was 1458.4 crores and is expected to continue further during next financial years.

- The online food delivery industry is highly competitive, with the company facing intense rivalry from players like Zomato, Uber Eats, Magic pin, and others.

Swiggy limited IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Swiggy limited IPO Allotment Status

Swiggy limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Swiggy limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post-Issue |

| Promoters Group | 63.56% | 53.24% |

| Public | 36.44% | 46.75% |

Swiggy limited IPO Outlook:

Swiggy limited is a new age QSR company, which is providing bridge between customer to restaurant and online grocer. It is a future looking business, but generally these kind of business witness high cash burns. The company is providing services for food delivery, quick commerce vertical for grocery through Instamart. As we witness cut throat competition from the existing players as well as new players. Company cash flow from operations (CFO) is negative and EBITDA is also negative. So we advise investors to avoid this IPO, as listed players are available at better valuation and we can get it at discount price after listing.

Swiggy limited IPO FAQ:

Ans. Swiggy IPO is a main-board IPO of 290,446,837 equity shares of the face value of ₹1 aggregating up to ₹11,327.43 Crores. The issue is priced at ₹371 to ₹390 per share. The minimum order quantity is 38 Shares.

The IPO opens on November 6, 2024, and closes on November 8, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Swiggy IPO opens on November 6, 2024 and closes on November 8, 2024.

Ans. Swiggy IPO lot size is 38 Shares, and the minimum amount required is ₹14,820.

Ans. The Swiggy IPO listing date is not yet announced. The tentative date of Swiggy IPO listing is Wednesday, November 13, 2024.

Ans. The minimum lot size for this upcoming IPO is 38 shares.