Hyundai Motor India IPO Company Profile:

Hyundai Motor India is a member of the Hyundai Motor Group, the third-largest auto original equipment manufacturer. As per CRISIL Report Company has established themselves as the second-largest auto OEM in the Indian passenger vehicle market since Fiscal 2009 in terms of domestic sales volumes. Company track record include the manufacturing and sale of reliable, feature-rich, and innovative four-wheeler passenger vehicles supported by the latest technology. Company has diverse portfolio which features 13 models across various segments, including sedans, hatchbacks, sports utility vehicles (SUVs), and battery electric vehicles (EVs). To date June 14, 2024, company has sold nearly 1.2 crores passenger vehicles in India and through exports.

| IPO-Note | Hyundai Motor India |

| Rs.1865 – Rs.-1960 per Equity share | Recommendation- Apply |

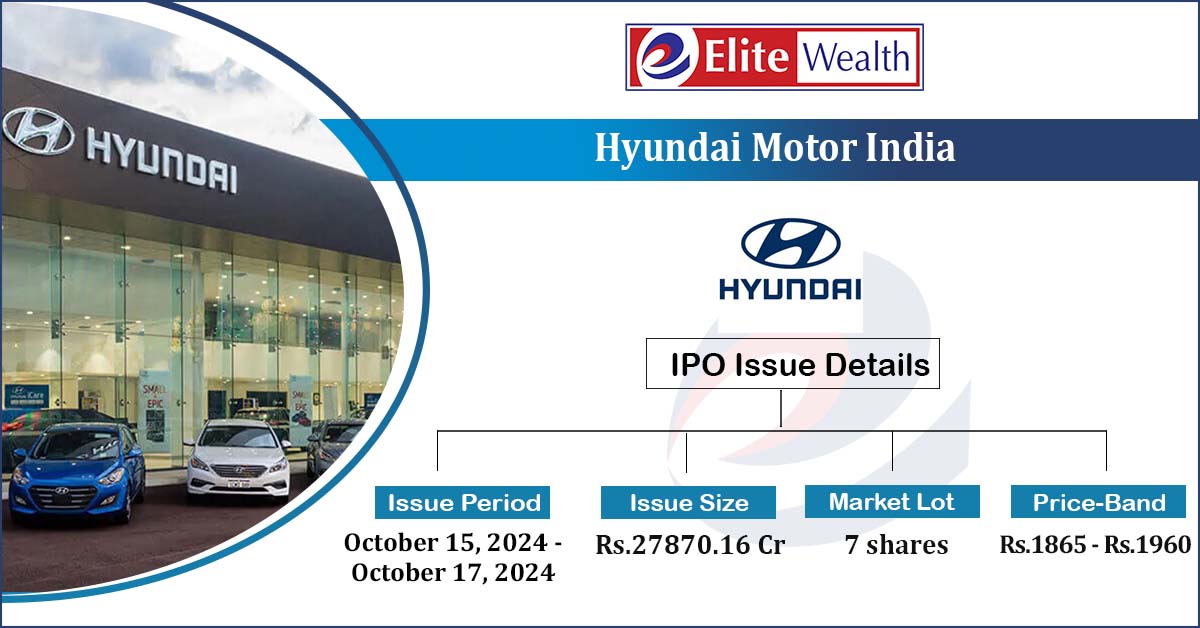

Hyundai Motor India IPO Details:

| Issue Details | |

| Objects of the issue | Entirely an offer for sale |

| Issue Size | Total issue size- Rs27870.16 Cr

Offer for sale – Rs 27870.16 Cr Employee discount – Rs 186 per share |

| Face value | Rs 10 per share |

| Issue Price | Rs 1865 to Rs 1960 per share |

| Bid Lot | 7 shares |

| Listing at | BSE,NSE |

| Issue Opens | October 15, 2024 to October 17, 2024 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Hyundai Motor India IPO Strengths:

- Hyundai Motor India benefits from its strong affiliation with Hyundai Motor Group, recognized as the third-largest auto OEM according to the CRISIL Report for FY23.

- According to the CRISIL Report, they have consistently held the position of the largest auto OEM in India by sales volume in the mid-size SUV sub-segment from Fiscal 2019 through the first 11 months of Fiscal 2024. Additionally, they were the largest exporter of passenger vehicles in India from Fiscal 2005 to the first 11 months of Fiscal 2024, achieving the highest cumulative exports during this period.

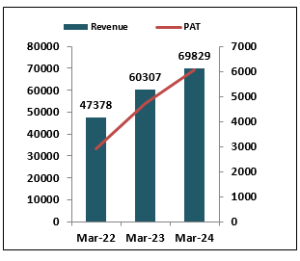

- In FY24, the company’s revenue reached Rs 69,829.05 crores, reflecting a 15.7% increase over FY23. The compound annual growth rate (CAGR) from FY22 to FY24 was 21.4%. Additionally, the profit after tax (PAT) for FY24 was Rs 6,060.04 crores, representing a 28.68% increase compared to FY23.

- Company cash flow from operations in FY24 stood at Rs 9251.95 crores which was 40% more than FY23.

- According to the CRISIL report, the company has the second-largest sales and service network in India based on customer touchpoints. As of December 31, 2023, it operates 1,366 sales outlets and 1,550 service stations.

Hyundai Motor India IPO Financial Performance:

Hyundai Motor India IPO Risk Factors:

- The Indian passenger car market is highly competitive, with the company facing significant challenges from Maruti, Mahindra & Mahindra, and Tata Motors.

- The sales volume of passenger vehicles is quite cyclical, with demand peaking during the festival season.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Hyundai Motor India IPO Allotment Status

Hyundai Motor India IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Hyundai Motor India IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post issue |

| Promoters Group | 100% | 82.5% |

| Others | – | 17.5% |

Hyundai Motor India IPO Outlook:

Hyundai Motors India is a prominent player in the automotive industry, making it an appealing option for investors. The company has shown robust financial performance, both in revenue and profitability, and this trend is anticipated to continue. However, the projected post-IPO P/E ratio of 26.7 appears relatively high. Therefore, we recommend that investors with a medium to long-term perspective consider applying for the IPO, as it may offer potential listing gains and long-term value.

Hyundai Motor India IPO FAQ:

Ans. Hyundai Motor IPO is a main-board IPO of 142,194,700 equity shares of the face value of ₹10 aggregating up to ₹27,870.16 Crores. The issue is priced at ₹1865 to ₹1960 per share. The minimum order quantity is 7 Shares.

The IPO opens on October 15, 2024, and closes on October 17, 2024.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Hyundai Motor IPO opens on October 15, 2024 and closes on October 17, 2024.

Ans. Hyundai Motor IPO lot size is 7 Shares, and the minimum amount required is ₹13,720.

Ans.The Hyundai Motor IPO listing date is not yet announced. The tentative date of Hyundai Motor IPO listing is Tuesday, October 22, 2024.

Ans. The minimum lot size for this upcoming IPO is 7 shares.