Aditya Birla Sun Life Crisil-IBX AAA NBFC-HFC Index-Dec 2025 Fund NFO:

- NBFC and HFC Segment Strengthening FinanciallyThe earnings, profitability, and asset quality of NBFCs and HFCs have significantly improved. Return on assets has been consistently rising, and NPAs are steadily improving.

- Growing credit demand to boost segment performanceIncreasing per capita income and easing inflation are driving credit demand for NBFCs, while rising housing demand in Tier I and II cities supports HFC growth. Credit for both segments is expected to grow at a CAGR of ~15% in the coming years.

- Better returns with lower risks – a short-term investment opportunityIndia’s debt yields remain near decade-high yield levels, with the spreads between NBFC-HFC issuers and gilt securities ranging from 135 to 150 basis points. Further, AAA-rated NBFC-HFC bonds are potentially low risk due to strong creditworthiness and financial stability.

- Sectorial Target Maturity Fund – A smart investment optionThese passively managed funds invest in a basket of debt securities with a defined maturity date, offering predictable returns. Such funds that invest in bonds of the NBFC-HFC segment are good route to capitalise on the short-term investment opportunity arisen.

Aditya Birla Sun Life Crisil-IBX AAA NBFC-HFC INDEX-Sep 2026 Fund NFO Details:

| Mutual Fund | Aditya Birla Sun Life Mutual Fund |

| Scheme Name | Aditya Birla Sun Life Crisil-IBX AAA NBFC-HFC Index-Dec 2025 Fund |

| Objective of Scheme | The investment objective of the scheme is to generate returns corresponding to the total returns of the securities as represented by the CRISIL-IBX AAA NBFC-HFC Index – Dec 2025 before expenses, subject to tracking errors. |

| Scheme Type | Open Ended |

| Scheme Category | Other Scheme – Index Funds |

| New Fund Launch Date | 08-Oct-2024 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 14-Oct-2024 |

| Indicate Load Seperately | |

| Minimum Subscription Amount | 1000 |

(source:amfiindia)

Scheme Documents

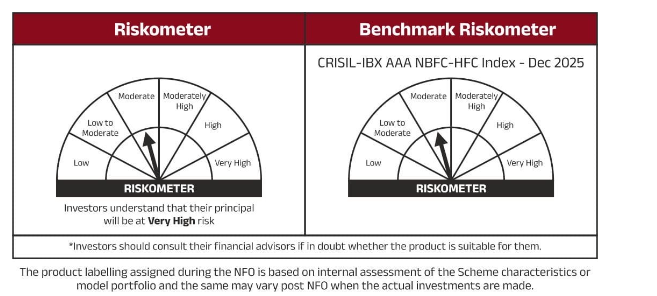

Aditya Birla Sun Life Crisil-IBX AAA NBFC-HFC Index-Dec 2025 Risko Meter: