Aditya Birla Sun Life Crisil-IBX AAA NBFC-HFC INDEX-Sep 2026 Fund NFO:

- Robust Growth in the NBFC-HFC SegmentWe believe this segment is witnessing improving metrics, with year-on-year increasing earnings growth, strong balance sheets, and declining NPAs.

- Surging Credit Demand Driving ExpansionRising per capita income and easing inflation are fuelling credit demand across NBFCs. Positive employment trends are boosting housing demand in Tier I and Tier II cities, further driving credit growth for HFCs.

- An Opportunity for Short-Term Debt InvestorsAs global interest rates begin to ease, India remains at near decade-high yield levels. The spread between high-quality NBFC-HFC issuers and gilt securities for 1–2-year tenures range from 135 to 150 basis point1, presenting an attractive investment opportunity.

1-Source: Bloomberg, Data as on 23rd September 2024 - Seize this opportunity with a Sector-Based Target Maturity FundA sector-based target maturity fund provides easy access to short-term debt investments in the NBFC-HFC segment. As a passive debt fund, it offers a convenient way to capitalize on this opportunity.

(source: mutualfund.adityabirlacapital.com/)

Aditya Birla Sun Life Crisil-IBX AAA NBFC-HFC INDEX-Sep 2026 Fund NFO Details:

| Mutual Fund | Aditya Birla Sun Life Mutual Fund |

| Scheme Name | Aditya Birla Sun Life Crisil-IBX AAA NBFC-HFC INDEX-Sep 2026 Fund |

| Objective of Scheme | The investment objective of the scheme is to generate returns corresponding to the total returns of the securities as represented by the CRISIL-IBX AAA NBFC-HFC Index – Sep 2026 before expenses, subject to tracking errors. |

| Scheme Type | Open Ended |

| Scheme Category | Other Scheme – Index Funds |

| New Fund Launch Date | 30-Sep-2024 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 07-Oct-2024 |

| Indicate Load Seperately | |

| Minimum Subscription Amount | 1000 |

(source:amfiindia)

Scheme Documents

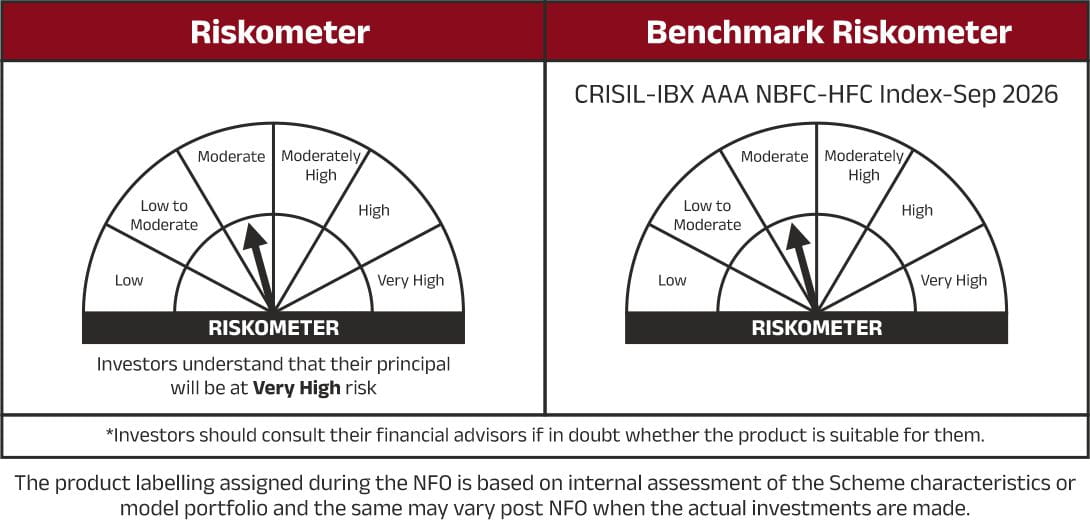

Aditya Birla Sun Life Crisil-IBX AAA NBFC-HFC INDEX-Sep 2026 Fund NFO Risko Meter: