Diffusion Engineers IPO Company Profile:

Diffusion Engineers specialize in manufacturing welding consumables, wear plates, wear parts, and heavy engineering machinery for key industries. With over four decades of experience, the company is committed to offer specialized repair and reconditioning services for heavy machinery and equipment. They also trade in anti-wear powders, as well as welding and cutting machinery. At their manufacturing facilities, they provide a super conditioning process—an advanced surface treatment solution for machine components. This process enhances wear resistance, eliminates stress, improves reparability, and ultimately extends the lifespan of equipment while reducing production costs. Additionally, they have developed a synergistic system of forward integration that allows them to manufacture specialized electrodes and flux-cored wires, which are used in producing wear-resistant plates, commonly known as wear plates.

| IPO-Note | Diffusion Engineers Limited |

| Rs.159 – Rs.168 per Equity share | Recommendation: Apply |

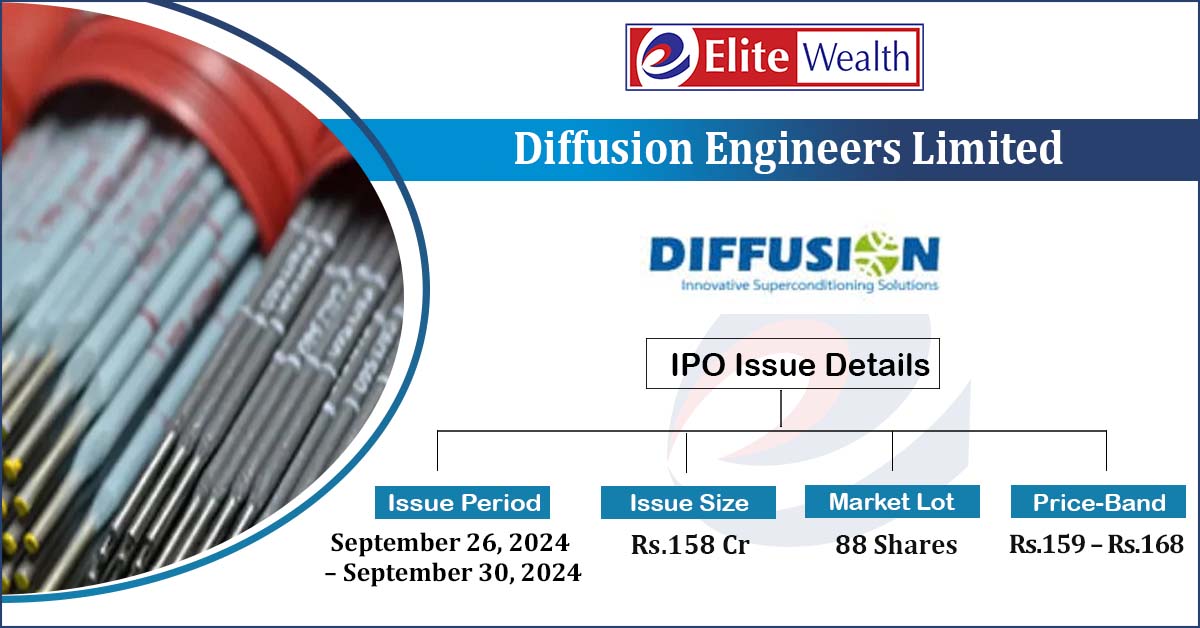

Diffusion Engineers IPO Details:

| Issue Details | |

| Objects of the issue | · Capital expenditure to increase manufacturing units

· Working capital requirements. · General corporate purposes. |

| Issue Size | Total issue Size – Rs.158 Cr

Fresh Issue – Rs 158 Cr |

| Face value | Rs.10 |

| Issue Price | Rs.159 – Rs.168 per share |

| Bid Lot | 88 Shares |

| Listing at | BSE, NSE |

| Issue Opens | September 26, 2024 – September 30, 2024 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Diffusion Engineers IPO Strengths:

-

Diffusion Electronics is a leading manufacturer of a wide range of industrial instruments. The company provides a diverse portfolio of products and services, including anti-wear consumables, wear parts, welding services, and the manufacture of heavy engineering equipment.

-

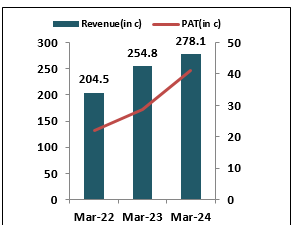

In FY24, the company generated revenue of Rs 278 crores, reflecting a 9% increase compared to FY23. The compound annual growth rate (CAGR) for revenue from FY22 to FY24 was 16.61%. Additionally, the profit after tax (PAT) for FY24 reached Rs 30.8 crores, a 39% rise from FY23. The CAGR for net profit during the same period was 34.6%.

-

For the fiscal year ending FY24, the return on equity (ROE) and return on capital employed (ROCE) were 18.52% and 20.53%, respectively, indicating that the company generated a strong return on its capital. Additionally, the EBITDA margin improved to 17.04% in FY24, up from 13.65% in FY23.

-

The company has a robust presence through its subsidiaries in Singapore, Turkey, and the Philippines, as well as joint ventures in the United Kingdom and Malaysia, which contribute significantly to its revenue.

-

The company reported a positive cash flow from operations (CFO) of ₹39 crores in FY24, compared to a negative CFO of ₹47 crores in FY23. Additionally, it invested ₹31 crores in the purchase of property, plant, and equipment, which will further enhance its production capacity.

Diffusion Engineers IPO Risk Factors:

-

The company operates in a highly competitive industry with low barriers to entry. It faces significant competition from listed companies such as Ador Welding and AIA Engineering, as well as various unorganized players.

-

The company’s performance is greatly impacted by sectors like cement, engineering, and power etc with 75% of its revenue depending on these industries.

Diffusion Engineers IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Diffusion Engineers IPO Allotment Status

Diffusion Engineers IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Diffusion Engineers IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post issue |

| Promoters Group | 93.10% | 69.7% |

| Others | 6.9% | 30.3% |

Diffusion Engineers IPO Outlook:

Diffusion Engineers Limited is an emerging player in the welding consumables sector, showcasing strong financial performance through consistent revenue and profit growth. The company’s shares are attractively valued at 20.6 times its earnings after the issue, which is lower than that of its competitors. We recommend that investors should apply for this issue for long-term gains and potential listing profits.

Diffusion Engineers IPO FAQ:

Ans. Diffusion Engineers IPO is a main-board IPO of 9,405,000 equity shares of the face value of ₹10 aggregating up to ₹158.00 Crores. The issue is priced at ₹159 to ₹168 per share. The minimum order quantity is 88 Shares.

The IPO opens on September 26, 2024, and closes on September 30, 2024.

Bigshare Services Pvt Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Diffusion Engineers IPO opens on September 26, 2024 and closes on September 30, 2024.

Ans. Diffusion Engineers IPO lot size is 88 Shares, and the minimum amount required is ₹14,784.

Ans. The Diffusion Engineers IPO listing date is not yet announced. The tentative date of Diffusion Engineers IPO listing is Friday, October 4, 2024.

Ans. The minimum lot size for this upcoming IPO is 88 shares.