Allied Blenders and Distillers IPO Company Profile:

Allied Blenders and Distillers Limited (ABD) is an Indian spirit’s firm, very popular for its leading brand Officers Choice, which was launched in 1988. Allied Blenders and Distillers Limited provides a varied range of whiskies, brandies, and other spirits, with a major focus on quality and innovative product. The company has a strong distribution or supply chain network, and it also give importance to corporate social responsibility. the company’s strategic expansion, high standards, and quality goods have helped them maintain a strong market position in the spirits industry.

| IPO-Note | Allied Blenders and Distillers Limited |

| Rs.267 – Rs.281 per Equity share | Recommendation: Avoid as listed players are more attractive |

Allied Blenders and Distillers IPO Details:

| Issue Details | |

| Objects of the issue | · Repayment of some outstanding borrowings

· General corporate purposes |

| Issue Size | Total issue Size – ₹1500 cr

Fresh Issue – ₹1000 cr Offer for Sale – ₹500 cr |

| Face value | Rs.2 |

| Issue Price | ₹267 to ₹281 per share |

| Bid Lot | 53 shares |

| Listing at | BSE, NSE |

| Issue Opens | June 25, 2024 to June 27, 2024 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Allied Blenders and Distillers IPO Strengths:

- Among the largest IMFL company in India with a diversified and contemporary product portfolio.

- Strong brand recognition.

- Strategically located, large scale and advanced manufacturing facilities with sophisticated research and a development centre.

- Access to extensive pan-India distribution network with ability to scale and Well-positioned to capture tailwinds in the Indian IMFL industry.

- The alcohol consumption per capita in India was forecast to continuously increase between 2024 and 2029 by in total 0.1 liters (+2 percent). After the ninth consecutive increasing year, the per capita consumption is estimated to reach 5.06 liters and therefore a new peak in 2029.

- It had an estimated market share (in terms of sales volume) of 11.8 percent in the Indian whisky market for fiscal 2023.

- Whisky contributed the maximum to its revenue at 97.36 percent in FY23 and 96.95 percent in nine months period ended December 2023.

- The company has reserved equity shares worth Rs 3 crore for its employees, and a discount of ₹26 per equity share

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Allied Blenders and Distillers IPOAllotment Status

Allied Blenders and Distillers IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Allied Blenders and Distillers IPO Risk Factors:

- The Company depends on the sale of whisky products, and any decline in the whisky sale would significantly harm our business, financial condition, operations, and prospects.

- The company is known for the popularity of its brands, especially Officer’s Choice. Any decline in the sale of these brands could negatively affect business and financial performance.

- The operations are subject to extensive Central and State regulations. Changes in the regulatory environment may cause the company to incur additional costs.

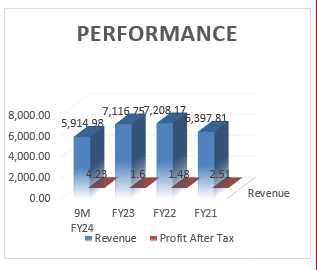

Allied Blenders and Distillers IPO Financial Performance:

Allied Blenders and Distillers IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 96.21% | 80.91% |

Allied Blenders and Distillers IPO Outlook:

Allied Blenders and Distillers Limited wishes to boost its market position by expanding its product selection and increasing brand visibility for its flagship product, “Officer’s Choice” whisky. The company also intends to enter new areas, both domestic and foreign, by using its strong distribution or supply chain network. The company’s strategic aims aim to drive long-term growth while maintaining Allied Blenders and Distillers Limited’s leadership in the spirits business. The company is offering a discount of ₹26/- P/S to eligible employees. Keeping in mind its financial performance we feel listed players are better placed compare to this company, thus we recommend only aggressive investors apply for the listing gains only.

Source: RHP, EWL Research

Allied Blenders and Distillers IPO FAQ:

Ans. Allied Blenders IPO is a main-board IPO of 53,380,783 equity shares of the face value of ₹2 aggregating up to ₹1,500.00 Crores. The issue is priced at ₹267 to ₹281 per share. The minimum order quantity is 53 Shares.

The IPO opens on June 25, 2024, and closes on June 27, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Allied Blenders IPO opens on June 25, 2024 and closes on June 27, 2024.

Ans. Allied Blenders IPO lot size is 53 Shares, and the minimum amount required is ₹14,893.

Ans. The Allied Blenders IPO listing date is not yet announced. The tentative date of Allied Blenders IPO listing is Tuesday, July 2, 2024.

Ans. The minimum lot size for this upcoming IPO is 53 shares.