Kronox Lab Sciences Limited IPO Company Profile:

Kronox Lab Sciences Limited (KLSL) manufactures specialty fine chemicals with high purity for a range of end applications. Phosphate, sulphate, acetate, chloride, citrate, nitrates, nitrites, carbonate, EDTA derivatives, hydroxide, succinate, gluconate, and other products are among the 185 items in the company’s product line. High Purity Specialty Fine Chemicals from the company are utilized in a variety of applications, such as the production of APIs, pharmaceutical formulations, scientific research, nutraceuticals, agrochemical formulations, biotech applications, metal refineries, personal care products, and animal health products. In addition to producing goods that meet a range of national and international standards, the company also engages in customized manufacturing to meet client specifications for high levels of purity that deviate from the industry standards. These products are sold to clients in India and over 20 other countries including the United States, Argentina, Mexico, Australia, Egypt, Spain, Turkey, UK, Belgium, UAE, and China. The company operates from its three manufacturing facilities, which are located in Gujarat’s Vadodara near the seaports of Nhava Sheva, Mundra, Kandla, and Hazira. The facilities will be 17,454 square meters in size and have an installed capacity of 7,242 TPA as of December 31, 2023.

| IPO-Note | Kronox Lab Sciences Limited |

| Rs.129 – Rs.136 per Equity share | Recommendation: Apply for Long-Term |

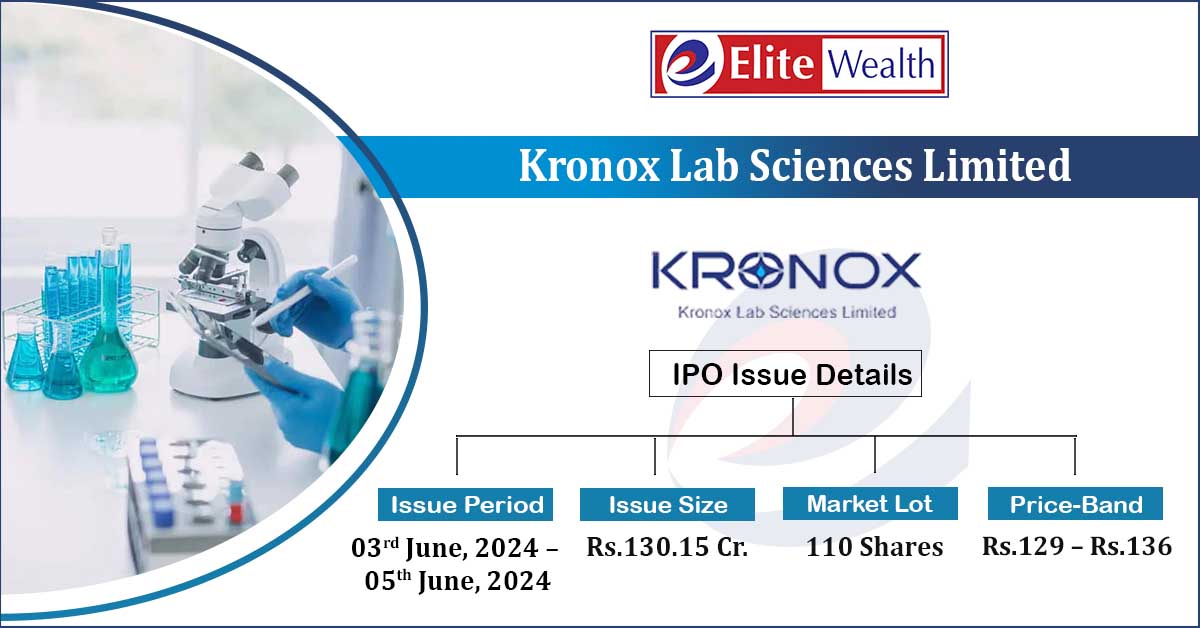

Kronox Lab Sciences Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.130.15 Cr.

Offer for Sale – Rs.130.15 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.129 – Rs.136 |

| Bid Lot | 110 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 03rd June, 2024 – 05th June, 2024 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Kronox Lab Sciences Limited IPO Strengths:

-

The company manufactures a broad range of high-purity specialty fine chemicals that are used in a variety of industries, including biotech, pharmaceuticals, animal health, nutraceuticals etc.

-

KLSL has maintained its long-standing relationships with its clients; in FY23, sales from its top 20 clients totaled ₹49.68 crores, with a contribution rate of 67.05%.

-

It operates in the industry which has high entry barriers.

-

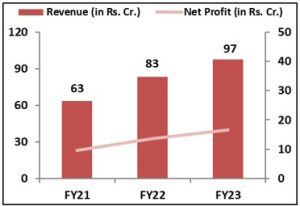

With increased operations and efficient management, company’s financials during the last three years have consistently exhibited growth in profits and revenues. The company also has no debt, giving it enough leverage to apply for debt financing in the future.

Kronox Lab Sciences Limited IPO Risk Factors:

-

The company majorly exports its products to the USA which contributed 22.93% of the company’s revenue in FY23.

-

Its top 20 products account for the majority of revenues however its product portfolio includes over 185 products. Company’s operations will be impacted if there is a decline in the market for any of these goods.

-

KLSL does not have long-term agreements with any of its customers. Furthermore, it derives 50.68% of its revenue from its top 10 customers in FY23. Any reductions in the demand by these customers can adversely impact the business.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Kronox Lab Sciences Limited IPO Allotment Status

Kronox Lab Sciences Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Kronox Lab Sciences Limited IPO Financial Performance:

Kronox Lab Sciences Limited Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 100% | 74.21% |

| Others | 0% | 25.79% |

Source: RHP, EWL Research

Kronox Lab Sciences Limited IPO Outlook:

KLSL operates in the High Purity Specialty Fine Chemicals sector offering a wide range of products. Its product portfolio consists 185 products and another 122 is in the pipeline. Company has a monopoly in certain products and has consistently demonstrated strong financials over the years. The PE of KLSL stands at 31x on the upper price band which seems reasonable compared to its peers’ average of 67.5x. Considering all the factors, we recommend investors to apply in the offering with long-term perspective.

Kronox Lab Sciences Limited IPO FAQ:

Ans. Kronox Lab Sciences IPO is a main-board IPO of 9,570,000 equity shares of the face value of ₹10 aggregating up to ₹130.15 Crores. The issue is priced at ₹129 to ₹136 per share. The minimum order quantity is 110 Shares.

The IPO opens on June 3, 2024, and closes on June 5, 2024.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Kronox Lab Sciences IPO opens on June 3, 2024 and closes on June 5, 2024.

Ans. Kronox Lab Sciences IPO lot size is 110 Shares, and the minimum amount required is ₹14,960.

Ans. The Kronox Lab Sciences IPO listing date is not yet announced. The tentative date of Kronox Lab Sciences IPO listing is Monday, June 10, 2024.

Ans. The minimum lot size for this upcoming IPO is 110 shares.