Diwali Samvat 2080 Recommendations

| Company | Sector | CMP (Rs.) | Target (Rs.) | Allocation | Upside | Time Horizon |

| Amara Raja Energy & Mobility | Auto Ancillary | 620 | 780 | 8% | 26% | 12 months |

| Angel One | Finance | 2805 | 3400 | 8% | 21% | 12 months |

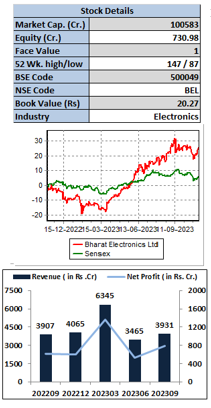

| Bharat Electronics | Engineering | 136 | 160 | 9% | 18% | 12 months |

| Cipla | Pharmaceuticals | 1206 | 1400 | 10% | 16% | 12 months |

| Hero Motocorp | Automobile | 3090 | 3700 | 10% | 20% | 12 months |

| ICICI Bank | Banks | 934 | 1200 | 11% | 28% | 12 months |

| Lemon Tree Hotels | Hotels | 113 | 140 | 9% | 24% | 12 months |

| PVR Inox | Entertainment | 1612 | 2060 | 9% | 28% | 12 months |

| Reliance Industries | Refineries | 2320 | 2700 | 11% | 16% | 12 months |

| Tata Power | Power | 245 | 300 | 8% | 22% | 12 months |

| Welspun Enterprises | Infrastructure | 265 | 325 | 7% | 23% | 12 months |

Diwali Samvat 2079 Performance

| Company | Recommended Price | Target | Status | High + Dividend | Gains from High* |

| Berger Paints | 615 | 740 | Position Closed | 682.95 | 11% |

| HDFC Bank | 1400 | 1650 | Target Achieved | 1776.50 | 27% |

| Maruti Suzuki | 8200 – 8400 | 9800 | Target Achieved | 10935.00 | 30% |

| Relaxo | 975 | 1220 | Position Closed | 976.50 | 0% |

| Reliance Industries | 2400 | 3120 | Target Achieved | 3127.00 | 30% |

| Siemens India | 2740 | 3200 | Target Achieved | 4078.85 | 49% |

| Sun Pharmaceuticals | 970 | 1200 | Target Almost Hit | 1181.20 | 22% |

| Tata Chemicals | 1150 | 1380 | Position Closed | 1163.00 | 1% |

| Tata Power | 215 | 280 | Target Achieved | 278.50 | 30% |

| Ultratech Cement | 6185 | 7425 | Target Achieved | 8788.95 | 42% |

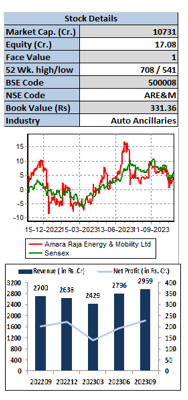

Amara Raja Energy & Mobility Limited( CMP – Rs. 620 Target – Rs.780)

Amara Raja Energy & Mobility Limited (ARE&M) is also one of the largest manufacturers of energy storage products for both industrial and automotive applications in India. ARE&M encompasses a diverse range of solutions and products, which includes energy storage solutions, Lithium-ion cell manufacturing, wide range of EV chargers, Li-ion battery pack assembly, automotive and industrial lubricants, and exploration of new chemistries, among others.

Key Takeaways:

-

Amara Raja is expanding into new markets, such as the energy storage and electric vehicle battery markets. This expansion is likely to drive growth for the company in the coming years. The board approved an investment of INR5b in the wholly owned subsidiary, Amara Raja Advanced Cell Technologies, for Li-ion battery manufacturing.

-

Amara Raja is investing heavily in research and development. This investment is likely to help the company develop new battery technologies and improve its existing products.

-

Amara Raja is one of the leading manufacturers of batteries in India, and it has a significant market share in the telecom and automotive battery segments. It is benefiting from the growing demand for batteries in India, as well as the increasing deployment of 5G networks and electric vehicles.

Outlook:

ARE&M is a well-positioned company with a strong growth outlook. Company expects a 6-7% YoY increase in the aftermarket for 4W and a strong 12- 13% increase in the aftermarket for 2W. Furthermore, the industrials sector is growing at a constant rate of 7-8% YoY, and due to continuous expansion initiatives, there has been a considerable increase in demand within the telecom market as 5G networks require more batteries than previous generations of networks, and Amara Raja is a leading supplier of telecom batteries in India. We recommend to buy the stock for the target price of Rs. 780 with the time horizon of 12 months.

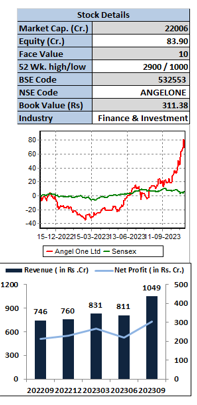

Angel One Limited(CMP – Rs.2805 Target – Rs.3400)

Angel One Limited is the largest listed retail stock broking house in India, in terms of active clients on NSE. It is a technology-driven financial services provider that offers its clients margin funding, brokerage and consulting services, and distribution of financial products from third parties. The broking and allied services are offered through online and digital platforms to clients acquired directly and through assisted business.

Key Takeaways:

-

Angel One effectively built a sizable customer base with its strong brokerage products (super app and its periodic enhancements), which is demonstrated by the company’s 26.2% retail F&O market share.

-

Company is integrating its Super App platform with its lending partner and is going to provide unsecured consumer loans. Along with this Angel One has incorporated Angel One Wealth Management as its wholly owned subsidiary for targeting wealth management customers with a ticket size of INR5m-INR 10m.

-

The company is expecting final approval from SEBI for its AMC business by the end of FY24 or early FY25. The primary focus of the AMC business will be on passive products. The AMC industry is expected to grow at a CAGR of 14% over the next five years on account of rising disposable income, increasing financial awareness and government initiatives.

Outlook:

Angel One is a great play on the digitalization and the financialization of savings. It reflected strong operating performance in Q2FY24 with markets hitting all-time high. Management’s continuous focus on the investment in the technology would further strengthen its position among peers. We remain positive on Angel One due to expected growth in the net interest income on account of growth in MTF book, lower capex and better F&O orders. On the performance front, the TTM EPS of the stock is at Rs.121.61 and is trading at the PE of 23.15x at the current price level of Rs.2,815. We recommend buying of the stock at the current price level for the target price of Rs.3,400 with the time horizon of 12 months.

Hero MotoCorp Limited(CMP – Rs.3090 Target – Rs.3700)

Hero MotoCorp Limited is the world’s largest manufacturer of two-wheeler motorcycles, with a strong track record of innovation and growth. The company is known for its high-quality, fuel-efficient motorcycles, which are popular with both urban and rural riders. Hero MotoCorp offers a wide range of motorcycles and scooters, from basic commuter bikes to powerful sports bikes. The company’s popular models include the Splendor, HF Deluxe, Passion, Maestro Edge, and Pleasure. Hero MotoCorp is also a leader in electric vehicle technology, and has launched a number of electric scooters in recent years.

Key Takeaways:

-

Management highlighted a solid festive sales till date (+15% YoY) and expects momentum to remain strong. Rural demand is growing up, with the entry level category, HF Deluxe, and Passion exhibiting substantial growth.

-

Hero MotoCorp reported higher margin performance in the second quarter, owing to lower material costs and the benefits of operating leverage. Due to product mix, gross profit per vehicle climbed 5.5% YoY, while EBITDA margin improved 30 basis points YoY to 14.1%.

-

the management intends to increase market share in the premium category by releasing new items at competitive pricing (during FY24/25), building exclusive shops (Premia), and implementing distinct digital promotion techniques. The company has over 25,000 bookings for the Harley X440 and a 14k unit order book for the Karizma model, both of which it hopes to serve over the next four months.

Outlook:

The management forecasts progressive recovery in rural demand (particularly in the entry-level category), new product introductions in premium motorcycles and scooters, and a ramp-up of the EV product portfolio to help drive double-digit revenue growth in FY25, owing to the strong Indian economy. Going forward, the business expects EBITDA margins to be in the region of 14%-16%. We are bullish on the company notwithstanding a rise in rural demand and Harley volume, a solid dividend yield (3.7%), and a reasonable value. We recommend to buy the stock for the target price of Rs. 3700 with the time horizon of 12 months.

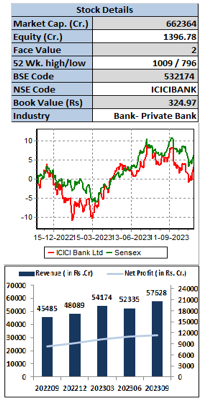

ICICI Bank Limited(CMP – Rs.934 Target – Rs.1200)

ICICI Bank Limited is the second largest private bank of India and has a leading position in other financial services businesses through its subsidiaries. The bank offers a wide range of banking and financial services including commercial banking and treasury operations to large set of customers viz. large and mid-corporates, MSME, agriculture and retail businesses. The Bank’s business segments include Retail Banking, Wholesale Banking, Treasury, and Other Banking. The bank is working with a widespread network of over 6,248 branches and 16,927 ATMs across country.

Key Takeaways:

-

ICICI bank continued to report strong performance in Q2FY24. Healthy credit growth across segments and lower credit cost led by lower slippages and higher recoveries helped the bank to sustain strong performance despite compression in the NIM.

-

Asset quality of the bank further improved with GNPA/NNPA ratio at 2.48%/0.43% vs. 2.72%/0.48% QoQ. Net slippages also reduced to Rs.116 cr. to 1,807 cr. QoQ led by higher recoveries in the SME and corporate segments.

-

The bank guided that it has very minimal presence in small ticket size unsecured PL loans where stress is emerging and its overall unsecured portfolio continues to perform well, thus growth is strong.

Outlook:

ICICI Bank remains one of the prominent bank among the private banking space with strong business momentum and healthy asset quality. It is well positioned with superior margins, strong RoE and robust capitalisation levels. Moreover, its well-performing subsidiaries, which are strong players in their respective fields, add value to the overall business. We remain positive on the ICICI Bank considering its sustained growth leadership across segments, ability to drive productivity and sustained RoAs. Hence, we suggest investors to buy the stock on the CMP for the target price of Rs.1200.

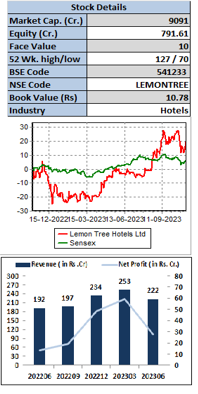

Lemon Tree Hotels Limited(CMP – Rs.113 Target – Rs.140)

Lemon Tree Hotels Limited (LTHL) is India’s largest hotel chain in the mid-priced hotel sector, and the third largest overall, on the basis of controlling interest in owned and leased rooms, as of June 30, 2017. LTHL opened its first hotel with 49 rooms in May 2004 and currently operates ~9,400 rooms in 96 hotels across 61 destinations, in India and abroad, under its various brands viz. Aurika Hotels & Resorts, Lemon Tree Premier, Lemon Tree Hotels, Red Fox Hotels, Keys Prima, Keys Select and Keys Lite. As the current pipeline becomes operational, LTHL will be operating ~10,450 rooms in 106 hotels across 64 destinations, in India and abroad.

Key Takeaways:

-

Lemon Tree Hotels Ltd opened the 669-room Aurika Mumbai Skycity making it the country’s biggest hotel by room count. This expansion will aid in meeting the growing demands of both business and leisure tourists. This launch also moves the company closer to its objective of increasing its overall inventory, including existing and upcoming rooms, to 20,000+ rooms in the next four years.

-

The company anticipates that free cash flow will be used to repay debt in 4-5 years.

-

The majority of Lemon Tree’s guests are domestic; overseas visitors contribute little, resulting in the company’s minimal reliance on foreign visitors.

Outlook:

Lemon Tree is the leader in the fastest-growing sector in Indian hospitality, with 90 hotels (8,491 rooms) in Q1 FY24. It stands to gain from its efforts in brand creation, cost efficiency, prudent global expansion, and pricepoint mix. Its aggressive expansion strategy and asset-light approach bode well for the long run. With a rebound in corporate travel and major events and conferences, Lemon Tree, which has 86% of its hotels in business destinations, stands to gain further. We recommend to buy the stock for the target price of Rs. 140 with the time horizon of 12 months.

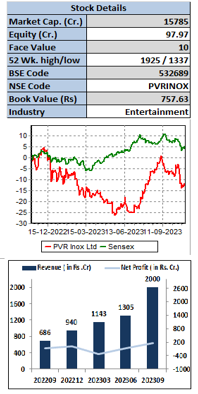

PVR Inox Limited(CMP – Rs.1612 Target – Rs.2060)

PVR INOX Limited, the country’s largest theatre chain, is a giant in the Indian film exhibition sector. The company, which was formed by the merging of two titans, PVR Cinemas and INOX Leisure, has a strong network of over 1,708 screens spread across 360 properties in 115 cities, and an aggregate seating capacity of 3.59 lakh seats. PVR INOX Limited serves to a vast variety of moviegoers through its diversified range of cinema formats, including regular theatres, IMAX, 4DX, Gold Class, Director’s Cut, and Playhouse, under the prestigious brands of PVR, and INOX.

Key Takeaways:

-

PVRINOX announced the best quarter in history, as content in several languages engaged with customers. It also witnessed the resurrection of Hindi material, with two of the biggest blockbusters in movie history, ‘Jawan’ and ‘Gadar 2’. Even several low-budget Hindi films performed well, reminiscent of pre-pandemic days.

-

Net debt was reduced by INR3 billion in 1HFY24, and the company aims to complete FY24 with a net debt-to-EBIDA ratio of 1x.

-

Occupancy increased dramatically to 32.3%, owing to positive responses to Bollywood and other movies.

Outlook:

PVR Inox, the country’s largest theatre chain recorded its highest-ever sales, EBITDA, and PAT in Q2FY24. Also notable is management’s prediction of INR 1.2bn to INR 1.4bn in EBITDA synergy in H1FY24, with more to follow. The company anticipates a positive FCF in FY24. It is also aiming to reduce profits volatility by negotiating revenue sharing contracts with landlords. Overall, management anticipates a continuous increase in ROCE to the mid-teens in FY24. We recommend to buy the stock for the target price of Rs. 2060 with the time horizon of 12 months.

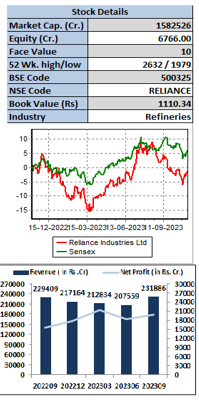

Reliance Industries Limited(CMP – Rs.1011 Target Rs. 1300)

Reliance Industries Ltd. (RIL) is an Indian multinational conglomerate company headquartered in Mumbai, Maharashtra, India. It operates in multiple industries, including refining and petrochemicals, oil and gas exploration and production, retail, telecommunications, and media. The company is a diversified conglomerate with a significant presence in India and a growing global footprint. Its focus on innovation, customer satisfaction, and sustainability has helped the company become a leader in multiple industries and continues to drive its growth and success.

Key Takeaways:

-

RIL reported strong earnings with robust operational performance in Q2FY24. Net profits made healthy jump as retail, digital services and consumer segments grew. Net debt of the company was lower due to strong operating cash flows and capital raise. Company has successfully commissioned and tested the performance of all eight wells in KG-D6 MJ field.

-

Reliance Retail is maintaining high growth with accelerated store additions and aggressive foray into digital & new commerce.

Reliance Jio holds leadership position in the Indian telecom sector; 5G, JioAirFiber and JioBharat are its three major growth engines which are gaining substantial market share. The opportunity in Digital segment, along with the potential of tariff hikes and market share gains from VIL gives RJio to gain further value.

Outlook:

The medium-to-long term outlook for RIL is favourable due to developments in the retail and digital industries, increased gas production from new fields, the nationwide rollout of 5G services, and JioAirFiber. Development in the retail business is expected to be boosted by the upcoming festive season. Furthermore, the global oil demand growth is expected to remain strong led by voluntary cuts by OPEC+ and geopolitical tensions. RIL has given the EPS of Rs. 101.09 on TTM basis and is trading at the PE of 23x on the current price level of 2320. We recommend investors to buy the stock for the target price of Rs. 2700 with the time horizon of 12 months.

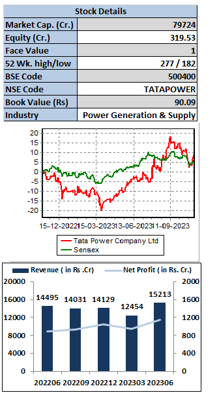

Tata Power Limited(CMP – Rs.245 Target – Rs.300)

Tata Power Company Ltd. (TPCL) is India’s largest private sector power utility with a generation capacity of 14,294 MW, out of which 38% accounts for clean & green energy. The company has emerged as a pioneer in the Indian power sector, with a track record of good performance, customer care and sustained growth. It has presence in all the segments of the power sector namely generation (thermal, hydro, solar, wind and liquid fuel), transmission and distribution. The services offered by the company includes Design & Development, Direct Marketing, Power Projects & Related Services and Transmission & Distribution.

Key Takeaways:

-

The company reported healthy performance in Q1FY24 due to lower input costs. Going further company is expected to achieve strong operational and financial performance on the back of its capacity expansions in the renewable energy segment, corrections in polysilicon and thermal coal prices and strong business execution.

-

Company has strong and well-diversified order book of Rs. 17,643 crores at the end of Q1FY24. It has signed a MoU with the Maharashtra Government of Rs.13,000 cr. for pumped hydro storage projects. Along with this TPREL, subsidiary of the Tata Power has signed power purchase agreements for commissioning two solar projects (200MW and 150MW) to provide clean and sustainable electricity to MSEDCL.

-

India has one of the lowest power consumption per capita which suggests significant growth potential for the Tata Power.

Outlook:

Tata Power is expanding its business portfolio across renewables, transmission and distribution, as well as customer centric businesses of Solar Rooftops, Solar Pumps, and Micro grids, EV charging, Energy Services (ESCO), Home Automation and Floating Solar. The company’s focus to shift from a B2G to B2C model would further drive robust earnings growth over the next 4-5 years. The company’s renewables and distribution business makes it the best private player in the sector. Currently Tata Power is trading at the PE of 23x and BV of 3x at the current price level of Rs.245. Hence, we recommend to buy the stock for the target price of Rs.300 with the time horizon of 12 months.

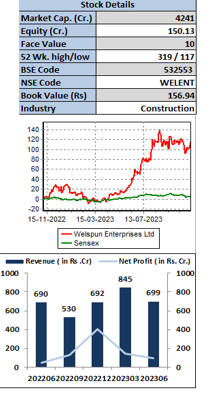

Welspun Enterprises Limited(CMP – Rs.265 Target – Rs.325)

Welspun Enterprises Limited (WEL), a subsidiary of the Welspun Group, is one of India’s fastest-growing infrastructure companies. The company’s primary business is in the construction of roads and water infrastructure and has a joint venture with Adani Enterprise through which it invests in the oil and gas sector. As a developer, the company primarily concentrates on Hybrid Annuity Model (HAM) projects, although it also pursues value-adding projects in the BOT-Toll and EPC sectors.

Key Takeaways:

-

The company has recently acquired 50.1% stake in the Michigan Engineers Pvt. Ltd., a technology based EPC Company. This acquisition aligns with the WEL’s strategy to grow the water infrastructure business segment and enter the tunneling business.

-

Company has strong portfolio of road and water projects worth of Rs.9,600 cr. out of which 37% comprises road projects and 63% water projects. The management aim to secure additional orders worth Rs.6,000 cr. to Rs.8,000 cr. in the current fiscal.

-

Company inaugurated the Mukarba Chowk Panipat project, which has already received the PCOD. The Varanasi to Aurangabad NH2 road project is progressing well. Along with these the Dharavi Waste Water Treatment Facility project is in the final stages of design approval and local clearances.

Outlook:

WEL’s Q1 FY 2024 performance reflects positive outcomes of their efforts and investments made over the past few years. It has a healthy cash position of Rs.1,058 cr. and comfortable level of debt. Company continues its strategic positioning towards development of BOT & HAM and EPC projects. Further it plans to explore monetization possibilities of various assets, including HAM assets and oil and gas portfolio and also evaluating opportunities in the renewable energy space. We remain positive on WEL’s diversified portfolio, strong execution and light asset model. On the performance front, the TTM EPS of the stock is at Rs.19.39 and is trading at the PE of 14.57x .We recommend buying of the stock at the current price level for the target price of Rs.325 with the time horizon of 12 months.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Kiran Tahlani, Elite Wealth Limited, kirantahlani@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or e-mailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL

Provided that research analyst or research entity shall not be required to make a disclosure as per sub-clauses (c), (d) and (e) of clause (ii) or sub-clauses (a) and (b) of clause (iii) to the extent such disclosure would reveal material non-public information regarding specific potential future investment banking or merchant banking or brokerage services transactions of the subject company.

(4) EWL or its proprietor has never served as an officer, director or employee of the subject company;

(5) EWL has never been engaged in market making activity for the subject company;

(6) EWL shall provide all other disclosures in research report and public appearance as specified by the Board under any other regulation