Indegene Limited’s IPO Company Profile :

Indegene Limited specializes in digital-led commercialization services for the life sciences industry, catering to biopharmaceutical, emerging biotech, and medical devices companies. With over two decades of expertise in the healthcare domain and advanced technology platforms, they provide comprehensive solutions covering drug development, clinical trials, regulatory submissions, pharmacovigilance, complaints management, and sales and marketing. Their portfolio supports all aspects of commercial, medical, regulatory, and R&D operations for life sciences firms. As of December 31, 2023, they served 65 active clients from six operation hubs and 17 offices across North America, Europe, and Asia.

Indegene Limited’s Business Operations Solutions

- Enterprise Commercial Solutions:

Indegene assists life sciences companies with digital marketing operations, leveraging insights from the Everest Report indicating sales and marketing as the largest segment of industry expenditure in 2022. Services include creating customized marketing plans, expanding reach to healthcare professionals (HCPs), and providing insights on HCP preferences. Through Enterprise Commercial Solutions, they drive efficiency and personalization of engagement strategies for HCPs and patients, utilizing digital communication channels and providing digital asset management, marketing automation, customer data management, and analytics solutions. Proprietary Natural Language Processing (NLP) and generative artificial intelligence (Gen AI) tools reduce dependence on manpower and enhance efficiency while ensuring regulatory compliance.

- Omnichannel Activation:

Indegene’s Omnichannel Activation solutions facilitate a “digital first” approach for optimizing promotion of biopharmaceutical products and medical devices to HCPs across multiple channels. They leverage digital technologies and proprietary analytics to achieve outcomes traditionally delivered by medical representatives, but with higher efficiencies and reduced costs. Channels used include emails, virtual sales representatives, social media, and other digital platforms, providing ‘Digital Rep Equivalence’ through the NEXT HCP Journey Optimization platform.

- Enterprise Medical Solutions:

Indegene establishes centers of excellence (CoEs) to consolidate regulatory and medical operations for clients. CoEs offer services such as writing medical content, regulatory submissions, product labels, pharmacovigilance, and real-world evidence (RWE) based medical research. Proprietary NLP-based and Gen AI-based tools ensure quality, regulatory compliance, and scalability of medical content handling.

- Others:

Enterprise Clinical Solutions focus on driving efficiencies in drug discovery and clinical trial operations, including digitally-enabled patient recruitment, clinical data management, and regulatory assistance. Consultancy services provided through subsidiary DT Associates Limited (DT Consulting) help life sciences companies with digital transformation efforts for enhanced customer experience.

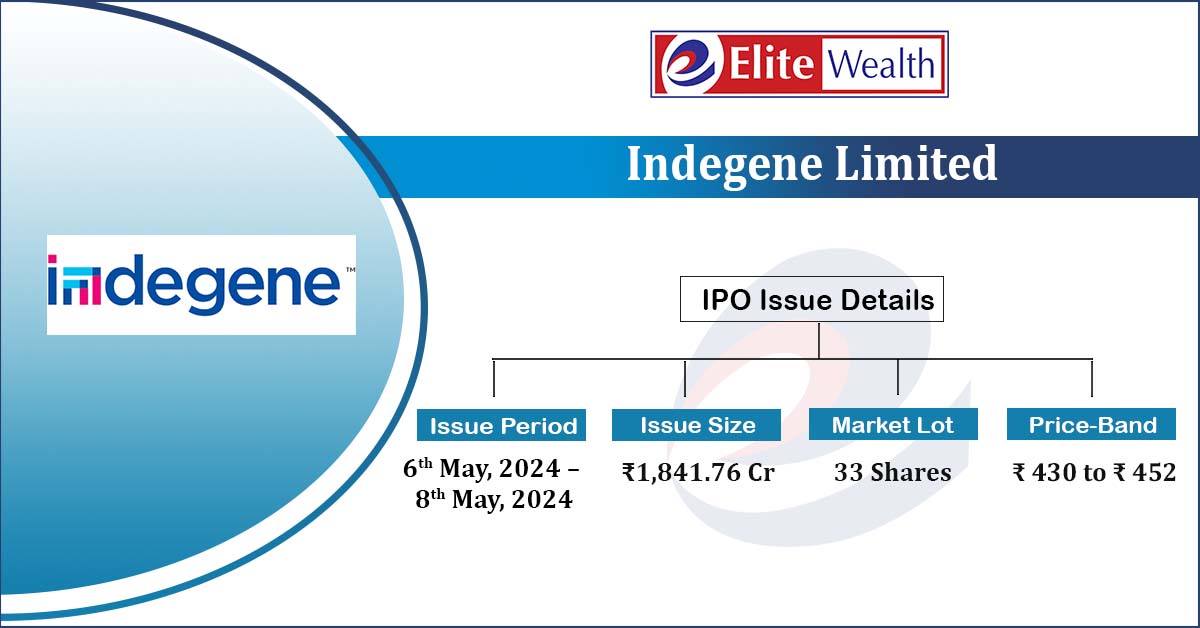

Indegene Limited’s IPO Details:

| IPO Open Date | May 6, 2024 |

| IPO Close Date | May 8, 2024 |

| Listing Date | [.] |

| Face Value | ₹ 2 per share |

| Price | ₹ 430 to ₹ 452 per share |

| Lot Size | 33 Shares |

| Issue Size | 40,746,891 shares (aggregating up to ₹1,841.76 Cr) |

| Fresh Issue | 16,814,159 shares (aggregating up to ₹760.00 Cr) |

| Offer for Sale | 23,932,732 shares of ₹2 (aggregating up to ₹1,081.76 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| QIB Shares Offered | Not more than 50% of the Offer |

| NII (HNI) Shares Offered | Not less than 35% of the Offer |

| Retail Shares Offered | Not less than 15% of the Offer |

Indegene Limited’s IPO Profit & Loss Analysis:

| Particulars (in cr.) | FY-23 | FY-22 | FY-21 | CAGR |

| Revenue from operations | 2306.13 | 1664.61 | 966.27 | 33.6% |

| Other Income | 57.97 | 25.89 | 30.65 | |

| Total Income | 2364.10 | 1690.50 | 996.92 | 33.4% |

| Employee Cost | 1464.76 | 1014.34 | 535.60 | |

| Other expenses | 445.15 | 363.35 | 200.15 | |

| EBITDA | 454.19 | 312.81 | 261.18 | 20.3% |

| EBITDA margin% | 19.21% | 18.50% | 26.20% | |

| Depreciation | 59.81 | 33.45 | 25.55 | |

| Interest | 31.33 | 5.96 | 6.96 | |

| Share of loss of an associate | -0.20 | |||

| Exceptional Item | -46.90 | 2.99 | ||

| PBT | 363.05 | 226.50 | 231.46 | 16.2% |

| Total tax | 96.95 | 63.68 | 45.78 | |

| PAT | 266.10 | 162.82 | 185.68 | 12.7% |

| PAT margin% | 11.26% | 9.63% | 18.63% |

Indegene Limited’s IPO Pre-Offer shareholding of the Selling Shareholders:

| S. No. | Name of the Selling Shareholder | Number of Equity Shares held on a fully diluted basis | Percentage of equity share capital on a fully diluted basis (%) |

| 1 | Manish Gupta | 2,25,75,672 | 10.13 |

| 2 | Dr. Rajesh Bhaskaran Nair | 2,03,01,204 | 9.11 |

| 3 | Anita Nair | 13,76,298 | Negligible |

| 4 | Vida Trustees Private Limited | 91,88,802 | 4.12 |

| 5 | BPC Genesis Fund I SPV, Ltd. | 1,77,17,910 | 7.95 |

| 6 | BPC Genesis Fund I-A SPV, Ltd | 91,90,178 | 4.12 |

| 7 | CA Dawn Investments | 4,55,31,837 | 20.42 |

| Total | 12,58,81,901 | 55.85 |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Indegene Limited’s IPO Allotment Status

JNK India IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Indegene Limited’s IPO Strengths:

- Deep Domain Expertise in Healthcare:

-

Indegene’s understanding of the healthcare domain is fundamental to their success in modernizing and digitizing life sciences commercialization processes. This expertise encompasses various aspects, including the journey of a drug from research to market, navigating regulatory landscapes, and developing medical content for diverse stakeholders.

-

A significant portion (20.49%) of their delivery employees possess healthcare-related educational backgrounds, ranging from medical degrees (MD, MBBS) to pharmaceutical degrees (PhD, MPharm, BPharm). This expertise allows for a nuanced understanding of client needs and industry challenges.

-

-

Robust Portfolio of Proprietary AI-Driven Tools and Platforms:

-

Indegene has developed a suite of proprietary tools and platforms under the “NEXT” brand, leveraging advanced technologies such as artificial intelligence (AI), machine learning (ML), natural language processing (NLP), and advanced analytics.

-

These tools play a pivotal role in optimizing various aspects of the R&D and commercialization processes for life sciences companies, enhancing efficiency, effectiveness, and quality.

-

- Strong Client Relationships and High Retention Rates:

-

Indegene boasts long-standing relationships with major biopharmaceutical companies globally, including the top 20 by revenue in FY 2023. Their ability to consistently meet client needs and deliver value has resulted in high retention rates, with revenues from existing clients exceeding those from the previous year.

-

The trust and satisfaction of their clients underscore Indegene’s reputation as a reliable partner in the life sciences industry.

-

-

Global Delivery Model with Enterprise-Wide COEs and Omnichannel Activation Capabilities:

-

Indegene offers solutions through a global delivery model, leveraging enterprise-wide Centers of Excellence (COEs) and digital Omnichannel Activation capabilities. COEs comprise subject matter experts who collaborate closely with clients to deliver comprehensive, multi-year solutions tailored to their specific needs.

-

Omnichannel Activation capabilities enable digital sales and marketing campaigns, reducing reliance on traditional methods and optimizing customer engagement across multiple channels.

-

- Experienced Management and Diverse Talent Pool:

- Indegene’s management team brings together years of experience in healthcare, marketing, and technology roles, providing strategic direction and leadership to the company.

- The company values diversity and inclusion, with employees representing 22 nationalities. This diverse talent pool contributes to a rich and innovative work environment, fostering creativity and collaboration.

- Employee-Centric Culture and Recognition:

-

Indegene’s focus on creating an employee-centric culture has been recognized consistently, earning them accolades as one of India’s best companies to work for since 2016 by the Great Place to Work Institute. Their commitment to employee satisfaction and well-being contributes to a motivated workforce and enhances overall performance.

-

Indegene Limited’s IPO Risk Factors:

-

The business is solely focused on the life sciences industry and may be adversely impacted by factors affecting the life sciences industry, including the growth of the overall life sciences industry, outsourcing and other trends.

-

The majority of company’s revenues are derived from its Subsidiaries. Any disruptions in the operations of one or more of its Subsidiaries may adversely affect its business, financial condition, results of operations.

-

If the company is unable to manage attrition and attract and retain skilled professionals, it may have an adverse impact on its business prospects, reputation and future financial performance.

-

If the company is unable to generate new engagements from their clients, it may have a negative impact on its business, cash flows and results of operations.

Indegene Limited’s IPO Objects of the Offer:

The Company proposes to utilise the Net Proceeds towards funding of the following objects:

- Repayment/prepayment of indebtedness of one of our Material Subsidiaries, ILSL Holdings, Inc.;

- Funding the capital expenditure requirements of our Company and one of our Material Subsidiaries, Indegene, Inc.; and

- General corporate purposes and inorganic growth.

Indegene Limited IPO FAQ:

Ans. Indegene IPO is a main-board IPO of 40,746,891 equity shares of the face value of ₹2 aggregating up to ₹1,841.76 Crores. The issue is priced at ₹430 to ₹452 per share. The minimum order quantity is 33 Shares.

The IPO opens on May 6, 2024, and closes on May 8, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE..

Ans. The Indegene IPO opens on May 6, 2024 and closes on May 8, 2024.

Ans. Indegene IPO lot size is 33 Shares, and the minimum amount required is ₹14,916..

Ans. The Indegene IPO listing date is on May 13, 2024..

Ans. The minimum lot size for this upcoming IPO is 33 shares.