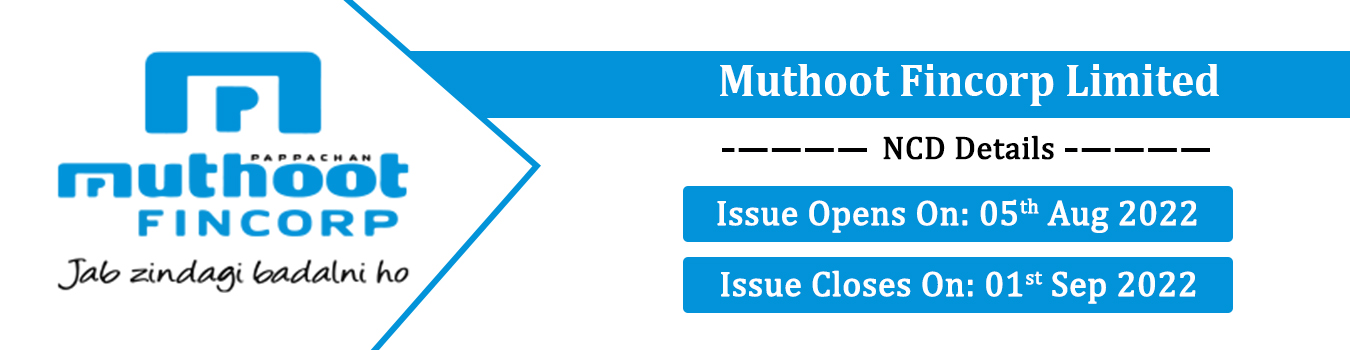

Muthoot Fincorp Ltd NCD Details

| Issue size: | Base Issue of Rs. 25,000 Lakhs with an option to retain oversubscription upto Rs. 25,000 Lakhs , aggregating to Rs. 50,000 Lakhs |

| Type and Nature of Instrument | Secured redeemable non-convertible debentures |

| Issue Price: | Rs1,000/- each NCD |

| Face value: | Rs1,000/- each NCD |

| Minimum Lot size: | 1 (one) NCD |

| Market Lot: | 1 (one) NCD |

| Minimum Application Size: | 10 (ten) NCDs (i.e. Rs10,000/- (Rupees Ten Thousand Only) either taken individually or collectively across all or any series of NCDs |

| In Multiples of: | 1 (one) NCD (Rs1,000) across all series of NCDs |

| Mode of allotment | In dematerialised form only |

| Credit Rating: | The NCDs have been rated “Crisil A+ (Stable)” by CRISIL Limited |

| Rating agency: | CRISIL Limited |

| Public Issue Account Bank, Sponsor Bank and Refund Bank: | Axis Bank Limited |

Specific Terms of the Prospectus:

The terms of the NCDs offered pursuant to the Issue are as follows:

| Options | I | II | III | IV | V | VI | VII* |

| Nature | Secured | Secured | Secured | Secured | Secured | Secured | secured |

| Tenure | 27 Months | 38 Months | 48 Months | 27 Months | 38 Months | 48 Months | 96 Months |

| Frequency of Interest

Payment |

Monthly | Monthly | Monthly | Cumulati ve | Cumulati ve | Cumulati ve | Cumulati ve |

| Minimum Application | Rs. 10000 (10 NCDs) | ||||||

| In multiples, of | 1 NCD after minimum application | ||||||

| Face Value of NCDs (₹

/NCD) |

Rs.1000 (1 NCD) | ||||||

| Issue Price (₹ /NCD) | Rs.1000 (1 NCD) | ||||||

| Mode of Interest

Payment/ Redemption |

Through various options available | ||||||

| Coupon (%) per annum* | 8.00% | 8.25% | 8.35% | N.A. | N.A. | N.A. | N.A. |

| Coupon Type | Fixed | ||||||

| Redemption Amount (₹

/NCD) for Debenture Holders* |

1,000 | 1,000 | 1,000 | 1,196 | 1,297 | 1,395 | 2,007 |

| Effective Yield (%) (per annum)* | 8.29% | 8.56% | 8.67% | 8.29% | 8.56% | 8.66% | 9.09% |

| Put and Call Option | N.A. | ||||||

| Deemed Date of

Allotment |

September 6, 2022 | ||||||

*Maximum allotment under series VII is Rs.7,500 lakhs