EMS Limited IPO Company Proflie:

EMS Limited is a multi-disciplined EPC business that focuses on offering comprehensive services in water and wastewater collection, treatment, and disposal. The company offers comprehensive, all-inclusive services, including engineering and design, construction, and installation of facilities for treating home, industrial, and municipal waste. It has been committed to sustainable development by promoting a clean and green environment and modern infrastructure. The co. actively engage in government tenders and maintain a self-sufficient in-house team of engineers to ensure compliance with quality and industry standards. It has executed total of 67 projects, of which 50 were executed by the company itself and 17 were executed by the proprietorship before it was taken over by the company in June 2012. As of 31st July, 2023, co. is operating and maintaining 18 projects including WWSPs, WSSPs, STPs & HAM aggregating of Rs.1,745 cr. & 5 O&M projects aggregating to Rs.99.3 cr.

| IPO-Note | EMS Limited |

| Rs.200 – Rs.211 per Equity share | Recommendation: Subscribe |

EMS Limited IPO Details:

| Issue Details | |

| Objects of the issue | · To fund working capital requirements

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.321.24 Cr.

Fresh Issue – Rs.146.24 Cr. Offer for Sale – Rs.175 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.200 – Rs.211 |

| Bid Lot | 70 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 08th Sep, 2023 – 12th Sep, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check EMS Limited IPO Allotment Status

Go EMS Limited IPOallotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

EMS Limited IPO Strengths:

-

EMS has an in-house design, engineering, and execution team that possess expertise in various areas such as process description, calculations, design codes and standards, and facility layouts. This capability allows it to accurately bid on projects and deliver high-quality services in a timely and cost-effective manner.

-

It is engaged in the business of providing a wide range of water and wastewater management services, including Sewerage solutions, Water Supply Systems, Water and Waste Treatment Plants, Electrical Transmission and Distribution, and more. This diverse portfolio enhances the co.’s potential to serve various government authorities and bodies.

-

Co’s scalable and asset light business model resulted in efficient utilization of capital resulting in lower debt and higher ROCE.

EMS Limited IPO Key Highlights:

-

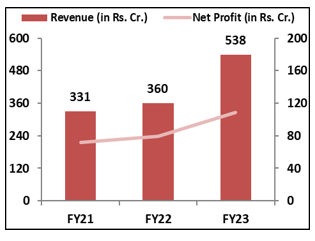

Revenue of the co. has increased from Rs.331 Cr. in FY21 to Rs.538 Cr. in FY23 with a CAGR of 17.6%; Net Profit also increased from Rs.72 Cr. in FY21 to Rs.109 Cr. in FY23 with a CAGR of 14.8%

-

Co’s EBITDA Margin & PAT Margin stands at 27.7% & 20% respectively in FY23.

-

As of March, 2023, ROCE and ROE ratio of the co. is 28.26% and 22.27%.

-

Debt to Equity of the co. stands at 0.09 as of March, 2023.

EMS Limited IPO Financial Performance:

EMS Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 96.71% | 69.70% |

| Others | 3.29% | 30.30% |

Source: RHP, EWL Research

EMS Limited IPO Risk Factors:

-

Co is 100% dependent on government projects; any reduction in budget allocation to this sector may affect the number of projects available for bidding, impacting the co.’s business.

-

It has faced blacklisting in the past, which can raise concerns about its reputation and ability to secure future projects.

EMS Limited IPO Outlook:

EMS Limited is a leading infrastructure solutions provider with a focus on sewage systems, water supply, waste management, electricity transmission, and road construction. The co. mainly works in water and waste water management where its business model works like collecting, treating, and supplying water and wastewater through different Methods. Co. is also involved in electrical transmission and civil construction. It has completed many government and private projects and has a good track record in operation and maintenance. EMS is further focusing to expand its business operations to other regions of the country, especially the North-East and South India. Additionally it is capitalizing on government policy initiatives in WWTP and WSSP sectors. The wastewater management system growth outlook in India also seems positive on the back of increasing population and urbanization, growing industrial sector and stringent government regulations. P/E of the co. stands at 10.78x on the upper price band compared to the industry average of 13.86x, which seems reasonably priced. The IPO of EMS Limited offers a favorable opportunity in the water and wastewater management sector. Co.’s financials, strong order book and broad portfolio looks promising hence, we suggest to subscribe to the offering

EMS Limited IPO FAQ

Ans. EMS IPO is a main-board IPO of [.] equity shares of the face value of ₹10 aggregating up to ₹321.24 Crores. The issue is priced at ₹200 to ₹211 per share. The minimum order quantity is 70 Shares.

The IPO opens on September 8, 2023, and closes on September 12, 2023.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The EMS IPO opens on September 8, 2023 and closes on September 12, 2023.

Ans. EMS IPO lot size is 70 Shares, and the minimum amount required is ₹14,770.

Ans. The EMS IPO listing date is not yet announced. The tentative date of EMS IPO listing is Thursday, September 21, 2023.

Ans. The minimum lot size for this upcoming IPO is 70 shares.