Baroda BNP Paribas Business Conglomerates Fund (BBNPC) NFO Why Conglomerates thrive?

-

Diversified revenue streams mitigate risk: Presence of a conglomerate across multiple sectors diversifies risk, where potentially profitable mature businesses generate steady cash flows that can offset losses from experimental or high-risk ventures.

- Leveraging Legacy: Conglomerates aim to leverage their strong brand reputation and goodwill to empower their subsidiaries, creating a combined effect of trust, credibility, and market access.

- Financial firepower to invest in innovative ventures: Indian conglomerates are set to invest nearly $800 billion in growth over the next decade, almost triple their spending in the past ten years. Around 40% of this will flow into emerging sectors like clean energy, semiconductors, EVs, and data centres (S&P Global Report, Oct 2024, latest available data). With their legacy of resilience and long-term vision, conglomerates are uniquely positioned to back sunrise industries with meaningful capital and strategic commitment.

(source: barodabnpparibasmf.in)

Introducing Baroda BNP Paribas Business Conglomerates Fund:

Salient features of the Scheme

- Focused on companies from leading diversified conglomerates.

- Invests at least 80% of its net assets in companies that are part of business conglomerates in India. Conglomerates will be identified as groups based in India, led or controlled by promoters, and comprising at least two listed companies in different sectors or industries.

- The Scheme will invest in at least four groups, with exposure limited to 25% of the net assets per group.

*The mention of any company or group names in this document/advertisement is for illustrative purposes. It does not imply any endorsement, partnership, or affiliation or future position in the named companies or groups. The companies listed are not responsible for the performance of the mutual fund schemes, and Baroda BNP Paribas Mutual Fund / AMC does not endorse or guarantee the performance of these companies or their products. Investors are advised to carefully consider their investment objectives and consult with a financial advisor before making any investment decisions

(source: barodabnpparibasmf.in)

Baroda BNP Paribas Business Conglomerates Fund (BBNPC) NFO Opportunity Landscape:

Baroda BNP Paribas Business Conglomerates Fund (BBNPC) NFO Scheme Facts:

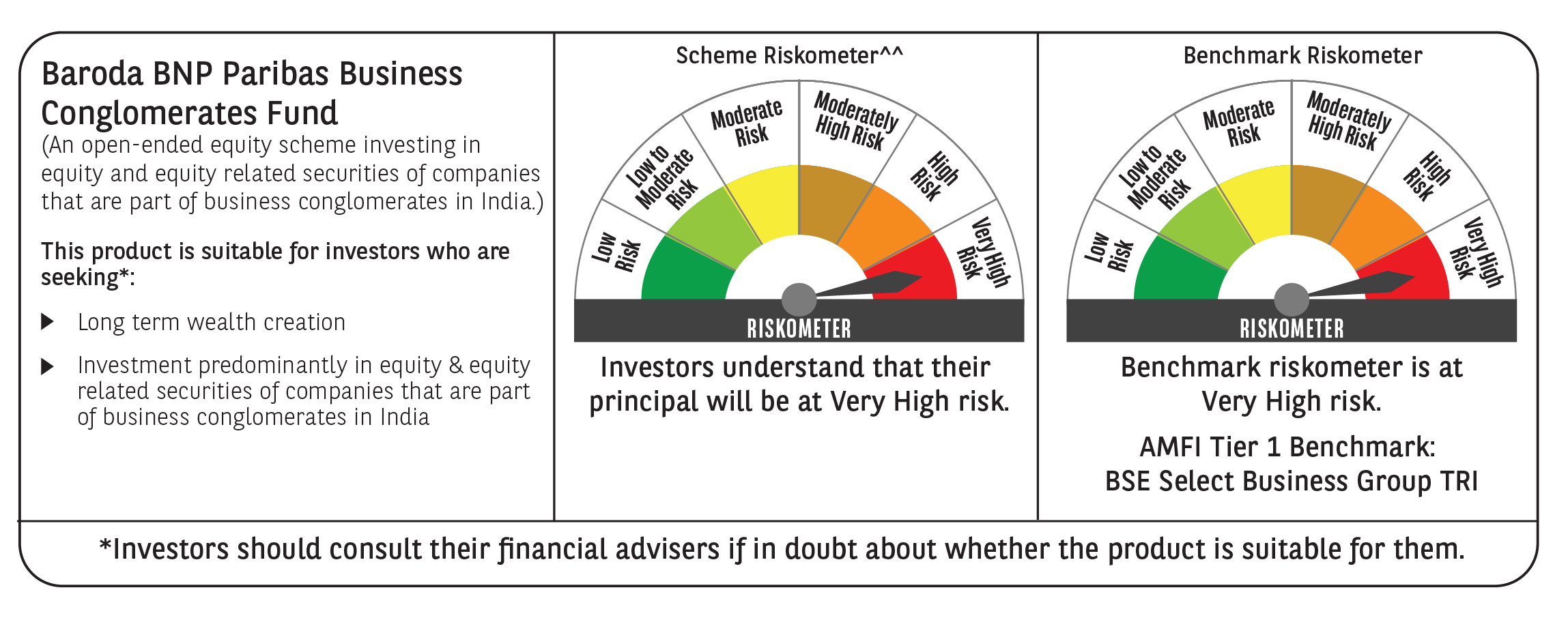

| Scheme Name | Baroda BNP Paribas Business Conglomerates Fund |

| Type of the Scheme | An open-ended equity scheme investing in equity and equity related securities of companies that are part of business conglomerates in India |

| Category | Sectoral / Thematic Fund – Conglomerate Theme |

| Investment Objective | The investment objective of the Scheme is to achieve long term capital appreciation by investing in equity and equity related securities of companies that are part of business conglomerates in India. The Scheme does not guarantee/indicate any returns. However, there can be no assurance that the investment objective of the Scheme will be realized. |

| AMFI Tier 1 Benchmark | BSE Select Business Group TRI |

| Fund Manager | Mr. Jitendra Sriram and Mr. Kushant Arora |

| Load Structure |

The above load shall also be applicable for switches between the schemes of the Fund and all Systematic Investment Plans, Systematic Transfer Plans, Systematic Withdrawal Plans. No load will be charged on units issued upon re-investment of amount of distribution under same IDCW option and bonus units. |

| Minimum Application Amount/switch in | Lumpsum investment: Rs. 1,000 and in multiples of Rs. 1 thereafter. Systematic Investment Plan: (i) Daily, Weekly, Monthly SIP: Rs. 500/- and in multiples of Re. 1/- thereafter (ii) Quarterly SIP: Rs. 1500/- and in multiples of Re. 1/- thereafter. There is no upper limit on the amount for application. The Trustee / AMC reserves the right to change the minimum amount for application and the additional amount for application from time to time in the Scheme and these could be different under different plan(s) / option(s). |

(source: barodabnpparibasmf.in)

Baroda BNP Paribas Business Conglomerates Fund (BBNPC) NFO Scheme Details:

The investment objective of the Scheme is to achieve long term capital appreciation by investing in equity and equity related securities of companies that are part of business conglomerates in India. The Scheme does not guarantee/indicate any returns. However, there can be no assurance that the investment objective of the Scheme will be realized

| Mutual Fund | Baroda BNP Paribas Mutual Fund |

| Scheme Name | Baroda BNP Paribas Business Conglomerates Fund (BBNPC) |

| Objective of Scheme | The investment objective of the Scheme is to achieve long term capital appreciation by investing in equity and equity related securities of companies that are part of business conglomerates in India. The Scheme does not guarantee/indicate any returns. However, there can be no assurance that the investment objective of the Scheme will be realized |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Sectoral/ Thematic |

| New Fund Launch Date | 02-Sep-2025 |

| New Fund Earliest Closure Date | 15-Sep-2025 |

| New Fund Offer Closure Date | 15-Sep-2025 |

| Indicate Load Seperately | |

| Minimum Subscription Amount | 1000 and in multiples of Re.1/- therafter |

| For Further Details Please Visit Website | https://www.barodabnpparibasmf.in/ |

(source: https://www.amfiindia.com/)

Scheme Documents

(source: barodabnpparibasmf.in)

Baroda BNP Paribas Business Conglomerates Fund (BBNPC) NFO Riskometer:

(source: barodabnpparibasmf.in)