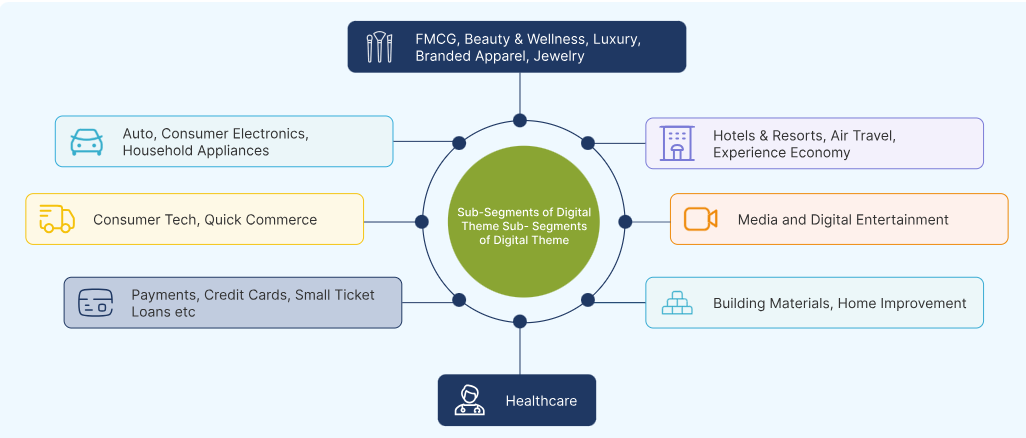

Consumption Landscape in India

(source: mf.whiteoakamc.com)

(source: mf.whiteoakamc.com)

Why Invest in: WhiteOak Consumption Opportunities Fund

- Consumption Index has a long term track record of Strong Returns with Low Volatility

- Catalysts: Shift in government focus from capital expenditure to consumption reflected in:

Social Welfare Schemes Personal Income Tax Cuts GST Rate cuts Expected Pay Commission Hikes - Strong research capabilities of research team, leveraging on our global experience

- Team covers 180+ companies relevant for this Scheme

- Can leverage the global experience of investing in Consumer Companies

- Growing universe of Consumer Companies through IPOs

- Significant focus on discretionary and new age businesses where there has been large value creation globally

For understanding purpose only. Portfolio will be managed as per stated Investment objective, investment strategy & asset allocation in the Scheme Information Document (SID) and is subject to the changes within provisions of SID of the Scheme.

How do we evaluate consumer companies?

The basic framework remains the same; tools, techniques, lens different for different sectors.

Framework

Superior returns on incremental capital

Unit economics, industry characteristics, disciplined expansion, nature of structural competitive advantage

Scalable long term opportunity

Cross country comparisons, assessing drivers for market share shift in favor of organized sector, adjacencies and cross-selling opportunities

Strong execution and governance

Management focus, passionate execution, process orientation, discipline, culture of timely reviews, agility

Lens, Tools,

Techniques

Techniques

- Product brands vs retailers – ownership of the product/pipe/customer? The choices to balance ROIC and growth

- Robustness of back-end to support scale; Leverage of infrastructure and corporate set up to target into adjacencies

- Economics – Store level break even and paybacks, SSSG trends, full-price sell through rate, customer loyalty and satisfaction metrics , sources of operating leverage, scope for margin expansion, reinvestment discipline

(source: mf.whiteoakamc.com)

Structure & Key Terms

-

NFO Period20thJanuary to 3rd February 2026

-

Type of SchemeAn open ended equity scheme following consumption theme.

-

Investment ObjectiveTo provide long-term capital appreciation by investing predominantly in equity and equity related instruments of companies engaged in consumption and consumption related activities or allied sectors and/or are expected to benefit from the domestic consumption led demand. There is no assurance that the investment objective of the Scheme will be achieved.

-

Asset Allocation PatternEquity & Equity related Instruments of companies engaged in consumption and consumption related activities or allied sectors and/or are expected to benefit from the domestic consumption led demand: 80% – 100%

Equity & Equity related Instruments of companies other than above (including REITS): 0% – 20%

Debt Securities and Money Market Instruments: 0% – 20%

Units issued by InvITs: 0% – 10%

Please refer to the Scheme Information Document for detailed asset allocation. -

PlansRegular Plan & Direct Plan

-

OptionsGrowth Option

-

Minimum Application Amount / Switch-inFor Lumpsum Purchase: Minimum of Rs. 500/- and in multiples of Re. 1/- thereafter

For SIP Purchase: Rs. 100/- for Weekly, Fortnightly & Monthly Frequency, Rs. 500/- for Quarterly SIP (and in multiples of Re. 1/- thereafter),

Min. SIP installments: For weekly, Fortnightly, Monthly installments- 6, For Quarterly installments- 4 -

Load StructureEntry Load: Nil.

Exit Load: In respect of each purchase / switch-in of Units, an Exit Load of 1.00% is payable if Units are redeemed/ switched-out within 1 month from the date of allotment. No Exit Load is payable if Units are redeemed / switched-out after 1 month from the date of allotment. -

Fund ManagerMr. Ramesh Mantri (Equity), Ms. Trupti Agarwal (Assistant FM, Equity), Mr. Dheeresh Pathak (Assistant FM, Equity), Mr. Piyush Baranwal (Debt), Mr. Ashish Agrawal (for Arbitrage Transactions),

-

Benchmark IndexNifty India Consumption TRI

-

TaxationShort Term Capital Gains (STCG): 20%

Long Term Capital Gains (LTCG): 12.50% (With holding period more than 12 months) Additional Surcharge and Cess will be levied as applicable. LTCG Tax rate and holding period are illustrative and not final. Depending on the acquisition and redemption date the tax rate and period of holding may differ.

(source: mf.whiteoakamc.com)

WhiteOak Capital Consumption Opportunities Fund NFO:

| Mutual Fund | WhiteOak Capital Mutual Fund |

| Scheme Name | WhiteOak Capital Consumption Opportunities Fund |

| Objective of Scheme | To provide long-term capital appreciation by investing predominantly in equity and equity related instruments of companies engaged in consumption and consumption related activities or allied sectors and/or are expected to benefit from the domestic consumption led demand. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Sectoral/ Thematic |

| New Fund Launch Date | 20 Jan 2026 |

| New Fund Earliest Closure Date | 03 Feb 2026 |

| New Fund Offer Closure Date | 03 Feb 2026 |

| Indicate Load Separately | Entry Load: Nil Exit Load: In respect of each purchase / switch-in of Units, an Exit Load of 1.00% is payable if Units are redeemed/ switched-out within 1 month from the date of allotment. No Exit Load is payable if Units are redeemed / switched-out after 1 month from the date of allotment |

| Minimum Subscription Amount | Minimum of Rs. 500/- and in multiples of Re. 1/- |

| For Further Details Please Visit Website | https://mf.whiteoakamc.com/ |

(source: https://www.amfiindia.com/)

Scheme Documents

(source: mf.whiteoakamc.com)

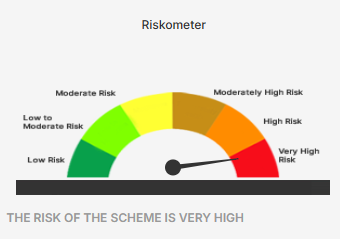

WhiteOak Capital Consumption Opportunities Fund NFO Riskometer:

(source: mf.whiteoakamc.com)