| Result Analysis: HCL Technologies Limited (CMP: Rs.1110.05) | Result Update: Q1FY24 |

HCL Technologies Limited is a global technology company, home to more than 223,438 people across 60 countries, delivering industry-leading capabilities centered around digital, engineering, cloud, and Al, powered by a broad portfolio of technology services and products. We work with clients across all major verticals, providing industry solutions for Financial Services, Manufacturing, Life Sciences and Healthcare, Technology and Services, Telecom and Media, Retail and CG, and Public Services. Consolidated revenues as of 12 months ending June 2023 totaled $ 12.8 billion.

| Stock Details | |

| Market Cap. (Cr.) | 301230.38 |

| Equity (Cr.) | 542.73 |

| Face Value | 2 |

| 52 Wk. high/low | 1203 / 876 |

| BSE Code | 532281 |

| NSE Code | HCLTECH |

| Book Value (Rs) | 241.02 |

| Sector | IT – Software |

| Key Ratios | |

| Debt-equity: | 0.11 |

| ROCE (%): | 24.59 |

| ROE (%): | 22.2 |

| EPS TTM: | 54.73 |

| P/BV: | 4.6 |

| P/E TTM: | 20.28 |

Result Highlights:

-

The company experienced a slight decrease in revenue of 1.2% QoQ to Rs.26,296 cr. and a 2.8% QoQ decline in net profit by 11.3% to Rs.3,531 cr. The primary factors contributing to this performance decline were the demand softness in large verticals, project ramp downs & reduced discretionary spending.

-

EBIT Margin of the company also declined by 130 bps QoQ in the quarter and stands at 16.9%, led by an increase in SG&A Expenses.

-

Among segments, IT and business services had strong growth in the number of new contracts signed, but the majority of these gains were offset by a decrease in discretionary spending, which resulted in flat QoQ sales in CC. Deal ramp-downs caused ER&D services to decline 5.2% on a quarterly basis. According to management, this sector has now stabilized. Software revenue was consistent in CC terms on YoY basis.

-

Across geographies, while North America (63% of revenue) improved by 0.2% QoQ, Europe (28.7% of revenue) and RoW (7.9% of revenue) degrew by 2.4% and 6.2% QoQ (in the CC terms) respectively.

-

Company won 18 new deals in Q1FY24 aggregating to $1.6bn as compared to the previous quarter of $2.1bn. The deal pipeline, which increased 26.2% YoY, is still at an all-time high. 11 large transactions in the software market and 7 large deals in services were inked.

-

In Q1, the attrition rate decreased from 19.5% in Q4FY23 to 16.3%. Although, Headcount also decreased by 2,506 employees QoQ to close at 223,438 employees.

- HCL Tech announced an interim dividend of Rs.10 per share.

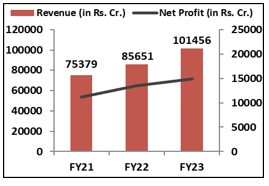

Financial Performance:

Shareholding Pattern:

| Particulars (In %) | Q4FY23 | Q1FY22 |

| Promoters Group | 60.72 | 60.72 |

| FIIs | 18.81 | 18.46 |

| DIIs | 15.91 | 15.54 |

| Public | 4.19 | 4.88 |

| Others | 0.4 | 0.4 |

Management Commentary:

Commenting on the June quarter results, C Vijayakumar, CEO and MD said, “In Q1 FY 24, our revenue and people strength sequentially moderated in line with the demand environment. We delivered a 6.3% YoY growth in CC at company level and 7,1% YoY CC for the Services business. We experienced double-digit YoY growth, in our largest verticals – Financial Services, Manufacturing, and Life Sciences and Healthcare fueled by large deals. These large deals helped offset cuts in client discretionary spend in these verticals. We are expecting other verticals to pick up as well shortly. This combined with the strength of our record-high pipeline enables us to maintain our guidance for the year.”

Outlook:

HCL Technologies showed subdued performance in Q1FY24 with a further decline of 1.2% QoQ in revenue and profits by 11.3% QoQ. Because of North American uncertainty and delayed decision-making, the near-term future for IT services is still uncertain. The long-term demand environment is still solid, and the IT industry is projected to pick up steam starting in H2FY24 and moving forward. Due to its numerous long-term partnerships with top global brands, HCL Tech is well-positioned to promote growth over the long run. Richer revenue visibility provides hope for the company’s future business success. However, escalating worries about economic uncertainty in developed nations and ongoing supply-side restrictions are making it difficult for the corporation to continue growing in the future.

Results:

| Particulars (In Rs. Cr.) | Q1FY24 | Q4FY23 | Q1FY23 | QoQ% | YoY% |

| Revenue from Operations | 26,296 | 26,606 | 23,464 | -1.2% | 12.1% |

| Other Income | 344 | 453 | 409 | -24.1% | -15.9% |

| Total Income | 26,640 | 27,059 | 23,873 | -1.5% | 11.6% |

| Employee Benefit Expenses | 15,014 | 14,665 | 12,978 | 2.4% | 15.7% |

| Employee benefit Expenses as % of Sales | 57.1% | 55.1% | 55.3% | 200 bps | 180 bps |

| Purchase of stock-in-trade | 468 | 577 | 355 | -18.9% | 31.8% |

| Changes in inventories of stock-in-trade | 67 | -14 | -9 | -578.6% | -844.4% |

| Outsourcing costs | 3,628 | 3,786 | 3,593 | -4.2% | 1.0% |

| Depreciation & Amortisation Expense | 927 | 1,027 | 983 | -9.7% | -5.7% |

| Other Expense | 1,754 | 1,729 | 1,572 | 1.4% | 11.6% |

| EBIT | 4,438 | 4,836 | 3,992 | -8.2% | 11.2% |

| EBIT Margin | 16.9% | 18.2% | 17.0% | -130 bps | -10 bps |

| Profit After Tax (PAT) | 3,531 | 3,981 | 3,281 | -11.3% | 7.6% |

| PATM (%) | 13.4% | 15.0% | 14.0% | 160 bps | – 60 bps |

| EPS (in Rs.) | 13.05 | 14.71 | 12.13 | -11.3% | 7.6% |

| Segment Revenue (In Rs. Cr.) | Q1FY24 | Revenue % | Q4FY23 | QoQ% | Q1FY23 | YoY% |

| IT and Business services | 19,642 | 74.7% | 19,632 | 0.1% | 17,070 | 15.1% |

| Engineering and R&D services | 4,047 | 15.4% | 4,274 | -5.3% | 3,904 | 3.7% |

| HCL Software | 2,607 | 9.9% | 2,700 | -3.4% | 2,490 | 4.7% |

| Geography Revenue % | Q1FY24 | Q4FY23 | Q1FY23 | QoQ | YoY |

| America | 64.2% | 63.8% | 64.5% | 40 bps | -30 bps |

| Europe | 27.8% | 28.9% | 28.7% | -110 bps | -90 bps |

| Rest of the World | 8.0% | 7.3% | 6.8% | 70 bps | 120 bps |

Source: Company website, EWL Research

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Kiran Tahlani, Elite Wealth Limited, kirantahlani@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or e-mailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL

Provided that research analyst or research entity shall not be required to make a disclosure as per sub-clauses (c), (d) and (e) of clause (ii) or sub-clauses (a) and (b) of clause (iii) to the extent such disclosure would reveal material non-public information regarding specific potential future investment banking or merchant banking or brokerage services transactions of the subject company.

(4) EWL or its proprietor has never served as an officer, director or employee of the subject company;

(5) EWL has never been engaged in market making activity for the subject company;

(6) EWL shall provide all other disclosures in research report and public appearance as specified by the Board under any other regulations.