Platinum Industries Limited IPO Company Details:

Platinum Industries Limited (PIL) is a specialized chemical company which is in the business of manufacturing PVC Stabilizers. These chemical additives are added during the manufacturing process of products made of polyvinyl chloride (PVC) in order to improve the product’s performance and longevity. These stabilizers improve the material’s thermal stability, enabling it to tolerate heat without suffering appreciable deterioration or loss of its physical characteristics. With a 13.00% market share in the domestic market, the company ranks third among PVC stabilizer manufacturers in terms of sales.

PIL has three business segments: PVC stabilizers, CPVC additives, and lubricants. These products are used in PVC pipes, electrical wires, cables, PVC foam boards, and other packaging materials. Chemical compounds known as chlorinated PVC (CPVC) additives improve PVC’s resistance to a variety of corrosive and chemical agents. Because of this, CPVC can be used in hot water handling applications including fire sprinklers, industrial pipes, and plumbing systems. The lubricants are an essential component of the PVC mixture. By reducing the melt viscosity, these lubricants are utilized to lessen the friction between PVC molecules.

The company has a manufacturing facility in Palghar, Maharashtra which is spread across 21,000 Sqft of land. The facility is located near JNPT (Nhava Sheva) Port it can import raw materials as well as export finished products to the global market. Additionally, PIL has proposed the construction of a second production site in Palghar, Maharashtra, in order to increase its capacity in India. The company also plans to open a manufacturing facility in Egypt as part of its expansion. Egypt does not currently have a production facility for PVC stabilizer, and the majority of its PVC stabilizer imports come from Turkey, Iran, Saudi Arabia, and India, according to the CRISIL Report.

| IPO-Note | Platinum Industries Limited |

| Rs.162 – Rs.171 per Equity share | Recommendation: Subscribe |

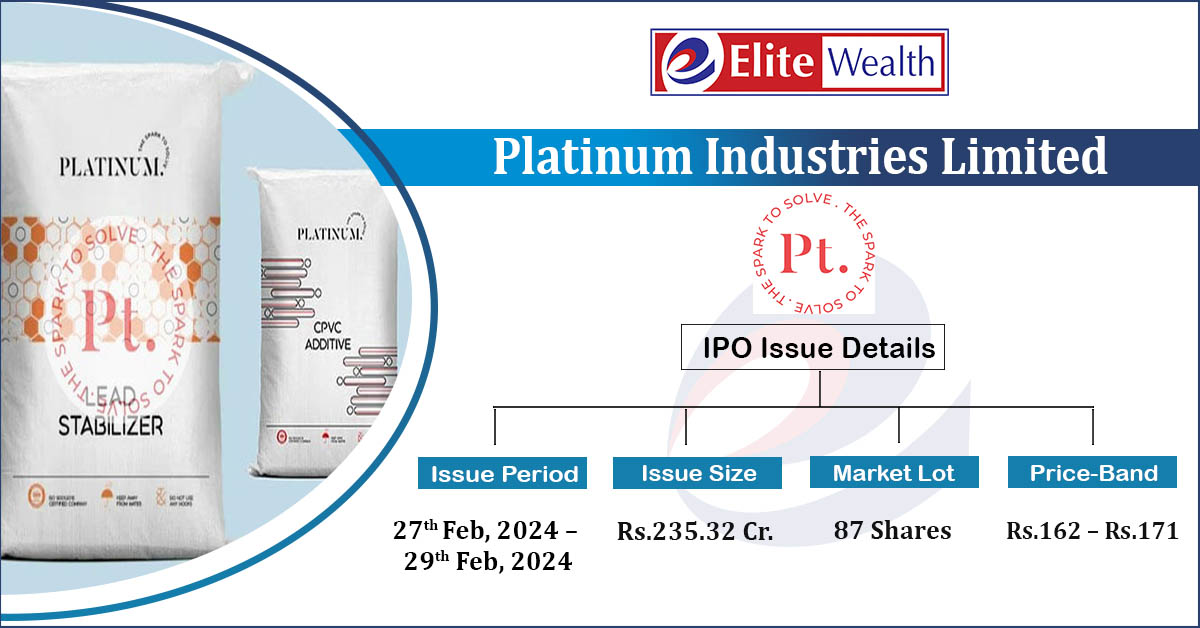

Platinum Industries Limited IPO Details:

| Issue Details | |

| Objects of the issue | · To invest in the subsidiary

· To fund capital expenditure requirement towards setting up of manufacturing facility |

| Issue Size | Total issue Size – Rs.235.32 Cr.

Fresh Issue – Rs.235.32 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.162 – Rs.171 |

| Bid Lot | 87 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 27th Feb, 2024 – 29th Feb, 2024 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Platinum Industries Limited IPO Strengths:

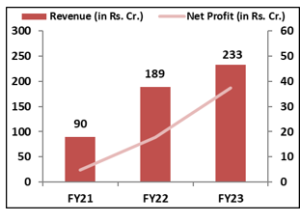

- PIL has expanded from manufacturing two products to several products. Since FY21, revenues and net profits have increased significantly at a 62% and 179% CAGR, respectively.

- The company is a leader in the PVC stabilizer industry and is focusing on expanding its global market share.

- The company has diversified product portfolio and has created more than 400 grades specifically for PVC applications to cater their customers.

Platinum Industries Limited IPO Financial Performance:

Platinum Industries Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 94.73% | 71.00% |

| Others | 5.27% | 29.00% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Platinum Industries Limited IPO Allotment Status

Platinum Industries Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Source: RHP, EWL Research

Platinum Industries Limited IPO Risk Factors:

-

The top five clients account for ~78% of the company’s revenue, while the top ten customers account for 86%; which increases the concentration risk for the business, and the loss of a single, sizable client can drastically reduce profits.

-

It does not have any long-term contracts with its suppliers, any changes to the raw material supply could negatively impact the company’s profit margins.

Platinum Industries Limited IPO Outlook:

PIL offers a variety of PVC stabilizers, lubricants & other items and has carved out a niche for itself with high-margin, innovative, and high-quality products. Both the company’s top and bottom lines showed growth, and the management is optimistic that these trends will continue in upcoming years. The PE of PIL stands at 25x on the upper price band which seems fair when compared to its peer’s average of 23.38x. Considering the valuations, financials and future growth prospect we recommend investors to apply in the offering.

Platinum Industries Limited IPO FAQ

Ans. Platinum Industries IPO is a main-board IPO of 13,761,225 equity shares of the face value of ₹10 aggregating up to ₹235.32 Crores. The issue is priced at ₹162 to ₹171 per share. The minimum order quantity is 87 Shares.

The IPO opens on February 27, 2024, and closes on February 29, 2024.

Bigshare Services Pvt Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Platinum Industries IPO opens on February 27, 2024 and closes on February 29, 2024.

Ans. Platinum Industries IPO lot size is 87 Shares, and the minimum amount required is ₹14,877.

Ans. The Platinum Industries IPO listing date is not yet announced. The tentative date of Platinum Industries IPO listing is Tuesday, March 5, 2024.

Ans. The minimum lot size for this upcoming IPO is 87 shares.