Manoj Vaibhav Gems ‘N’ Jewellers Limited IPO Company Profile:

Manoj Vaibhav Gems ‘N’ Jewellers Limited (MVJL) is a regional jewelry brand in South India which offers gold, silver, and diamond jewelry, precious gemstones, and other jewelry products. The company sells its range through retail showrooms as well as through its website. It caters to all economic segments of the micro markets of Andhra Pradesh and Telangana through their retail showrooms and their website with a focus on both rural and urban markets. The company has 13 showrooms, including two franchisee showrooms, across eight towns and two cities in Andhra Pradesh & Telangana; it holds approximately 4% of the local jewelry market and 10% of the organized sector in these states.

| IPO-Note | Manoj Vaibhav Gems ‘N’ Jewellers Limited |

| Rs.204 – Rs.215 per Equity share | Recommendation: Aggressive investors may Apply |

Manoj Vaibhav Gems ‘N’ Jewellers Limited IPO Details :

| Issue Details | |

| Objects of the issue | · To fund capital expenditure

· To fund inventory cost · To gain listing benefits |

| Issue Size | Total issue Size – Rs.270.20Cr.

Fresh Issue – Rs.210 Cr. Offer for Sale – Rs.60.20 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.204 – Rs.215 |

| Bid Lot | 69 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 22nd Sep, 2023 – 26th Sep, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Manoj Vaibhav Gems ‘N’ Jewellers Limited IPO Strengths :

-

MVJL has nearly three-decade focus on the micro markets of Andhra Pradesh and Telangana, giving it deep insight into local customer sentiments and preferences.

-

Company’s Go to Market strategy is its key business enabler helped it to expand its market reach, deepen its connections with customers, and has enabled it to build a loyal customer base.

-

It offers diverse product designs at varied price range to customers across budget bracket.

Manoj Vaibhav Gems ‘N’ Jewellers Limited IPO Key Highlights:

-

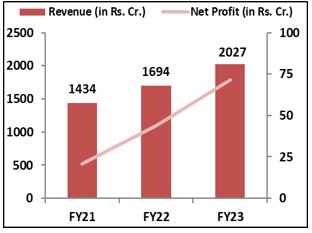

Revenue of the co. has increased from Rs.1434 Cr. in FY21 to Rs.2027 Cr. in FY23 with a CAGR of 12%; Net Profit also increased from Rs.21 Cr. in FY21 to Rs.72 Cr. in FY23 with a strong CAGR of 51%

-

Co.’s ’s EBITDA Margin & PAT Margin stands at 7.1% & 3.5% respectively in FY23.

-

As of March, 2023, ROCE and ROE ratio of the co. is 17.7% and 23.19% respectively.

-

Debt to Equity ratio is decreasing over the years & currently stands at 1.34.

Manoj Vaibhav Gems ‘N’ Jewellers Limited IPO Risk Factors:

-

Co. generated 62% of its revenue from Visakhapatnam region in FY23; any specific risk related to this region may impact the revenues of the co.

-

The company, Promoters and Directors are involved in certain legal proceedings; any adverse decision in such proceedings may adversely affect its business.

-

MVJL operates in a highly competitive market and faces competition from other jewellery retailer. Increase in the competition may adversely impact co.’s operations and performance.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Manoj Vaibhav Gems ‘N’ Jewellers Limited IPO Allotment Status

Go Manoj Vaibhav Gems ‘N’ Jewellers Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Manoj Vaibhav Gems ‘N’ Jewellers Limited IPO Financial Performance:

Manoj Vaibhav Gems ‘N’ Jewellers Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 100% | 96.86% |

| Others | 0% | 3.14% |

Source: RHP, EWL Research

Manoj Vaibhav Gems ‘N’ Jewellers Limited IPO Outlook:

MVJL is one of the leading regional jewellery brand in South India majorly focused in the micro markets of Andhra Pradesh and Telangana. The co. sets itself apart by emphasizing ‘Relationships, by Design,’ putting a strong emphasis on providing great designs, superior quality, transparency, and outstanding customer service. It derives approximately 90% of its revenue from Gold jewelry, 3.7% from Silver jewelry/articles, 3.6% from Diamonds, and the remaining 2.7% from Platinum jewelry and other sources. The co. one of the earlier entrants in the organised jewellery retail market of Andhra Pradesh and continue to focus on regional expansion into the high growth untapped regions within the micro-markets of Andhra Pradesh & Telangana. It also focuses on further strengthening its rural focus and improving sales from existing showrooms along with leveraging its e-commerce platform. MVJL is offering the P/E of 12.03x compared to industry average of 68.69x. The co. provides a chance to be a part of a strong regional jewelry brand with a hyperlocal retail focus. It has early mover advantages in Andhra Pradesh, diverse product offerings, steady revenue growth, and attractive IPO pricing. However, it has risks of substantial working capital needs, regional concentration, and ongoing legal proceedings. Hence, we recommend only aggressive investors to apply to the offering.

Manoj Vaibhav Gems ‘N’ Jewellers IPO FAQ

Ans. Manoj Vaibhav Gems ‘N’ Jewellers IPO is a main-board IPO of 12,567,442 equity shares of the face value of ₹10 aggregating up to ₹270.20 Crores. The issue is priced at ₹204 to ₹215 per share. The minimum order quantity is 69 Shares.

The IPO opens on September 22, 2023, and closes on September 26, 2023.

Bigshare Services Pvt Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Manoj Vaibhav Gems ‘N’ Jewellers IPO opens on September 22, 2023 and closes on September 26, 2023.

Ans. Manoj Vaibhav Gems ‘N’ Jewellers IPO lot size is 69 Shares, and the minimum amount required is ₹14,835.

Ans. The Manoj Vaibhav Gems ‘N’ Jewellers IPO listing date is not yet announced. The tentative date of Manoj Vaibhav Gems ‘N’ Jewellers IPO listing is Friday, October 6, 2023.

Ans. The minimum lot size for this upcoming IPO is 69 shares.