Mahindra Manulife Small Cap Fund (NFO) Company Profile:

Mahindra Manulife Mutual Fund is a joint venture of Mahindra & Mahindra Financial Services Limited and Manulife Investment Management (Singapore) Pte. Ltd. this venture brings together Mahindra’s domestic market strength and track record of successfully building businesses focused on meeting customer needs and Manulife’s global wealth and asset management capabilities and abundance of experience in servicing the needs of Asian consumers across developed and developing markets. The company aims to offer a wide variety of investment solutions pan-India, with a focus on semi-urban areas.

Mahindra Manulife Mutual Fund is coming up with Mahindra Manulife Small Cap Fund, an NFO scheme with an investment objective to generate long-term capital appreciation by investing in a diversified portfolio of equity & equity related securities of small-cap companies, however, there can be no assurance that the investment objective of the scheme will be achieved. The scheme opens on the 21st of November, 2022, and closes on the 5th of December, 2022. The scheme reopens for continuous sale and purchase from the 14th of December, 2022.

Mahindra Manulife Small Cap Fund (NFO) details:

| Mutual Fund: | Mahindra Manulife Mutual Fund |

| Scheme Name: | Mahindra Manulife Small Cap Fund |

| Objective of Scheme: | The investment objective of the Scheme is to generate long-term capital appreciation by investing in a diversified portfolio of equity & equity-related securities of small-cap companies, However, there can be no assurance that the investment objective of the Scheme will be achieved. |

| New Fund Launch Date: | 21st November 2022 |

| New Fund Offer Closure Date: | 5th December 2022 |

| Fund Managers: | Mr. Abhinav Khandelwal and Mr. Manish |

| Minimum Application Amount (Lump sum): | Rs 1,000 and in multiples of Rs. 1/- thereafter |

| Minimum Amount for Switch-in: | Rs. 1,000/- and in multiples of Rs. 0.01/- thereafter. |

| Minimum Application Amount (SIP) for weekly and monthly frequencies: | 6 installments of Rs. 500 /- each and in multiples of Rs.1/-thereafter |

| Minimum Application Amount (SIP) for quarterly frequency | 4 installments of Rs. 1,500/- each and in multiples of Rs.1/- thereafter |

| Exit Load: | · An Exit Load of 0.5% is payable if Units are redeemed /switched out up to 3 months from the date of allotment;

· Nil if Units are redeemed/switched out after 3 months from the date of allotment. |

| Plans: | Regular & Direct |

| Options: | Growth; IDCW (Income Distribution cum Capital Withdrawal) |

| IDCW Sub-options: | IDCW Reinvestment & IDCW Payout |

Asset Allocation:

| Instrument | Indicative Allocation ( % of assets) | Risk Profile | |

| Minimum | Maximum | High/Moderate/Low | |

| Equity & Equity related instruments of Small Cap Companies* | 65 | 100 | Very High |

| Equity & Equity related instruments of other than Small Cap Companies | 0 | 35 | Very High |

| Debt and Money Market Securities (including TREPS (Tri-Party Repo), Reverse Repo) | 0 | 35 | Low to Moderate |

| Units issued by REITs & InvITs | 0 | 10 | Moderately High |

*Definition of Small Cap Companies: 251st company onwards in terms of full Market Capitalization.

Mahindra Manulife Small Cap Fund (NFO) Conclusion:

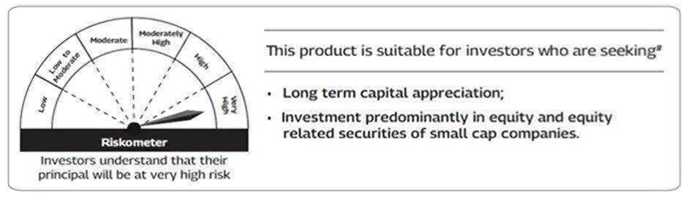

Small-cap companies have the potential to create wealth and generate alpha over the long term. Small caps are generally under-researched and under-owned and hence provide an opportunity for stock-picking at reasonable valuations. Small caps also provide exposure to companies that are potential market leaders in the industries they operate in for example textile, paper, sugar, and luggage, and have the potential to become midcaps tomorrow as they achieve scale. However, small-cap stocks are highly volatile and susceptible to market risk. Therefore, this product is suitable for investors who are seeking long-term capital appreciation and are seeking Investment predominantly in equity and equity-related securities of small-cap companies. Investors should consult with financial advisers at Elite Wealth if in doubt about whether the product is suitable for them.