Electronics Mart India Ltd. IPO Company Profile :

Electronic Mart India Ltd. is the 4th largest and one of the fastest growing consumer durables and electronics retailers in India and as of Financial Year 2021, they are the largest regional organized player in the southern region in revenue terms with dominance in the states of Telangana and Andhra Pradesh. They have been one of the fastest growing consumer durable & electronics retailers in India with a revenue CAGR of 17.90% from FY 2016 to FY 2021. The company offers a diversified range of products with focus on large appliances (air conditioners, televisions, washing machines and refrigerators), mobiles and small appliances, IT and others. It offers more than 70 consumer durable and electronic brands through retail, wholesale and e-commerce channel.

| IPO-Note | Electronics Mart India Ltd. |

| Rs.56 – Rs.59 per Equity share | Recommendation: Subscribe |

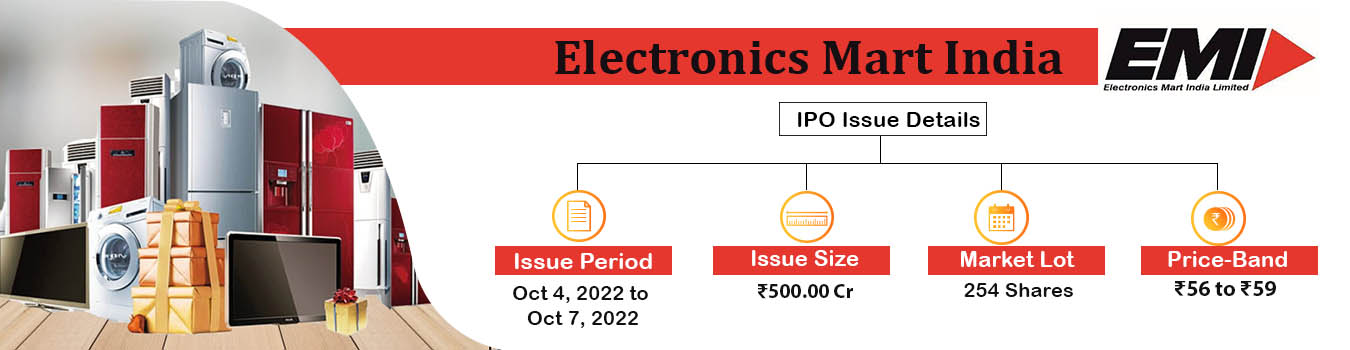

Electronics Mart India Ltd. IPO Details-

| Issue Details | |

| Objects of the issue | ·Funding of capital expenditure for expansion and opening of stores and warehouses.

·Repayment/prepayment of the borrowings. ·Working capital requirements |

| Issue Size | Issue Size – Rs. 500 Crore

Offer for Sale – Nill Fresh Issue – Rs. 500 Crore |

| Face value | Rs. 10 Per Equity Share |

| Issue Price | Rs. 56 – Rs. 59 |

| Bid Lot | 254 shares |

| Listing at | BSE, NSE |

| Issue Opens: | 4th October 2022 – 7th October 2022 |

| QIB | 50% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

| NII | 15% of Net Issue Offer |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Electronics Mart India Ltd. IPO Strengths:

- Long-standing relationship with leading consumer brands enables to procure products at competitive rates.

- Diversified product offering & deep knowledge and understanding of regional markets.

- Increasing market presence and geographic reach with cluster-based expansion with total 112 stores.

- Experienced management team with a proven track record of more than 40 years’.

Electronics Mart India Ltd. IPO Financial Performance:

Check Electronics Mart India Ltd. IPO Allotment Status

Go Electronics Mart India Ltd. IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Electronics Mart India Ltd. IPO Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoters Group | 99.99% | 77.97% |

| Public | 0.004% | 22.03% |

Source: RHP, EWL Research

Electronics Mart India Ltd. IPO Key Highlights:

-

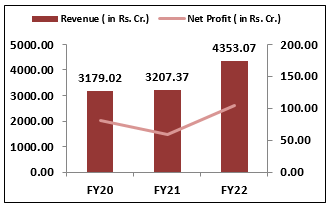

Revenue of the company increased from Rs 3,179 crore in FY 2020 to Rs 4,353 crore in FY 2022 with a CAGR of 11%.

-

Net profit of the company increased from Rs 82 crore in FY 2020 to Rs 104 crore in FY 2022 with a CAGR of 8.4%.

-

Operating profit margin of the company stood at 6.7% for the FY 2022, which is the second highest among its peers.

-

Total Debt of the company stood at Rs. 1,228 crore and Return on Equity is at 17.4% for FY 2022.

Electronics Mart India Ltd. IPO Risk Factors:

-

EMIL generate approx. 90% of retail sales from the stores in Telangana, AP and NCR so any adverse developments affecting operations in these states could have an adverse impact on the revenue and results of operations.

-

Around 60% revenue is dependent on the top five brands. The loss of any of the major brands can adversely affect the financials of the company.

-

Increasing competition from online retailers is a major threat for the company.

Electronics Mart India Ltd. IPO Outlook:

EMIL is one of the fastest growing consumer durable & electronics retailers in India and have consistently demonstrated profitability with a robust operating performance. The business model of the co. is a mix of ownership and lease rental model. The retail, wholesale, and e-commerce channel of the company contributed 91%, 1.48% and 0.92% respectively in the FY 2022. Large appliances, mobiles and small appliances & IT contribute to 55%, 35% and 10% respectively in the total sales of FY 2022. The consumer durables industry in which the company operates is expected to grow at 10-12% CAGR between fiscals 2022 to 2027. The financials of the co. looks good and on the upper band of the IPO it is offering the PE of 22 times compared to 32 times of Aditya Vision Ltd., the only listed peer of the company. So we recommend the investors to subscribe to the offering.

GO DIGIT General Insurance Limited IPO FAQ

Ans. Electronics Mart India Ltd. IPO will comprise fresh share issue and new offer share issue. The company aims to go public to accelerate its growth and expansion plan.

Ans. The company will open for subscription on 4th October 2022.

Ans. The minimum lot size that investors can subscribe to is 254 shares.

Ans. The Electronics Mart India Ltd. IPO listing date is 17 oct 2022.

Ans. The minimum lot size for this upcoming IPO is 254 shares.