| IPO-Note | Aditya Birla Sun life AMC Limited |

| Rs 695- Rs 712 per Equity share | Recommendation: Subscribe |

Company Profile: –

Aditya Birla sun life AMC is a joint venture between Aditya Birla Capital Limited (ABCL) and Sun Life AMC. Aditya Birla Sun Life AMC Ltd, is the fourth largest asset management company in India in terms of assets under management (AUM) and the largest non-bank mutual fund. It has total assets under management of Rs.275,454 crore as of the end of June quarter. More than 50% of its AUM comes from institutional customers, which is one of the reasons why the AMC is very strong in terms of non-equity AUM. It has achieved this leadership position through its focus on consistent investment performance, extensive distribution network, brand, experienced management team, and superior customer service. Aditya Birla Sun Life AMC posted a CAGR of 23.58% between March 2016 and March2020 in its equity AUM, which is the third highest among the top five AMCs and the fifth highest among the top 10 AMCs.

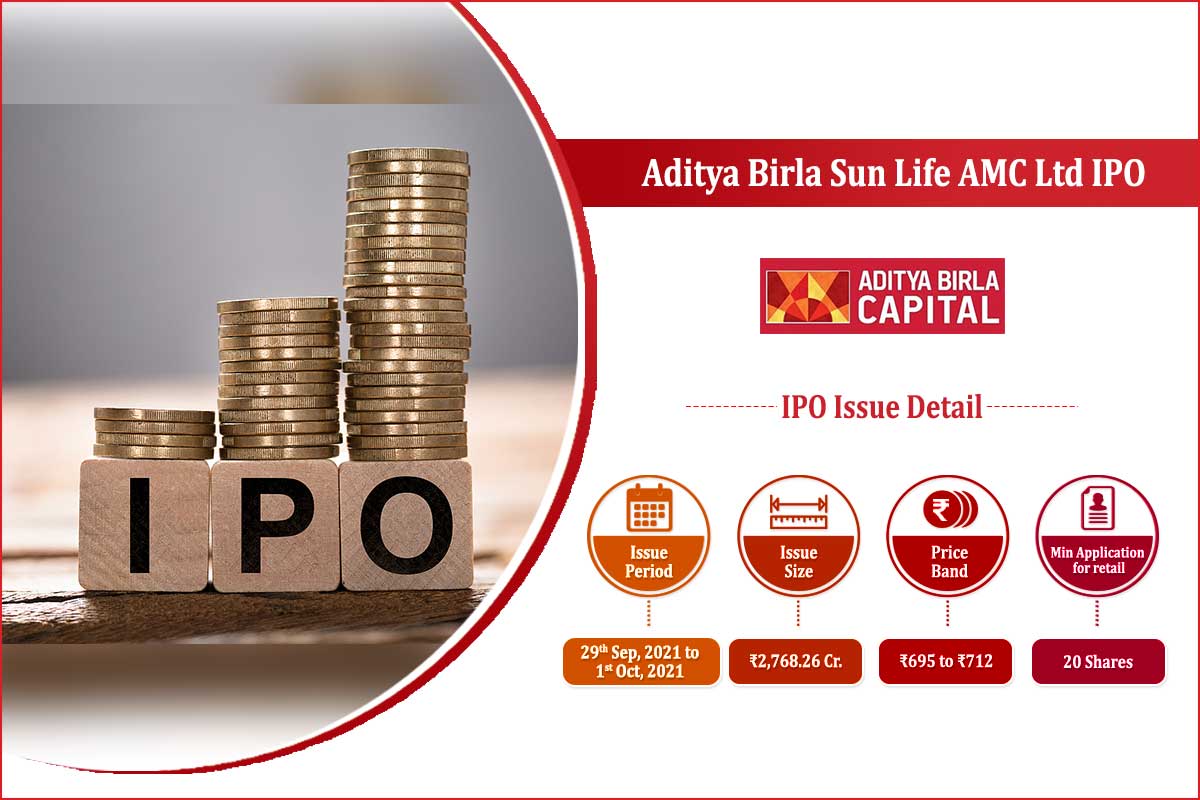

| Issue Details | |

| Objects of the issue | ·To achieve benefit of listing the Equity share on the stock Exchange

· The company expect that listing will enhance its visibility and brand image of the company. |

| Issue Size | Total issue Size – Rs.2768.26 Cr.

Offer for Sale – Rs.2768.26 Cr. |

| Face value | Rs.5.00 Per Equity Share |

| Issue Price | Rs. 695 – Rs. 712 |

| Bid Lot | 20 shares |

| Listing at | BSE, NSE |

| Issue Opens: | 29nd Sep, 2021 – 1st Oct, 2021 |

| QIB | 50% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

Check Aditya Birla Sun life AMC Limited IPO Allotment Status

Aditya Birla Sun life AMC Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

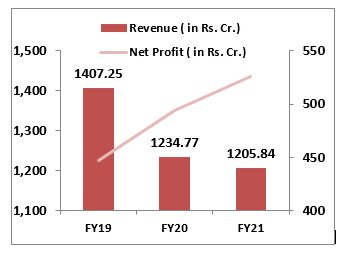

Financial Performance:

Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoter Group | 100% | 86.50% |

| Public | – | 13.5% |

Source: RHP, EWL Research

Strengths:

- Good mix of retail and institutional clients as well as equity and debt scheme.

- SIPs is material portion of ABSLAMC’s AUM and account 41.70% of the total equity oriented mutual fund AUM which is sticky portfolio as individual don’t stop SIP regularly.

- The Company has a geographically diversified pan-India distribution presence that is not only extensive but multi-channeled, with a significant physical as well as digital presence.

- Present in the industry with growth tailwind in the long term.

Key Highlights:

- Revenue from operations saw a growth at a CAGR of -7.4% from FY18-21 and profit growth at a CAGR of 8.5% from FY 18-21.

- PAT Margin improved from 31.7% in FY20 to 43.6% in FY21

- As on June 2021 debt portion of the AUM constituent 41.2%, equity portion is 38.1% and money market form 20.4% of monthly Average AUM

- As on March 2020 cash flow from operating Activity was ₹497 crores.

- The total cost to income ratio dropped to 49.32% in the F.Y 20 from 56.64% in the F.Y 2019.

- ROE of the company improved from 36.70% to 37.24% in 2020.

- In 1st quarter revenue improved to 332cr and profit improved to ₹ 155 cr.

Risk Factors:

- The increase in popularity of low margin product like ETFs and index fund can reduce profitability of the company.

- Regularity cap on fees can impact profitability of the company.

- Company is regularly losing market share to big players.

Outlook:

Aditya Birla AMC is one of the leading fund houses in India with a pan India presence offers a wide range of product across equity, debt, and balanced as well as structured asset classes. ABSL AMC provide other service like PMS, real estate Investment and AIF.AMC industry has seen robust growth, especially in recent years, driven by a growing investor base due to increasing penetration across geographies, strong growth of capital markets, technological progress, and regulations to make mutual fund products more transparent and investor-friendly. If we annualized FY22 earning on the post issue paid up equity capital it will be trading at a P/E of 33.09 which is below HDFC and Nippon AMC valuation. Considering the long term growth prospect, lower mutual fund penetration in India and strong promoter backing we recommend SUBSCRIBE for long term.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL

Need An Assistance: