PGIM India Multi Asset Allocation Fund NFO Investment Objective:

The investment objective of the Scheme is to seek to generate long term capital appreciation by investing in multiple asset classes including equity and equity related securities, debt and money market instruments, Gold ETFs & Silver ETFs. However, there is no assurance that the investment objective of the scheme will be achieved. The Scheme does not guarantee/ indicate any returns.

PGIM India Multi Asset Allocation Fund NFO Fund Type:

An open-ended scheme investing in Equity and Equity related instruments, Debt & Money Market instruments, Gold ETFs & Silver ETFs

(source: pgimindia.com)

PGIM India Multi Asset Allocation Fund NFO Investment Strategy:

The scheme will be actively managed. The allocation between various asset classes within the defined range will follow a dynamic asset allocation approach, investing predominantly across asset classes such as equity, debt, gold ETFs and silver ETFs. The scheme’s portfolio construct will depend on market conditions, global events, broad macroeconomic landscape, etc. The equity exposure will be managed dynamically and increased as and when factors are favourable towards the asset class.

Equity: The scheme will follow a bottom up approach to identify individual stocks. The intention is to run a market cap agnostic portfolio with a focus on high quality and high growth companies, i.e. companies with strong fundamentals, good management and having the potential to deliver sustainable growth over a period of time.

Diversification: The scheme aims to maintain a diversified portfolio across multiple sectors and asset classes to reduce concentration risk. It may also refer to proprietary/in-house models that are based on various broad market parameters, including but not limited to: Nifty 500 Price to Earnings Ratio, Gold Silver Ratio, etc. These models may be used by the fund manager as deemed appropriate. The fund manager will look to rebalance the portfolio at regular intervals.

The allocation to each asset class will be guided by a comprehensive asset allocation framework that considers market valuations and macroeconomic factors among other indicators.

About PGIM India Multi Asset Allocation Fund:

Diversifying across multiple asset classes tends to reduce portfolio risk and offer risk-adjusted returns over long run. By investing across a range of asset classes, investors minimize their risk of underperformance from one asset class. For instance, when equity markets are experiencing headwinds due to macroeconomic uncertainties, gold may do well. Conversely, silver prices may shine during an economic boom. Exposure to debt and derivatives provides a cushion to your portfolio when equity market is bearish. PGIM India Multi Asset Allocation Fund provides a blend of exposure to these asset classes under one fund with efficient tax structure of equity.

(source: pgimindia.com)

PGIM India Multi Asset Allocation Fund NFO:

| Mutual Fund | PGIM India Mutual Fund |

| Scheme Name | PGIM India Multi Asset Allocation Fund |

| Objective of Scheme | The investment objective of the Scheme is to seek to generate long term capital appreciation by investing in multiple asset classes including equity and equity related securities, debt and money market instruments, Gold ETFs & Silver ETFs. However, there is no assurance that the investment objective of the scheme will be achieved. The Scheme does not guarantee/ indicate any returns. |

| Scheme Type | Open Ended |

| Scheme Category | Hybrid Scheme – Multi Asset Allocation |

| New Fund Launch Date | 10 Nov 2025 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 25 Nov 2025 |

| Indicate Load Separately | • For Exits within 90 days from date of allotment of units: 0.50%. • For Exits beyond 90 days from date of allotment of units: NIL |

| Minimum Subscription Amount | Initial Min of Rs. 5,000 and in multiples of Rs.1 |

| For Further Details Please Visit Website | https://www.pgimindiamf.com |

(source: https://www.amfiindia.com/)

(source: pgimindia.com)

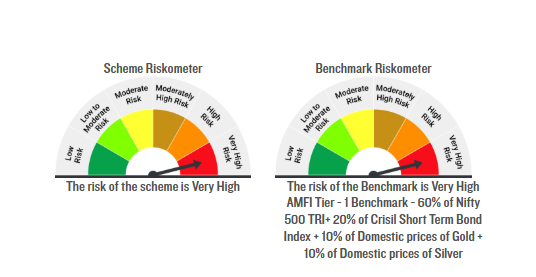

PGIM India Multi Asset Allocation Fund NFO Riskometer:

(source: pgimindia.com)