LIC MF Consumption Fund – Introduction:

Focused on Consumption Led Growth

Focuses on sector poised to benefit from rising consumer demand.

Fund Strategy

Focuses on premiumisation and discretionary consumption.

Blended Investment Approach

Combines top-down macro trends with bottom-up stock selection to identify emerging trends in consumption

Market Cap Agnostic

Invests across large, mid, and small-cap companies for broader exposure

Thematic Yet Diversified

Invests across multiple sectors within the consumption theme to balance risk and opportunity.

(source: licmf.com)

LIC MF Consumption Fund Investment Objective:

- The investment objective of the Scheme is to achieve long term capital appreciation by predominantly investing in equity and equity related instruments of companies following consumption theme.

- There is no assurance that the investment objective of the Scheme will be achieved.

(source: licmf.com)

LIC MF Consumption Fund Investment Strategy – U.P.L.I.F.T.

India’s consumption story is accelerating, driven by rising incomes, lifestyle upgrades, and a shift to organized sectors. LIC MF Consumption Fund seeks to harness these structural trends through a focused strategy built on six key growth drivers.

Urbanization

- Focus on sectors enhancing quality of life: Conveyance, Travel, Education, Healthcare, Insurance, etc.

Income Growth

- Rising disposable income shifts consumption from needs to wants

- Increased spending on discretionary and experiential categories

Premiumization

- Driven by rising aspirations and affluence

- Premium categories (e.g., Hospitality, Travel and Tourism, and Consumer Durables) expected to grow faster than mass-market segments

Formalization & Consolidation

- Shift from unorganized to organized markets

- Transition from unbranded to branded consumption

Lifestyle Upgrades

- Demand for luxury homes, premium cars, high-end gadgets (e.g., Premium phones, watches)

Technology & Digitization

- Surge in online shopping, quick commerce (QCOM), online gaming, and fintech adoption

- Digital platforms reshaping consumer behavior

(source: licmf.com)

LIC MF Consumption Fund NFO:

| Mutual Fund | LIC Mutual Fund |

| Scheme Name | LIC MF Consumption Fund |

| Objective of Scheme | The investment objective of the Scheme is to achieve long term capital appreciation by predominantly investing in equity and equity related instruments of companies following consumption theme. There is no assurance that the investment objective of the Scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Sectoral/ Thematic |

| New Fund Launch Date | 31 Oct 2025 |

| New Fund Earliest Closure Date | 14 Nov 2025 |

| New Fund Offer Closure Date | 14 Nov 2025 |

| Indicate Load Separately | Exit Load: 1. If units of the Scheme are redeemed / switched-out within 90 days from the date of allotment: a. Upto 12% of the units: No exit load will be levied b. Above 12% of the units: exit load of 1% will be levied 2. If units of the Scheme are redeemed / switched-out after 90 days from the date of allotment: No exit load will be levied. |

| Minimum Subscription Amount | Application/SwitchIn Rs.5000 & multiples of Re.1 |

| For Further Details Please Visit Website | https://www.licmf.com |

(source: https://www.amfiindia.com/)

Scheme Documents

(source: licmf.com)

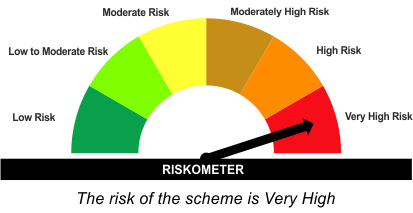

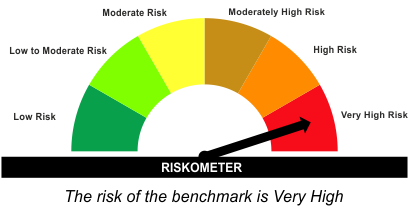

LIC MF Consumption Fund NFO Riskometer:

(source: licmf.com)