Sundaram Multi-Factor Fund brings together four proven factors – value, quality, momentum, growth, and size as on overlay into one well-diversified strategy.

This approach reduces reliance on any one factor and helps mitigate the risk of underperformance in specific market conditions.

Since different factors perform at different times in the market cycle, blending them supports more consistent and balanced performance over time.

Scheme Details

- Investment Objective

- The primary investment objective of the scheme is to achieve long-term capital appreciation for its investors. This objective will be pursued by strategically investing in a diversified portfolio of equity and equity-related instruments of multinational companies (MNCs). There is no assurance that the investment objective of the Scheme will be achieved.

- Asset Allocation

Instruments Indicative Asset Allocation

(% of total assets)Minimum Maximum Equity and Equity related Instruments of Multinational Companies (MNCs) 80% 100% Equity and Equity related instruments of companies other than those engaged in the multinational companies’ space 0% 20% Debt & Money Market Instruments 0% 20% - Type of Scheme

- An open-ended equity scheme following multinational company (MNC) theme

(source: sundarammutual.com)

Sundaram Multi-Factor Fund NFO Details:

| Mutual Fund | Sundaram Mutual Fund |

| Scheme Name | Sundaram Multi-Factor Fund |

| Objective of Scheme | The Investment Objective of the Scheme is to provide long-term capital growth to its Unitholders by following a multi factor based investment strategy. No Guarantee: There is no guarantee or assurance that the investment objective of the scheme will be achieved. Investors are neither being offered any guaranteed / indicated returns nor any guarantee on repayment of capital by the Schemes. There is also no guarantee of capital or return either by the mutual fund/sponsor/AMC/Trustee |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Sectoral/ Thematic |

| New Fund Launch Date | 02-Jul-2025 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 16-Jul-2025 |

| Indicate Load Seperately | Exit Load: 1% of the applicable NAV – Any redemptions, switch or withdrawals by way of SWP would be subject to an exit load within 365 days from the date of allotment. NIL – if the units are redeemed after 365 days from the date of allotment of units. Further, exit load will be waived on Intra-scheme Switch-outs/STP. Generally, the exit load will be calculated on First in First out (FIFO) basis. |

| Minimum Subscription Amount | 100 |

| For Further Details Please Visit Website | https://www.sundarammutual.com |

(source: https://www.amfiindia.com/)

Scheme Documents

(source: sundarammutual.com)

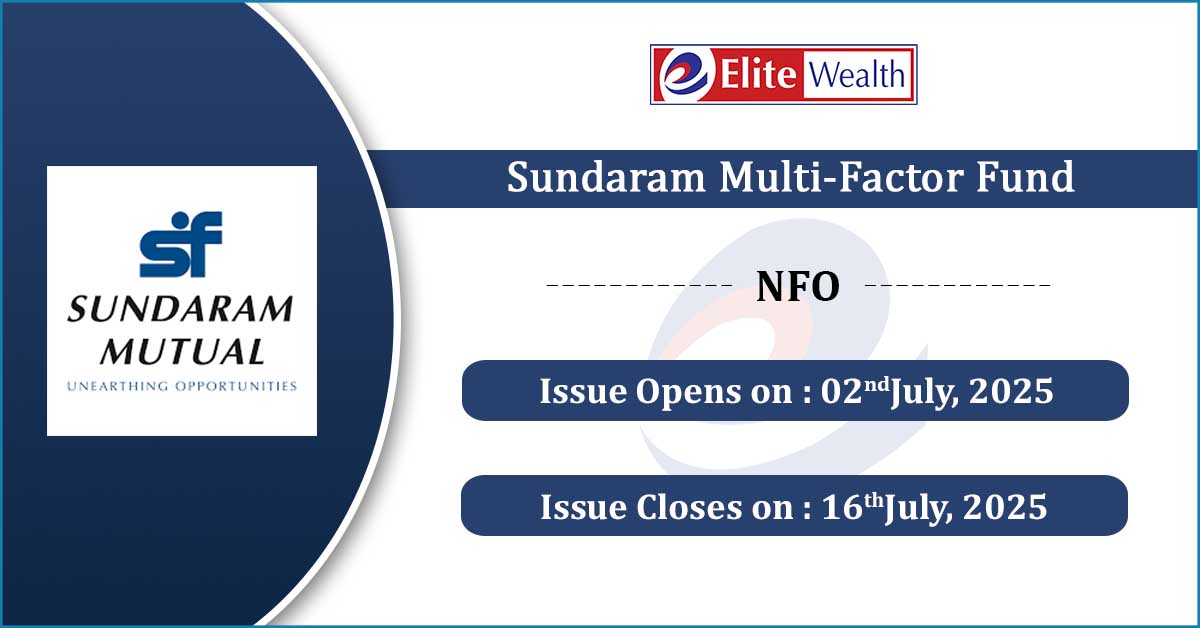

Sundaram Multi-Factor Fund NFO Riskometer:

(source: sundarammutual.com)