ICICI Prudential Quality Fund

India’s growth story is powered by a wide universe of companies- but only a select few demonstrate sound fundamentals. These quality businesses are characterized by robust balance sheets, consistent earnings and prudent management. In a volatile market, such companies may offer greater resilience and the potential for long-term growth- Introducing ICICI Prudential Quality Fund, an investment option for you because you deserve nothing less.

How does this scheme work?

- Invests in equity and equity related instruments following quality factor as a theme

- Diversified across large, mid and small-caps across multiple sectors

- Follows a combination of top-down and bottom-up investment approaches

Why invest in this scheme?

- Aims for long-term wealth creation by investing in quality businesses

- Follows a “quality at reasonable price” approach to balance growth and valuation

- Positioned to navigate current macro uncertainty and market volatility

(source:https://www.icicipruamc.com/)

ICICI Prudential Quality Fund NFO Details:

| Mutual Fund | ICICI Prudential Mutual Fund |

| Scheme Name | ICICI Prudential Quality Fund |

| Objective of Scheme | To generate long-term capital appreciation by investing in Equity & Equity related instruments of companies identified based on the Quality Factor. However, there can be no assurance or guarantee that the investment objective of the Scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Sectoral/ Thematic |

| New Fund Launch Date | 06-May-2025 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 20-May-2025 |

| Indicate Load Seperately | The Scheme shall not charge any entry load. Exit Load: (i) 1% of applicable Net Asset Value – If the amount sought to be redeemed or switch out within 12 months from allotment. (ii)NIL – If the amount sought to be redeemed or switched out more than 12 months. The Trustees shall have a right to prescribe or modify the exit load structure with prospective effect subject to a maximum prescribed under the Regulations. |

| Minimum Subscription Amount | 5000 |

| For Further Details Please Visit Website | https://www.icicipruamc.com |

(source: https://www.amfiindia.com/)

Scheme Documents

(source: https://www.icicipruamc.com/)

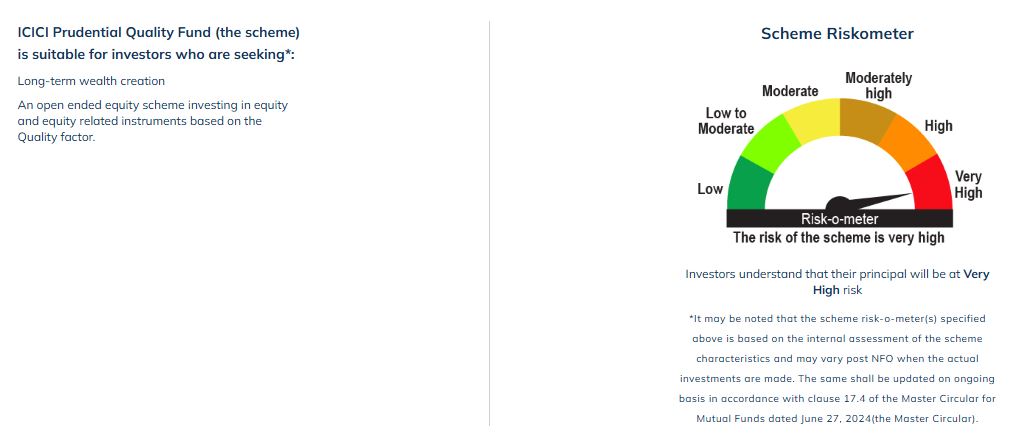

ICICI Prudential Quality Fund NFO Riskometer;