Why Nifty 500?

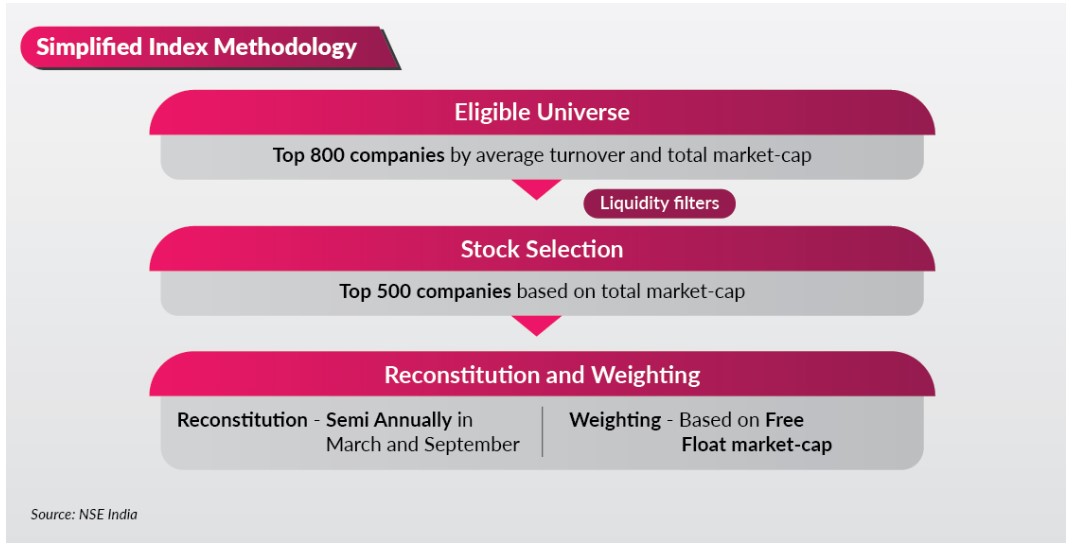

Investing in the Nifty 500 Index Fund allows you to be part of this dynamic growth story. The Nifty 500 Index is the most inclusive benchmark in the Indian market, covering nearly 90% of the nation’s listed companies. By investing in the Nifty 500, you’re not just diversifying your portfolio; you’re embracing the full spectrum of Bharat’s economic landscape.

(Source: NSE India, axismf.com)

About Axis Nifty 500 Index Fund:

The Axis Nifty 500 Index Fund aims to provide returns that closely correspond to the total returns of the Nifty 500 TR Index, subject to tracking errors. This fund seeks to offer investors exposure to a diversified portfolio representing 94% of the market capitalization of the Indian equity market, covering 21 sectors.

Source: NSE India

Benchmark: Nifty 500 TRI

Investing in Axis Nifty 500 Index Fund means aligning with some of India’s largest and most successful companies and sectors

(Source: NSE India, axismf.com)

Axis Nifty 500 Index Fund NFO Details:

| Mutual Fund | Axis Mutual Fund |

| Scheme Name | Axis Nifty 500 Index Fund |

| Objective of Scheme | To provide returns before expenses that closely correspond to the total returns of the Nifty 500 TRI, subject to tracking errors. There is no assurance that the investment objective of the Scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Other Scheme – Index Funds |

| New Fund Launch Date | 26-Jun-2024 |

| New Fund Earliest Closure Date | 09-Jul-2024 |

| New Fund Offer Closure Date | 09-Jul-2024 |

| Indicate Load Seperately | Entry Load: Not Applicable Exit Load: if redeemed/ switched out within 15 days from the date of allotment: 0.25% |

| Minimum Subscription Amount | Rs. 100 and in multiples of Re. 1/- thereafter |

(source:amfiindia)

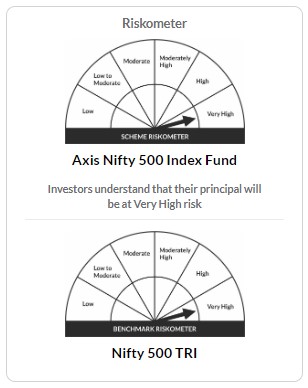

Axis Nifty 500 Index Fund NFO Risk-o-meter:

Axis Nifty 500 Index FundAn Open-Ended Index Fund tracking Nifty 500 TRI

- Long term wealth creation solution.

- An index fund that seeks to track returns by investing in a basket of Nifty 500 TRI stocks and aims to achieve returns of the stated index, subject to tracking error.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or model portfolio and the same may vary post NFO when actual investments are made

(Source: axismf.com)