Uniparts India Limited IPO Company Profile :

Uniparts India Limited (UIL) is an Indian-based global manufacturer of engineered systems and solutions and a leading supplier of systems and components for the off-highway market in the agriculture and construction, forestry and mining (“CFM”) and aftermarket sectors. The product portfolio of the company comprises core product verticals of 3-point linkage systems (“3PL”) and precision machined parts (“PMP”) as well as adjacent product verticals of power take off (“PTO”), fabrications and hydraulic cylinders or components. The business model of the company includes international sales, local deliveries, direct exports and wholesale sales. It operates through its six manufacturing facilities and four warehousing locations across the US, India, and Europe with its products reaching to over 125 customers in 25 countries.

| IPO-Note | Uniparts India Limited |

| Rs. 548 – Rs. 577 per Equity share | Recommendation: Subscribe |

Uniparts India Limited IPO Business Areas:

-

Agriculture: Uniparts Group is a manufacturer of 3-Point Linkage Systems for agricultural machinery globally. Product Portfolio offered to the Agriculture segment includes 3-Point Linkage System, Assemblies, Precision Machined Parts (PMP), Power take-off (PTO) components, Forginings as well as Hydraulic Cylinder

-

Construction & Forestry: Uniparts Group is a supplier of precision machined parts (PMP) and Hydraulic Cylinder Solutions to the mobile equipment market and in particular to the construction market.

-

After Market: Products range from 3-point linkage parts and machined forgings and fabrications are used for various agricultural applications.

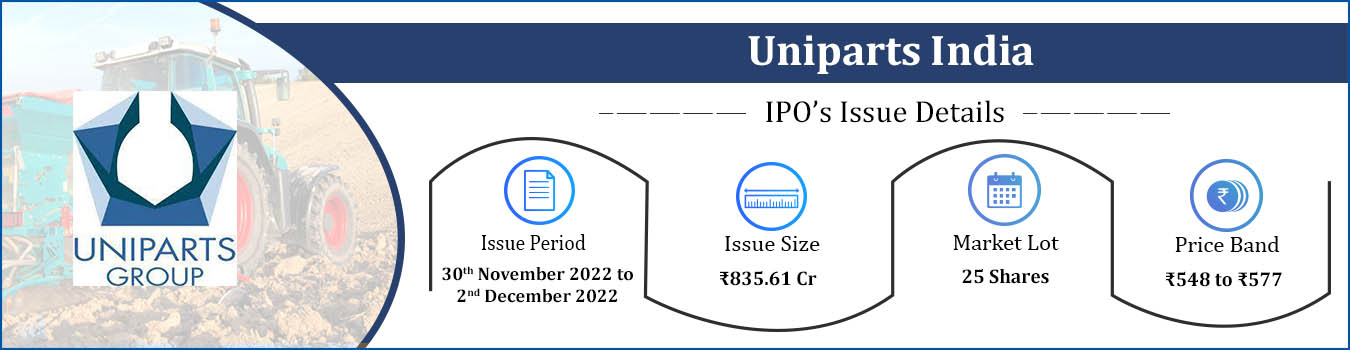

Uniparts India Limited IPO Details:

| Issue Details | |

| Objects of the issue | · To gain listing benefits |

| Issue Size | Total issue Size -Rs. 835.61 Cr.

Offer for Sale – Rs. 835.61 Cr. |

| Face value | Rs. 10.00 Per Equity Share |

| Issue Price | Rs. 548 – Rs. 577 |

| Bid Lot | 25 Shares |

| Listing at | BSE, NSE |

| Issue Opens: | 30th Nov, 2022 – 02nd Dec, 2022 |

| QIB | 50% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Uniparts India Limited IPO Allotment Status

Go Uniparts India Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Uniparts India Limited IPO Financial Analysis:

| Particulars | 9M FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | FY-19(in cr.) |

| Revenue | 880.89 | 903.14 | 907.22 | 1060.56 |

| Cost of goods sold | 274.1 | 352.89 | 328.78 | 372.32 |

| Gross profit | 606.79 | 550.25 | 578.44 | 688.24 |

| Gross profit margin | 68.88 | 60.93 | 63.76 | 64.89 |

| Empl. Cost | 160.58 | 185.44 | 211.76 | 221.74 |

| Other exp | 248.14 | 245.42 | 270.48 | 328.56 |

| EBITDA | 198.07 | 119.39 | 96.20 | 137.94 |

| EBITDA M | 22.49 | 13.22 | 10.60 | 13.01 |

| Depreciation | 27.16 | 37.25 | 35.44 | 30.09 |

| Interest | 4.22 | 8.1 | 17.96 | 18.19 |

| PBT | 166.69 | 74.04 | 42.80 | 89.66 |

| Total tax | 47.61 | 26.17 | 11.76 | 21.95 |

| PAT | 119.08 | 47.87 | 31.04 | 67.71 |

| Dep./revenue% | 3.08 | 4.12 | 3.91 | 2.84 |

| Int./revenue% | 0.48 | 0.90 | 1.98 | 1.72 |

Uniparts India Limited IPO Segment Revenue and % Share:

| Products | 9M FY-22(in cr.) | %Share | FY-21(in cr.) | %Share | FY-20(in cr.) | %Share | FY-19(in cr.) | %Share |

| 3 Point Linkage | 490.49 | 59.22% | 506.65 | 58.66% | 427.9 | 48.90% | 503.2 | 49.46% |

| Precision Machined Parts | 320.17 | 38.66% | 339.7 | 39.33% | 432.3 | 49.41% | 496.69 | 48.82% |

| Power Take-off Applications | 9.03 | 1.09% | 8.21 | 0.95% | 6.44 | 0.74% | 9.46 | 0.93% |

| Fabrication | 8.09 | 0.98% | 8.4 | 0.97% | 7.71 | 0.88% | 6.93 | 0.68% |

| Hydraulic Cylinders | 0.45 | 0.05% | 0.78 | 0.09% | 0.66 | 0.08% | 1.21 | 0.12% |

| Total | 828.23 | 100.00% | 863.74 | 100.00% | 875.01 | 100.00% | 1017.49 | 100.00% |

Uniparts India Limited IPO Revenue from segments:

Unipart’s most of the income is generated from the sale of 3-point linkage and precision machined parts in which the major percentage of the shares is from America, Europe, Japan, and India.

Uniparts India Limited IPO Key Highlights:

- Revenue of UIL has increased from Rs. 907 Cr. in FY20 to Rs. 1227 Cr. in FY22 with a CAGR of 10.60%.

- Net Profit of the co. significantly grew from Rs. 63 Cr. to Rs. 167 Cr. during FY20-22 with a CAGR of 38.6%.

- ROE and ROCE of the company is at 26.80% and 31% at the end of FY22.

Uniparts India Limited IPO Strengths:

- UIL has an estimated 16.68% market share of the global 3PL market and an estimated 5.92% market share in the global PMP market in the CFM sector in Fiscal 2022 in terms of value.

- Its international presence enables it to diversify the margins and mitigate risk related to particular geography.

- Company has long-term relationships with number of global OEM (Original Equipment Manufacturer) players in the agriculture and CFM sectors.

- The financials of the company is attractive with experienced and qualified management team.

Uniparts India Limited IPO Risk Factors:

-

Company is exposed to foreign currency exchange rate fluctuations, which may harm the results of operations and cause their results to fluctuate.

-

Availability and cost of raw materials and labor may adversely affect the business, financial condition, results of operations, and prospects.

-

Company may face an adverse impact on the sales and earnings as a result of risks associated with international sales and multi-location operations.

-

Company’s quarterly results may fluctuate significantly due to seasonality which could have a negative effect on the price of our Equity Shares.

Uniparts India Limited IPO Outlook:

UIL is an engineered systems and solutions manufacturer providing comprehensive solutions and high-quality, critical products and components for Off Highway Vehicles (OHV) industry including complete assemblies of precision engineered products and end-to-end solutions like product conceptualization, design, prototyping, testing, development and assembly. The revenue of the company is diversified across geographies and it generates around 50% revenue from USA. The company is focusing on higher value addition products and enhanced service offerings to improve the margin profile and also targeting new customer accounts and expand existing customer accounts. The world market for 3PL is expected to grow at nearly 6%-8% in 2021-2026, supported by robust growth in tractor production volumes in North America, India and Europe, steady growth in China and Japan while the global production value for PMP for articulated joints is expected to grow at CAGR of 6% – 8% during 2021-2026. Growth in these industries will support the growth of UIL. The company is offering PE of 15.6 times on the upper price band as compared to industry average of 27.26 times. Hence, we recommend to subscribe to the offering.

Uniparts India Limited IPO FAQ

Ans. Uniparts India IPO is a main-board IPO of 14,481,942 equity shares of the face value of ₹10 aggregating up to ₹835.61 Crores. The issue is priced at ₹548 to ₹577 per share. The minimum order quantity is 25 Shares.

The IPO opens on Nov 30, 2022, and closes on Dec 2, 2022.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Uniparts India IPO opens on Nov 30, 2022 and closes on Dec 2, 2022.

Ans. The minimum lot size that investors can subscribe to is 25 shares.

Ans. The Uniparts India IPO listing date is not yet announced. The tentative date of Uniparts India IPO listing is Dec 12, 2022.

Ans. The minimum lot size for this upcoming IPO is 25 shares.