YATRA Online Limited IPO Company Profile :

YATRA Online Limited is India’s largest corporate travel services provider in terms of number of corporate clients and the third largest online travel company in India among key OTA players in terms of gross booking revenue and operating revenue, for Fiscal Year 2023. The company has largest number of hotel and accommodation tie-ups amongst key domestic OTA players of over 2,105,600 tie-ups, as on March 31, 2023. The company is the leading corporate travel service provider in India with 813 large corporate customers and over 49,800 registered SME customers and the third largest consumer online travel company (OTC) in the country in terms of gross booking revenue for Fiscal 2023. Leisure and business travelers use the company’s mobile applications, its website, www.yatra.com, and it’s other offerings and services to explore, research, compare prices and book a wide range of travel-related services. These services include domestic and international air ticketing on nearly all Indian and international airlines, as well as bus 338 ticketing, rail ticketing, cab bookings and ancillary services within India. The company also provides access through its platform to hotels, homestays and other accommodations, with about 105,600 hotels in 1,490 cities and towns in India, as on Fiscal 2023 and more than two million hotels globally, which is the highest hotel inventory amongst key Indian OTA players.

| IPO-Note | YATRA Online Limited |

| Rs.135 – Rs.142 per Equity share | Recommendation: Avoid |

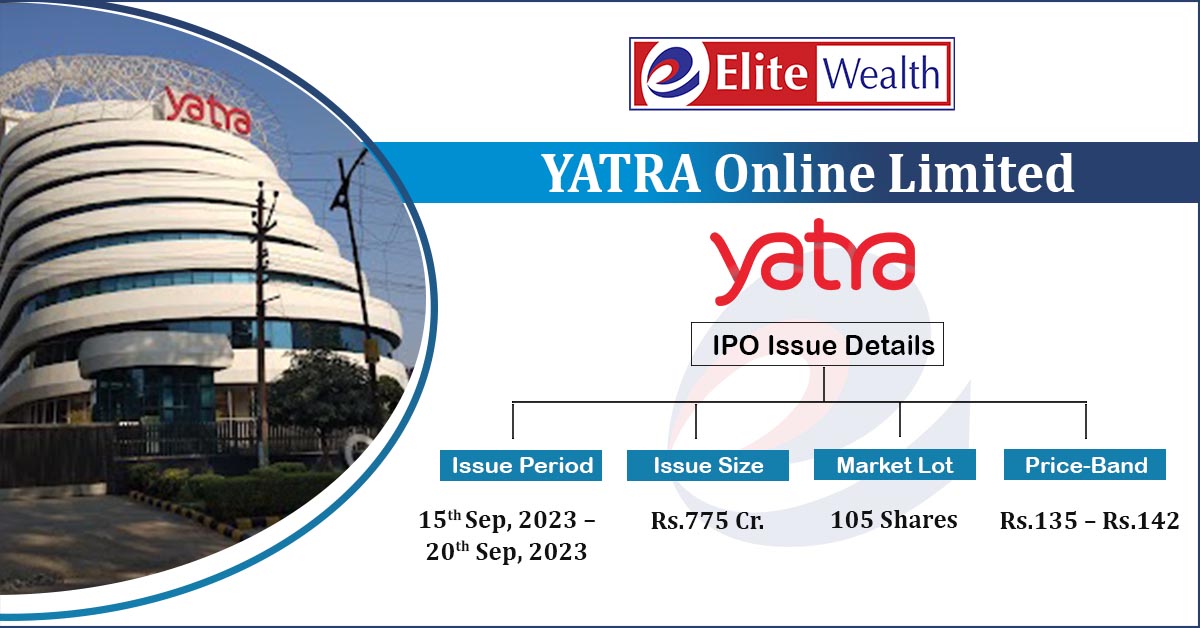

YATRA Online Limited IPO Details:

| Issue Details | |

| Objects of the issue | · Strategic investments, acquisitions, and inorganic growth, technology, and other organic growth initiatives

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.775 Cr.

Fresh Issue – Rs.602 Cr. Offer for Sale – Rs.173 Cr. |

| Face value | Rs.1 |

| Issue Price | Rs.135 – Rs.142 |

| Bid Lot | 105 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 15th Sep, 2023 – 20th Sep, 2023 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

YATRA Online Limited IPO Products and Services:

- Airline Tickets:

The airline ticketing business is primarily targeted to domestic air passengers and international travel from India. The company can access the real-time inventory via GDS service providers such as Amadeus and Galileo or through a “direct connect” to the airlines. The company has relationships with all major airlines operating in India, domestic and international such as Air Asia, Air India, Air India Express, Go First, IndiGo, SpiceJet, Vistara, and international airlines such as Air France-KLM, British Airways, Emirates, Etihad Airways, Lufthansa, Malaysia Airlines, Singapore Airlines, Thai Airways, and Qatar Airways, etc. The company charges its customers a service fee for booking airline tickets and receives fees from its GDS service providers based on the volume of sales completed by it through GDS.

- Hotels and Holiday Packages:

With approximately 93,500 hotels and homestays contracted in approximately 1,400 cities across India, YATRA Online Limited is India’s largest platform for domestic hotels. In the fiscal year 2021, more than 500,000 standalone hotel room nights were booked through the platforms, while more than 350,000 room nights have been booked from April to September 2021. Holiday package offerings consist of both fixed departure and customized holiday packages where most elements of their travel, including flights, hotels, sightseeing, transport, visa, and insurance, are all taken care of. Revenue from the Hotels and Packages business includes commissions and markups that the company earns for the sale of stand-alone hotel rooms and packages.

- Other Travel Products and Services:

Other Travel Products and Services include rail ticketing, bus ticketing, cab booking, and yatra freight.

YATRA Online Limited IPO Financial Analysis:

| Particulars | 6M FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | FY-19(in cr.) | CAGR |

| Revenue | 74.75 | 125.45 | 673.33 | 844.72 | -47.0% |

| Operating cost | 7.64 | 9.96 | 262.52 | 592.38 | |

| Empl. Cost | 49.06 | 73.63 | 165.77 | 247.37 | |

| Other exp | 28.96 | 64.28 | 198.33 | 330.17 | |

| EBITDA | -10.91 | -22.42 | 46.71 | -325.20 | -59.0% |

| EBITDA margin% | -14.60% | -17.87% | 6.94% | -38.50% | |

| Depreciation | 14.77 | 51.3 | 62.26 | 61.68 | |

| Interest | 4.79 | 10.24 | 18.07 | 16.24 | |

| PBT | -30.47 | -83.96 | -33.62 | -403.12 | -40.7% |

| Total tax | 0.31 | 6.63 | 3.95 | 5.33 | |

| PAT | -30.78 | -90.59 | -37.57 | -408.45 | -39.5% |

| Dep./revenue% | 19.76% | 40.89% | 9.25% | 7.30% | |

| Int./revenue% | 6.41% | 8.16% | 2.68% | 1.92% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check YATRA Online Limited IPO Allotment Status

Go YATRA Online Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

YATRA Online Limited IPO Revenue by Product types:

| Segment | 6M FY-22(in cr.) | % | FY-21(in cr.) | % | FY-20(in cr.) | % | FY-19(in cr.) | % |

| Air Ticketing | 49.49 | 66.23% | 89.31 | 71.19% | 261.39 | 38.82% | 344.93 | 40.83% |

| Hotel & Packages | 13.25 | 17.73% | 15.66 | 12.48% | 307.47 | 45.66% | 400.31 | 47.39% |

| Other services | 5.26 | 7.04% | 3.14 | 2.50% | 5.78 | 0.86% | 5.63 | 0.67% |

| Advertising revenue | 6.72 | 8.99% | 17.34 | 13.82% | 98.69 | 14.66% | 93.85 | 11.11% |

| Total | 74.72 | 100.00% | 125.45 | 100.00% | 673.33 | 100.00% | 844.72 | 100.00% |

YATRA Online Limited IPO Strengths:

-

The strength of the brand is reflected in the fact that over 90% of the company’s total traffic has come from direct and organic traffic (which are visitors who enter the company’s website through unpaid search results without any intermediary) for Fiscal 2020 and 2021. To further strengthen the brand, the company has, from time to time, signed up some of India’s leading celebrities as brand ambassadors in the past

-

Large and Loyal Customer Base with a booking success rate of 98.7% on the websites and mobile applications in the B2C channel for domestic transactions during the period April to September 2021. The Company has served approximately 700 large corporate customers and the customer retention rate has improved from approximately 96% in Financial Year 2020 to approximately 97% in Financial Year 2021 and approximately 98% for six months ended September 30, 2021.

-

YATRA Online Limited has designed a unique “go-to-market” strategy that is a mix of B2C and B2B. This comprehensive approach creates strong network effects resulting in significant cross-sell between business and leisure travelers, which it believes addresses the entire travel market in India. The company is India’s largest corporate travel services provider and the second-largest online travel company in India among key OTA players in terms of gross booking revenue and operating revenue, for Fiscal 2020.

-

To ensure that Yatra remains a market-leading Travel-Technology platform, the company will continue investing in the common technology platform in order to ensure that it can introduce new product offerings in an efficient and timely manner and deliver on the vision of being a ‘one-stop-shop’ for the customers when it comes to travel and travel related products.

- The combination of the company’s B2C and B2B channels enables it to target India’s most frequent and high spending travelers, namely, educated urban consumers, in a cost-effective manner.

- Large and Loyal Customer Base, the company recorded a booking success rate of 97.8% on its websites and mobile applications in the B2C channel for domestic transactions during fiscal 2023. In the corporate travel business customer retention rate in relation to corporate accounts has improved from 97% in fiscal year 2021 to 98% in fiscal year 2022 and remains consistent in fiscal year 2023 i.e., 98%.

- Trusted brand with a proven track record and targeted marketing strategy, the strength of the brand is reflected in the fact that over 90% of our total traffic has come from direct and organic traffic for Fiscal 2023. As on March 31, 2023, its mobile applications have been downloaded over 26 million times.

YATRA Online Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 98.59% | 69.89% |

| Others | 1.41% | 30.11% |

Source: RHP, EWL Research

YATRA Online Limited IPO Risk factors:

-

The Indian travel industry is highly competitive. Company’s success depends upon its ability to compete effectively against numerous established and emerging competitors, including other online travel agencies, or OTAs, traditional offline travel companies, travel research companies, payment wallets, search engines, and meta-search companies, both in India and abroad, such as MakeMyTrip Limited, Cleartrip Private Limited, Easy Trip Planner Limited, Thomas Cook India Limited, FCM Travel Solutions India Private Limited, GBT India Private Limited, CWT India Private Limited, Le Travenues Technology Private Limited, TripAdvisor and Trivago and in each case including their affiliated and group entities.

-

YATRA Online Limited is dependent on the airline ticketing business, which generates a significant percentage of its revenues and is derived from a small number of airline suppliers in India. If these airlines increasingly engage directly with customers or other similar online travel agencies, as applicable, or are unable to pay the company in a timely manner or at all, whether due to the deterioration of their financial position, an economic downturn, internal conflicts or any other reason, the company’s business, financial condition, results of operations, cash flows and prospects could be materially and adversely affected.

-

Air India has moved to a single GDS service provider platform for its domestic inventory; there can be no assurance that other airline suppliers will not institute similar measures

-

Yatra Online, Inc. delivered to Ebix Inc. (“Ebix”) the notice of termination of the merger agreement with Ebix and filed litigation in the Court of Chancery of the State of Delaware based upon Ebix’s breaches of the merger agreement and an ancillary extension agreement. In addition, Yatra Online, Inc. also sued Ebix for fraud and sued Ebix’s consortium of lenders for tortious interference with contractual relations. The termination of the merger with Ebix Inc. and related legal proceedings may materially and adversely affect our results of operations.

-

YATRA Online Limited has incurred losses in the past and may incur losses in the future. The ability to operate profitably depends upon a number of factors, some of which are beyond its control.

-

YOL is dependent on its airline ticketing business, which generates a significant percentage of its revenues and is derived from a small number of airline suppliers in India.

-

YOL has had restated losses in the past.

YATRA Online Limited IPO Key Highlights:

-

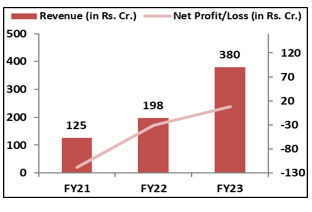

YOL reported total income/net profit – (loss) of Rs. 143.62 crore/Rs. – (118.86 crore) in FY21, Rs. 218.81 crore/Rs. – (30.79 crore) in FY22, and Rs. 397.47 crore/Rs. 7.63 crore in FY23.

-

YOL has recorded an average EPS of Rs. – (2.42) and an average RoNW of – (23.96%) during the past three fiscal years.

- The company recorded PAT margins of – (94.75) % (FY21), – (15.54) % (FY22), and 2.01% (FY23) for the previous three fiscal years.

Source: YATRA Online Limited DRAFT RED HERRING PROSPECTUS (DRHP)

YATRA Online Limited IPO Outlook:

Yatra Online Ltd. (YOL) is an online travel agency that spans the entire value chain of travel and hospitality covering B2C and B2B segments. Though the company has been in losses in the past, it finally became profitable in the FY23. Thanks to the security premiums that were received, the company was able to report a positive NAV. While some services saw a slight improvement, it saw a dramatic fall in its margins for air tickets, hotels, and packages. It has the highest attrition rates during the periods that have been documented, which is cause for worry. The major issue with the IPO is the value of the share which is set to highly overpriced at the PE ratio of 269.36X when compared to 56.53X of its peer hence we suggest to avoid this IPO.

YATRA Online Limited IPO FAQ

Ans. Yatra Online IPO is a main-board IPO of 54,577,465 equity shares of the face value of ₹1 aggregating up to ₹775.00 Crores. The issue is priced at ₹135 to ₹142 per share. The minimum order quantity is 105 Shares.

The IPO opens on September 15, 2023, and closes on September 20, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Yatra Online IPO opens on September 15, 2023 and closes on September 20, 2023.

Ans. Yatra Online IPO lot size is 105 Shares, and the minimum amount required is ₹14,910.

Ans. The Yatra Online IPO listing date is not yet announced. The tentative date of Yatra Online IPO listing is Friday, September 29, 2023.

Ans. The minimum lot size for this upcoming IPO is 105 shares.