Indian Market Outlook:

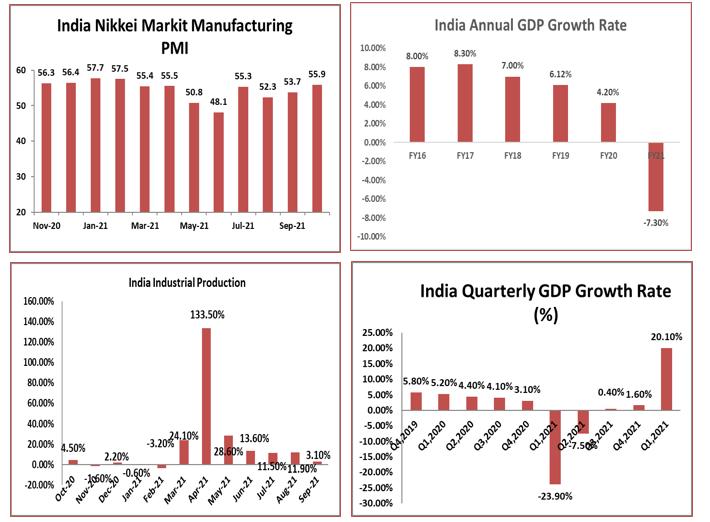

The Key benchmark indices fell over 2 percent during the week gone by led by anticipation of the US Federal Reserve’s stance, rising crude oil prices and growing concerns in Ukraine over a potential war with Russia. To tackle soaring inflation, the Fed signalled its intention to begin raising rates as early as March this year. The Fed further announced a reduction in monthly purchases of securities by an additional USD 30 billion for February 2022. Nifty ended the week with 2.92 percent lower at 17101.95 points while the Sensex ended with 3.11 percent lower at 57,200 points. BSE Small cap underperformed the key benchmark indices during the week. BSE Midcap index ended 3.07 percent lower, while the BSE Small cap index fell 3.43 percent. Foreign Institutional Investors were the net sellers during the week; sell equities worth Rs. 22158 crores while the DIIs were the net buyers of Rs. 10849 of crores. Bank Nifty was the outperformer during week rose 0.3 percent. Going forward upcoming week is going to be a busy week as Finance Minister Nirmala Sitharaman will present the Union Budget for fiscal year 2022-23 on February 1. The Economic Survey is scheduled to be placed in Parliament on January 31. Apart from it more data on the economy such as Infrastructure Output (YoY) (Dec) and Nikkei Markit Manufacturing PMI will be released with more corporate earnings coming next week. Automobile sales for January Month will also be released next week. Besides the Budget, developments in the Russo-Ukrainian crisis will also be key for the markets. We advise investors to invest in quality stocks with any further dip.

Latest Spot Price (in US $)

| Precious Metal | Current Price | Change (%) | 3 Month | 6 Month | 1 Year | |||||

| Gold | 1790.1 | -2.28 | 1.53 | -1.53 | -9.01 | |||||

| Silver | 22.48 | -7.71 | -7.60 | -19.46 | -12.15 | |||||

| Platinum | 1012.25 | -1.88 | 3.91 | -15.24 | 12.99 | |||||

| USD/INR | 75.034 | 0.88 | 1.07 | 1.95 | 1.52 | |||||

| Crude | 85.43 | 0.34 | 25.12 | 32.02 | 120.24 | |||||

| Date | Region | Event Description | Forecast | Previous |

| Jan 30,2022 | CNY | Manufacturing PMI (Jan) | 50.0 | 50.3 |

| Jan 31,2022 | INR | Infrastructure Output (YoY) (Dec) | – | 3.1% |

| Feb 01,2022 | INR | Nikkei Markit Manufacturing PMI | 54.7 | 55.5 |

| Feb 02,2022 | USD | Crude Oil Inventories | – | 2.377M |

| Feb 03,2022 | INR | Nikkei Services PMI (Jan) | 52.8 | 55.5 |

| Feb 03,2022 | SD | Initial Jobless Claims | – | 260K |

| Heading | Indicators | Current | Previous |

| RBI Policy Rate | Policy Repo Rate | 4.00% | 4.00% |

| Reverse Repo Rate | 3.35% | 3.35% | |

| Bank Rate | 4.25% | 4.25% | |

| Reserve Ratio | CRR | 4.00% | 4.00% |

| SLR | 18.00% | 18.00% | |

| Inflation Rate | Wholesale Price Index | 13.56% | 14.23% |

| Consumer Price Index | 5.59% | 4.91% | |

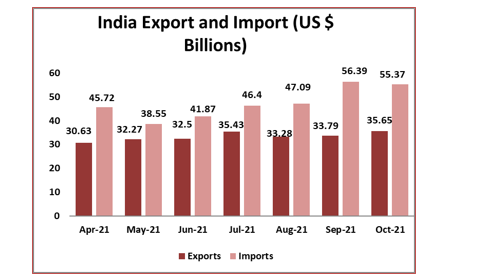

| Trade Data | Export ($ Million) | 37810 | 30040 |

| Import ($ Million) | 59480 | 52940 | |

| IIP | 1.4% | 3.2% |

| Domestic Indices | Closing (28th

Jan) |

Change | %Change |

| BSE Sensex | 57,200.23 | -1,836.95 | -3.11 |

| Nifty | 17,101.95 | -515.20 | -2.92 |

| Mid Cap | 24,186.73 | -764.94 | -3.07 |

| Small Cap | 28,940.18 | -1,027.03 | -3.43 |

| Bank Nifty | 37,689.40 | 115.10 | 0.31 |

| Global Indices | Closing (28th Jan) | Change | %Change |

| Dow Jones | 34,726.20 | 460.70 | 1.34 |

| Nasdaq | 13,770.60 | 1.70 | 0.01 |

| FTSE | 7,466.07 | -28.06 | -0.37 |

| Nikkei | 26,717.34 | -804.92 | -2.92 |

| Hang Seng | 23,550.08 | -1,415.47 | -5.67 |

| Shanghai Com | 3,361.44 | -161.13 | -4.57 |

| Net Inflow (Cr) | FII | DII |

| 24-Jan-2022 | -3,751.58 | 74.88 |

| 25-Jan-2022 | -7,094.48 | 4,534.53 |

| 27-Jan-2022 | -6,266.75 | 2,881.32 |

| 28-Jan-2022 | -5,045.34 | 3,358.67 |

| Total | -22,158.15 | 10,849.40 |

| Top Gainers | Closing Price | Prev Close | Chg (%) |

| Maruti Suzuki | 8550.95 | 8036.35 | 6.40 |

| Bajaj Auto | 3497.20 | 3308.75 | 5.70 |

| Cipla | 932.25 | 882.35 | 5.66 |

| Axis Bank | 764.70 | 728.90 | 4.91 |

| NTPC | 140.15 | 134.90 | 3.98 |

| Top Losers | Closing Price | Prev Close | Chg (%) |

| Tech Mahindra | 1410.65 | 711.50 | -15.37 |

| Bajaj Finserv | 15198.75 | 17258.95 | -11.94 |

| Wipro | 552.15 | 615.20 | -10.25 |

| Tata Steel | 1084.65 | 1206.70 | -10.11 |

| Titan Co. | 2315.60 | 2564.30 | -9.70 |

Source:Investing, NDTV, BSE, CNBCTV18, Moneycontrol,

Economic News:

-

Gold imports by India accelerated to the highest level in a decade last year as jewelry sales almost doubled, with the demand outlook remaining bright, according to the World Gold Council. Demand revived after two bleak years as Indians once again flocked to jewelry stores in 2021 as fears of the pandemic eased. Weddings and celebrations picked up in full swing in the three months through December, more than doubling full-year imports to about 925 tons, the highest since 2011, according to the council data.

-

The government appointed V Anantha Nageswaran as the chief economic advisor. He has assumed charge, the Ministry of Finance said on Friday. The appointment comes just ahead of the government’s economic survey and Budget 2022. The former Chief Economic Advisor Krishnamurthy Subramanian’s term ended in December. Nageswaran has wide-ranging experience across financial markets, research and academic. He holds a postgraduate diploma in management from the Indian Institute of Management, Ahmedabad, and a doctoral degree in finance from the University of Massachusetts, Amherst. His PhD thesis revolved around the empirical behavior of exchange rates.

Industry News:

-

Operating profitability of tractor makers is set to shrink by 300-400 basis points in the ongoing fiscal year owing to a sharp increase in raw material prices, primarily steel, along with lower sales volume, ratings agency Crisil said on Friday. Crisil also said it expects domestic tractor sales volume to decline 4-6 per cent in 2021-22 amid the volume growth moderating to 0.7 per cent in April-December 2021. In the ongoing fiscal year, Crisil said, prices of key raw materials such as steel and pig iron, which account for 75-80 per cent of total cost, have risen 35-40 per cent year-on-year in April-December and discretionary costs have normalized.

-

Bank credit grew 8.01 per cent to Rs 115 lakh crore and deposits rose 9.28 per cent to Rs 159.83 lakh crore in the fortnight ended January 14, according to RBI data. In the fortnight ended January 15, 2021, bank credit stood at Rs 106.43 lakh crore and deposits at Rs 146.25 lakh crore, as per the RBI’s Scheduled Banks’ Statement of Position in India as on January 14, 2022, released on Friday. In the previous fortnight ended December 31, 2021, advances rose 9.16 per cent and deposits increased 10.28 per cent.

Company News:

-

Kotak Mahindra Bank Ltd.’s quarterly profit rose on higher core income and provision write-back. Net profit for the private lender increased 15% over the year earlier to Rs 2,131 crore in the quarter ended December, according to its exchange filing. That compares with the Rs 2,074-crore consensus estimate of analysts tracked by Bloomberg. Its net interest income rose 12% year-on-year to Rs 4,334. Other income, too, was up 5.4% to Rs 1,361 crore. The net interest margin was at 4.62% for the quarter ended December 2021. The bank’s asset quality improved during the period. Its gross non-performing asset ratio fell 48 basis points sequentially to 2.71%. Net NPA ratio fell 27 basis points over the preceding three months to 0.79% as on Dec. 31.

-

A Joint venture of billionaire Gautam Adani-run group’s gas arm and Total of Francewalked away with the most – 14 licences to retail CNG to automobiles and piped cooking gas to households in the latest city gas bidding round, according to oil regulator PNGRB. Adani Total Gas won city gas rights in 14 out of 52 geographical areas (GAs) for which Petroleum and Natural Gas Regulatory Board (PNGRB) declared results on Friday. Hyderabad-based Megha Engineering and Infrastructure won 13 GAs, while state-owned IOC was adjudged winner in 8 GAs.

-

Larsen & Toubro (L&T) on Friday reported a consolidated net profit of Rs 2054.74 crore for the December quarter, down 16.70 per cent against a profit of Rs 2466.71 crore in the same quarter last year. The revenue from operations came in at Rs 39,562.92 crore, up 11.14 per cent against Rs 35,596.42 crore in the corresponding quarter last year. The Company bagged orders worth Rs 50,359 crore during the quarter, registering a decline of 31 per cent for the corresponding period in the previous year. The decline is coming on a much larger base due to high-speed rail corridor awarded last year.

Global News

-

S. employment costs rose at a robust pace for a second-straight quarter, wrapping up the strongest year of labor inflation in two decades as businesses competed for a limited supply of workers. The employment cost index, a broad gauge of wages and benefits, advanced 1% in the fourth quarter, according to Labor Department figures released Friday.

-

S. inflation-adjusted consumer spending fell last month by the most since February, suggesting that Americans tempered their outlays amid the latest Covid-19 wave and the fastest inflation in nearly 40 years.

Forthcoming Corporate Actions – 31st January – 5th February

| Security Name | Ex-Date | Purpose | Security Name | Ex-Date | Purpose |

| CCL | 31-Jan-22 | Interim Dividend – Rs. – 3.0000 | IIFLSEC | 03-Feb-22 | Interim Dividend – Rs. – 3.0000 |

| MASTEK | 31-Jan-22 | Interim Dividend – Rs. – 7.0000 | INTEGRA | 03-Feb-22 | Stock – Split from Rs.3/- to Rs.1/- |

| SAREGAMA | 31-Jan-22 | Interim Dividend – Rs. – 30.0000 | INTELLADV | 03-Feb-22 | E.G.M. |

| VISAKAIND | 31-Jan-22 | Interim Dividend – Rs. – 7.0000 | KIRLFER | 03-Feb-22 | Interim Dividend – Rs. – 2.5000 |

| INDIGRID | 01-Feb-22 | Income Distribution (InvIT) | LAOPALA | 03-Feb-22 | Interim Dividend – Rs. – 1.5000 |

| ORIENTELEC | 01-Feb-22 | Interim Dividend – Rs. – 0.7500 | MOTILALOFS | 03-Feb-22 | Interim Dividend – Rs. – 7.0000 |

| PCBL | 01-Feb-22 | Interim Dividend – Rs. – 10.0000 | NTPC | 03-Feb-22 | Interim Dividend |

| CONCOR | 02-Feb-22 | Interim Dividend – Rs. – 2.0000 | PARSHVA | 03-Feb-22 | Bonus issue 205:100 |

| COSMOFILMS | 02-Feb-22 | Interim Dividend – Rs. – 10.0000 | SANTETX | 03-Feb-22 | E.G.M. |

| HAZOOR | 02-Feb-22 | E.G.M. | SINDHUTRAD | 03-Feb-22 | Stock – Split from Rs.10/- to Rs.1/- |

| NGIL | 02-Feb-22 | E.G.M. | SRF | 03-Feb-22 | Interim Dividend – Rs. – 4.7500 |

| PGINVIT | 02-Feb-22 | Income Distribution (InvIT) | SWORDEDGE | 03-Feb-22 | Bonus issue 1:1 |

| SHARDACROP | 02-Feb-22 | Interim Dividend – Rs. – 3.0000 | SYMPHONY | 03-Feb-22 | Interim Dividend – Rs. – 1.0000 |

| SHAREINDIA | 02-Feb-22 | Interim Dividend – Rs. – 2.0000 | TCI | 03-Feb-22 | Interim Dividend – Rs. – 2.0000 |

| TORNTPHARM | 02-Feb-22 | Interim Dividend – Rs. – 25.0000 | TCIEXP | 03-Feb-22 | Interim Dividend – Rs. – 3.0000 |

| WENDT | 02-Feb-22 | Interim Dividend – Rs. – 20.0000 | THANGAMAYL | 03-Feb-22 | Interim Dividend – Rs. – 5.0000 |

| ACCELYA | 03-Feb-22 | Interim Dividend – Rs. – 17.0000 | UPSURGE | 03-Feb-22 | Interim Dividend – Rs. – 0.5000 |

| BIGBLOC | 03-Feb-22 | Interim Dividend – Rs. – 0.1000 | VAIBHAVGBL | 03-Feb-22 | Interim Dividend – Rs. – 1.5000 |

| DWL | 03-Feb-22 | E.G.M. | ZENSARTECH | 03-Feb-22 | Interim Dividend – Rs. – 1.5000 |

| GREENPANEL | 03-Feb-22 | Interim Dividend – Rs. – 1.5000 | CHAMBLFERT | 04-Feb-22 | Interim Dividend – Rs. – 4.5000 |

| GRMOVER | 03-Feb-22 | Interim Dividend – Rs. – 1.0000 | EMBASSY | 04-Feb-22 | Income Distribution RITES |

| IEX | 03-Feb-22 | Interim Dividend – Rs. – 1.0000 | MARICO | 04-Feb-22 | Interim Dividend – Rs. – 6.2500 |

| IIFL | 03-Feb-22 | Interim Dividend – Rs. – 3.5000 | SIYSIL | 04-Feb-22 | Interim Dividend |

Source: BSE, Elite wealth Research

Upcoming Key Board Meetings – 31st January – 5th February

| Symbol | Purpose | BM Date | Symbol | Purpose | BM Date |

| EXIDEIND | Interim Dividend;Quarterly Results | 31-Jan-22 | IGPL | Quarterly Results | 03-Feb-22 |

| HINDPETRO | Quarterly Results | 31-Jan-22 | KIRLOSIND | Quarterly Results | 03-Feb-22 |

| LGBBROSLTD | Audited Results | 31-Jan-22 | LUPIN | General;Quarterly Results | 03-Feb-22 |

| JINDALSAW | Quarterly Results | 31-Jan-22 | CENTENKA | Quarterly Results | 03-Feb-22 |

| BPCL | Interim Dividend;Quarterly Results | 31-Jan-22 | NAHARSPING | Quarterly Results | 03-Feb-22 |

| TATAMOTORS | Quarterly Results | 31-Jan-22 | SUNDRMFAST | Quarterly Results | 03-Feb-22 |

| ANDHRAPAP | Quarterly Results | 31-Jan-22 | THOMASCOOK | General;Quarterly Results | 03-Feb-22 |

| IFBAGRO | Quarterly Results | 31-Jan-22 | PFIZER | Quarterly Results | 03-Feb-22 |

| NAVNETEDUL | Quarterly Results | 31-Jan-22 | EIHOTEL | Quarterly Results | 03-Feb-22 |

| GRPLTD | Quarterly Results | 31-Jan-22 | ITC | Interim Dividend;Quarterly Results | 03-Feb-22 |

| GICHSGFIN | Quarterly Results | 31-Jan-22 | BANSWRAS | Quarterly Results | 03-Feb-22 |

| UPL | Quarterly Results | 31-Jan-22 | GMM | Interim Dividend;Quarterly Results | 03-Feb-22 |

| ADFFOODS | Quarterly Results | 31-Jan-22 | WESTLIFE | Quarterly Results | 03-Feb-22 |

| SCI | Quarterly Results | 31-Jan-22 | KENNAMET | Quarterly Results | 03-Feb-22 |

| RAMAPHO | Quarterly Results | 31-Jan-22 | GRINDWELL | Quarterly Results | 03-Feb-22 |

| VINATIORGA | Quarterly Results | 31-Jan-22 | COROMANDEL | Quarterly Results | 03-Feb-22 |

| AARTIDRUGS | Audited Results;Interim Dividend | 31-Jan-22 | FOODSIN | General;Quarterly Results | 03-Feb-22 |

| SUNPHARMA | Quarterly Results | 31-Jan-22 | HAWKINCOOK | Quarterly Results | 03-Feb-22 |

| CONFIPET | Quarterly Results | 31-Jan-22 | WELSPUNIND | Quarterly Results | 03-Feb-22 |

| VENUSREM | Quarterly Results | 31-Jan-22 | BLACKROSE | Quarterly Results | 03-Feb-22 |

| IOC | Interim Dividend;Quarterly Results | 31-Jan-22 | MARALOVER | Quarterly Results | 03-Feb-22 |

| POLYMED | General;Quarterly Results | 31-Jan-22 | NAHARPOLY | Quarterly Results | 03-Feb-22 |

| APARINDS | Quarterly Results | 31-Jan-22 | 3MINDIA | General;Quarterly Results | 03-Feb-22 |

| AJANTPHARM | Quarterly Results | 31-Jan-22 | PIIND | Interim Dividend;Quarterly Results | 03-Feb-22 |

| DSSL | General | 31-Jan-22 | KOPRAN | Quarterly Results | 03-Feb-22 |

| NAVINFLUOR | Quarterly Results | 31-Jan-22 | CAPPL | Quarterly Results | 03-Feb-22 |

| UCOBANK | Quarterly Results | 31-Jan-22 | JKTYRE | Quarterly Results | 03-Feb-22 |

| DWARKESH | Quarterly Results | 31-Jan-22 | EMAMILTD | Interim Dividend;Quarterly Results | 03-Feb-22 |

| KEC | Quarterly Results | 31-Jan-22 | AMBIKCO | Quarterly Results | 03-Feb-22 |

| GPIL | General;Quarterly Results | 31-Jan-22 | GAIL | General;Quarterly Results | 03-Feb-22 |

| VOLTAMP | Quarterly Results | 31-Jan-22 | CADILAHC | Quarterly Results | 03-Feb-22 |

| DAAWAT | Interim Dividend;Quarterly Results | 31-Jan-22 | RADICO | Quarterly Results | 03-Feb-22 |

| DLF | Quarterly Results | 31-Jan-22 | NITINSPIN | Interim Dividend;Quarterly Results | 03-Feb-22 |

| ADSL | General;Quarterly Results | 31-Jan-22 | TORNTPOWER | Interim Dividend;Quarterly Results | 03-Feb-22 |

| EDELWEISS | Quarterly Results | 31-Jan-22 | SAHYADRI | General;Quarterly Results | 03-Feb-22 |

| EMAMIPAP | Quarterly Results | 31-Jan-22 | BRIGADE | Quarterly Results | 03-Feb-22 |

| GPTINFRA | Interim Dividend;Quarterly Results | 31-Jan-22 | MHRIL | Quarterly Results | 03-Feb-22 |

| ORIENTCEM | Interim Dividend;Quarterly Results | 31-Jan-22 | ADANIPOWER | Quarterly Results | 03-Feb-22 |

| PDSMFL | Quarterly Results | 31-Jan-22 | GODREJPROP | Quarterly Results | 03-Feb-22 |

| SATIN | Quarterly Results | 31-Jan-22 | JUBLINDS | Quarterly Results | 03-Feb-22 |

| INFIBEAM | Bonus;Dividend;Pref. Issue;Results | 31-Jan-22 | TBZ | General;Quarterly Results | 03-Feb-22 |

| DYNAMIC | Quarterly Results | 31-Jan-22 | ADANITRANS | Quarterly Results | 03-Feb-22 |

| YASHO | Quarterly Results | 31-Jan-22 | LUXIND | Quarterly Results | 03-Feb-22 |

| KPITTECH | Interim Dividend;Quarterly Results | 31-Jan-22 | VBL | Audited Results | 03-Feb-22 |

| SMCGLOBAL | Quarterly Results | 31-Jan-22 | SIS | Quarterly Results | 03-Feb-22 |

| KRSNAA | Quarterly Results | 31-Jan-22 | ABCAPITAL | Quarterly Results | 03-Feb-22 |

| TATAMTRDVR | Quarterly Results | 31-Jan-22 | DCAL | Quarterly Results | 03-Feb-22 |

| KANSAINER | Quarterly Results | 01-Feb-22 | HGINFRA | General;Quarterly Results | 03-Feb-22 |

| GOODYEAR | Quarterly Results | 01-Feb-22 | AAVAS | Quarterly Results | 03-Feb-22 |

| PRSMJOHNSN | Quarterly Results | 01-Feb-22 | GLOSTERLTD | Quarterly Results | 03-Feb-22 |

| PGHH | Interim Dividend;Quarterly Results | 01-Feb-22 | PRINCEPIPE | Quarterly Results | 03-Feb-22 |

| INDHOTEL | Quarterly Results | 01-Feb-22 | SUMICHEM | Quarterly Results | 03-Feb-22 |

| ELECON | Quarterly Results | 01-Feb-22 | KALYANKJIL | Quarterly Results | 03-Feb-22 |

| IFBIND | Quarterly Results | 01-Feb-22 | BARBEQUE | Quarterly Results | 03-Feb-22 |

| ORIENTCQ | Quarterly Results | 01-Feb-22 | IPL | Quarterly Results | 03-Feb-22 |

| VIPIND | Quarterly Results | 01-Feb-22 | ROLEXRINGS | Quarterly Results | 03-Feb-22 |

| CHOLAFIN | Quarterly Results | 01-Feb-22 | SAKSOFT | Quarterly Results | 03-Feb-22 |

| NRAGRINDQ | Quarterly Results | 01-Feb-22 | DALMIASUG | Interim Dividend;Quarterly Results | 04-Feb-22 |

| TTKPRESTIG | Interim Dividend;Quarterly Results | 01-Feb-22 | LAXMIMACH | Quarterly Results | 04-Feb-22 |

| POONAWALLA | Quarterly Results | 01-Feb-22 | BIRLACORPN | Quarterly Results | 04-Feb-22 |

| GAEL | General;Quarterly Results | 01-Feb-22 | SHREECEM | Interim Dividend;Quarterly Results | 04-Feb-22 |

| NEULANDLAB | General;Quarterly Results | 01-Feb-22 | THERMAX | Quarterly Results | 04-Feb-22 |

| MANGCHEFER | Quarterly Results | 01-Feb-22 | TATASTEEL | General;Quarterly Results | 04-Feb-22 |

| PANACEABIO | General | 01-Feb-22 | SIEMENS | Quarterly Results | 04-Feb-22 |

| JINDALSTEL | Quarterly Results | 01-Feb-22 | GNFC | Quarterly Results | 04-Feb-22 |

| INDOCO | Quarterly Results | 01-Feb-22 | NOCIL | Quarterly Results | 04-Feb-22 |

| TECHM | Quarterly Results | 01-Feb-22 | SINTEX | Quarterly Results | 04-Feb-22 |

| SUTLEJTEX | Quarterly Results | 01-Feb-22 | AUTOAXLES | Quarterly Results | 04-Feb-22 |

| ADANIPORTS | Quarterly Results | 01-Feb-22 | PRAKASH | Quarterly Results | 04-Feb-22 |

| TRITURBINE | Quarterly Results | 01-Feb-22 | AMNPLST | Quarterly Results | 04-Feb-22 |

| ARTEMISMED | Quarterly Results | 01-Feb-22 | ANUHPHR | Quarterly Results | 04-Feb-22 |

| JUBLINGREA | Interim Dividend;Quarterly Results | 01-Feb-22 | BAYERCROP | Quarterly Results | 04-Feb-22 |

| LXCHEM | Quarterly Results | 01-Feb-22 | VISAKAIND | Audited Results;Quarterly Results | 04-Feb-22 |

| SONACOMS | Interim Dividend;Quarterly Results | 01-Feb-22 | DEEPAKSP | Quarterly Results | 04-Feb-22 |

| HDFC | Quarterly Results | 02-Feb-22 | DIGISPICE | Quarterly Results | 04-Feb-22 |

| BALRAMCHIN | Interim Dividend;General;Quarterly Results | 02-Feb-22 | VADILENT | Quarterly Results | 04-Feb-22 |

| BLUESTARCO | Quarterly Results | 02-Feb-22 | VADILALIND | Quarterly Results | 04-Feb-22 |

| DABUR | Quarterly Results | 02-Feb-22 | DFM | Quarterly Results | 04-Feb-22 |

| RELCAPITAL | General;Quarterly Results | 02-Feb-22 | JAMNAAUTO | Quarterly Results | 04-Feb-22 |

| DCW | Quarterly Results | 02-Feb-22 | VENKYS | Quarterly Results | 04-Feb-22 |

| MAHSEAMLES | Quarterly Results | 02-Feb-22 | IOLCP | Interim Dividend;Quarterly Results | 04-Feb-22 |

| JKLAKSHMI | Quarterly Results | 02-Feb-22 | JUBLPHARMA | Quarterly Results | 04-Feb-22 |

| TATACONSUM | Quarterly Results | 02-Feb-22 | UGARSUGAR | Amalgamation;General;Results | 04-Feb-22 |

| APOLLOTYRE | Quarterly Results | 02-Feb-22 | EVEREADY | Quarterly Results | 04-Feb-22 |

| ZEEL | Quarterly Results | 02-Feb-22 | BANKINDIA | Quarterly Results | 04-Feb-22 |

| ALKYLAMINE | Quarterly Results | 02-Feb-22 | CUB | Quarterly Results | 04-Feb-22 |

| DHANUKA | Interim Dividend;Quarterly Results | 02-Feb-22 | GATI | Quarterly Results | 04-Feb-22 |

| GILLETTE | Interim Dividend;Quarterly Results | 02-Feb-22 | GULPOLY | General;Quarterly Results | 04-Feb-22 |

| JINDRILL | Quarterly Results | 02-Feb-22 | DIVISLAB | Quarterly Results | 04-Feb-22 |

| SURYALAXMI | Quarterly Results | 02-Feb-22 | MANGALAM | General;Quarterly Results | 04-Feb-22 |

| TIMKEN | Quarterly Results | 02-Feb-22 | FSL | Quarterly Results | 04-Feb-22 |

| GET&D | Quarterly Results | 02-Feb-22 | ASTRAL | Quarterly Results | 04-Feb-22 |

| ACRYSIL | Interim Dividend;Quarterly Results | 02-Feb-22 | ASIANTILES | General | 04-Feb-22 |

| BALAMINES | Quarterly Results | 02-Feb-22 | RECLTD | Quarterly Results | 04-Feb-22 |

| ZYDUSWELL | Quarterly Results | 02-Feb-22 | ABFRL | Quarterly Results | 04-Feb-22 |

| SOMANYCERA | General;Quarterly Results | 02-Feb-22 | MONTECARLO | Quarterly Results | 04-Feb-22 |

| ASTAR | Quarterly Results | 02-Feb-22 | MINDACORP | Interim Dividend;Quarterly Results | 04-Feb-22 |

| TRIVENI | Quarterly Results | 02-Feb-22 | INDIGO | Quarterly Results | 04-Feb-22 |

| IOB | Quarterly Results | 02-Feb-22 | ALKEM | Interim Dividend;Quarterly Results | 04-Feb-22 |

| WELENT | Quarterly Results | 02-Feb-22 | NH | Quarterly Results | 04-Feb-22 |

| M&MFIN | Quarterly Results | 02-Feb-22 | AVL | General;Quarterly Results | 04-Feb-22 |

| KAMDHENU | Quarterly Results | 02-Feb-22 | MAGADHSUGAR | Quarterly Results | 04-Feb-22 |

| NELCAST | Quarterly Results | 02-Feb-22 | KIOCL | Quarterly Results | 04-Feb-22 |

| ECLERX | Quarterly Results | 02-Feb-22 | DIAMONDYD | Quarterly Results | 04-Feb-22 |

| VGUARD | Quarterly Results | 02-Feb-22 | GODREJAGRO | Quarterly Results | 04-Feb-22 |

| JUBLFOOD | Quarterly Results;Stock Split | 02-Feb-22 | CREDITACC | Quarterly Results | 04-Feb-22 |

| BAJAJCON | Interim Dividend;Quarterly Results | 02-Feb-22 | AWHCL | Quarterly Results | 04-Feb-22 |

| BEDMUTHA | Quarterly Results | 02-Feb-22 | DEVYANI | Quarterly Results | 04-Feb-22 |

| FCONSUMER | Quarterly Results | 02-Feb-22 | VIJAYA | Quarterly Results | 04-Feb-22 |

| ZUARI | Quarterly Results | 02-Feb-22 | PAYTM | Quarterly Results | 04-Feb-22 |

| MNKCMILTD | Quarterly Results | 02-Feb-22 | XPROINDIA | Quarterly Results | 04-Feb-22 |

| VRLLOG | Interim Dividend;Quarterly Results | 02-Feb-22 | ANDHRAPET | Quarterly Results | 05-Feb-22 |

| GOKULAGRO | Quarterly Results | 02-Feb-22 | BANCOINDIA | Quarterly Results | 05-Feb-22 |

| BLS | Interim Dividend;Quarterly Results | 02-Feb-22 | SBIN | Quarterly Results | 05-Feb-22 |

| SFL | Quarterly Results | 02-Feb-22 | GOODRICKE | Quarterly Results | 05-Feb-22 |

| SHANKARA | Quarterly Results | 02-Feb-22 | SAURASHCEM | Quarterly Results | 05-Feb-22 |

| AVADHSUGAR | Quarterly Results | 02-Feb-22 | SARDAEN | Quarterly Results | 05-Feb-22 |

| MASFIN | Interim Dividend;General;Results | 02-Feb-22 | GSCLCEMENT | Amalgamation;Quarterly Results | 05-Feb-22 |

| SHALBY | General;Quarterly Results | 02-Feb-22 | NAHARINDUS | Quarterly Results | 05-Feb-22 |

| SANDHAR | Quarterly Results | 02-Feb-22 | AARTIIND | Audited Results | 05-Feb-22 |

| ADANIGREEN | Quarterly Results | 02-Feb-22 | BANKBARODA | Quarterly Results | 05-Feb-22 |

| ATGL | Quarterly Results | 02-Feb-22 | JKCEMENT | Quarterly Results | 05-Feb-22 |

| IIFLWAM | Quarterly Results | 02-Feb-22 | UTTAMSUGAR | Quarterly Results | 05-Feb-22 |

| AARTISURF | Audited Results;Quarterly Results | 02-Feb-22 | ACE | Quarterly Results | 05-Feb-22 |

| SURYODAY | Quarterly Results | 02-Feb-22 | DLINKINDIA | Quarterly Results | 05-Feb-22 |

| WINDLAS | Quarterly Results | 02-Feb-22 | PDMJEPAPER | Quarterly Results | 05-Feb-22 |

| MOL | Quarterly Results | 02-Feb-22 | PARAGMILK | Quarterly Results | 05-Feb-22 |

| TITAN | Quarterly Results | 03-Feb-22 | ADVENZYMES | Quarterly Results | 05-Feb-22 |

| ESTER | Quarterly Results | 03-Feb-22 | AFFLE | Quarterly Results | 05-Feb-22 |

| HCC | General;Quarterly Results | 03-Feb-22 | UJJIVANSFB | Quarterly Results | 05-Feb-22 |

Source: BSE, Elite wealth Research

Major Economy Indicators

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL