Vishal Mega Mart Limited IPO Company Profile:

Vishal Mega Mart is a comprehensive destination catering to the needs of middle and lower-middle-income consumers in India. Through its portfolio of both owned and third-party brands, it offers a diverse range of merchandise that addresses both the aspirational and daily requirements of customers. The product offering spans across three key categories: apparel, general merchandise, and fast-moving consumer goods.

| IPO-Note | Vishal Mega Mart Limited |

| Rs.74– Rs.78 per Equity share | Recommendation: Apply |

Vishal Mega Mart Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· Entirely an offer for sale |

| Issue Size | Total issue Size – Rs.8000 Cr

Offer for sale- Rs 8000Cr |

| Face value |

Rs.10 |

| Issue Price | Rs.74 – Rs.78 per share |

| Bid Lot | 190 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | December 11, 2024- December13, 2024 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Vishal Mega Mart Limited IPO Strengths:

- Vishal Mega Mart has a diverse and expanding portfolio of proprietary brands across the apparel, general merchandise, and fast-moving consumer goods (FMCG) categories. Their brand portfolio includes exclusive offerings for men, women, children, and infants.

- In FY24, sales from company’s own brands accounted for 71% of total sales, generating revenue of Rs 6,399 crore. The revenue from operations driven by the sales of their own brands has grown at a compound annual growth rate (CAGR) of 27.72% between FY2022 and FY2024.

- The company operates a pan-India network of 645 stores across 33 Tier 1 cities and 381 Tier 2 cities and beyond, as of September 30, 2024. As of March 31, 2024, the company is ranked among the top two offline-first diversified retailers in India based on its presence in cities. The company expanded its store count from 557 in FY23 to 661 in FY24.

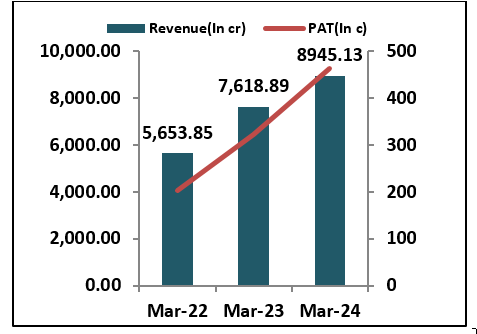

- In FY24, company reported sales of Rs 8,911 crore, reflecting a 17.5% increase compared to FY23. The company achieved a compound annual growth rate (CAGR) of 26% in revenue between FY22 and FY24. Additionally, the company reported a profit after tax (PAT) of Rs 416.9 crore, marking a 43% growth over FY23.

The company was the most efficient company in terms of adjusted Return on Capital Employed (ROCE) among the leading offline-first diversified retailers in India, with a ROCE of 70.95% in FY24.

Vishal Mega Mart Limited IPO Risk Factors:

- They face intense competition with online retailers and other e- commerce websites.

Vishal Mega Mart Limited IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Vishal Mega Mart Limited IPO Allotment Status

Vishal Mega Mart Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Vishal Mega Mart Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 98.77% | 76.02% |

| Others | 12.3% | 23.98% |

Vishal Mega Mart Limited IPO Outlook:

Vishal Mega Mart has positioned itself as a prominent player among offline diversified retailers in India, with a robust nationwide presence and strong financial performance in terms of revenue and profit. The current offering is a complete offer for sale, with no proceeds allocated for expansion or growth. The company shares are priced at a post-issue price-to-earnings (P/E) ratio of Rs 76 per share, based on an FY24 EPS of Rs 1.02. Based on our analysis of the company’s fundamentals and business model, we recommend that investors with a medium-to-long-term horizon consider applying for the issue, with the potential for long-term gains and listing benefits.

Vishal Mega Mart Limited IPO FAQ:

Ans. Vishal Mega Mart IPO is a main-board IPO of 1,025,641,025 equity shares of the face value of ₹10 aggregating up to ₹8,000.00 Crores. The issue is priced at ₹74 to ₹78 per share. The minimum order quantity is 190 Shares.

The IPO opens on December 11, 2024, and closes on December 13, 2024.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Vishal Mega Mart IPO opens on December 11, 2024 and closes on December 13, 2024.

Ans. Vishal Mega Mart IPO lot size is 190 Shares, and the minimum amount required is ₹14,820.

Ans. The Vishal Mega Mart IPO listing date is not yet announced. The tentative date of Vishal Mega Mart IPO listing is Wednesday, December 18, 2024.

Ans. The minimum lot size for this upcoming IPO is 190 shares.