Vibhor Steel Tubes IPO Company Details:

Vibhor Steel Tubes Limited (VSTL) is a manufacturer and exporter of steel pipes, and supplies exclusively to Jindal Pipes Ltd. under the Jindal Star brand. The company produces a wide range of goods, including hollow steel pipe, Steel ERW Black and Galvanized Pipes, Cold rolled Steel (CR) Strips/ Coils, mild steel, and carbon steel. These goods serve as structural elements as well as shaft frames for automobiles and steep pipes used as bicycle frames. On April 1, 2023, the Company and Jindal Pipes extended their agreement. According to the terms of the arrangement, VSTL has obtained a six-year contract with Jindal, during which time JPL will place an order for a minimum of one lakh MT annually. VSTL agreed to sell to JPL at a 2% discount below the gross sale price in exchange for this. The company owns two manufacturing facilities, one each in Telangana and Maharashtra. The primary purpose of both operations is to supply Jindal Pipes with steel tubes. Sixty-seven people work for the company directly, with Mr. Vijay, Mr. Vibhor, and Mr. Vijay Laxmi Kaushik in charge. These promoters have worked in the mild steel and stainless steel welded tubes business for around thirty years.

| IPO-Note | Vibhor Steel Tubes Limited |

| Rs.141 – Rs.151 per Equity share | Recommendation: Listing Gains |

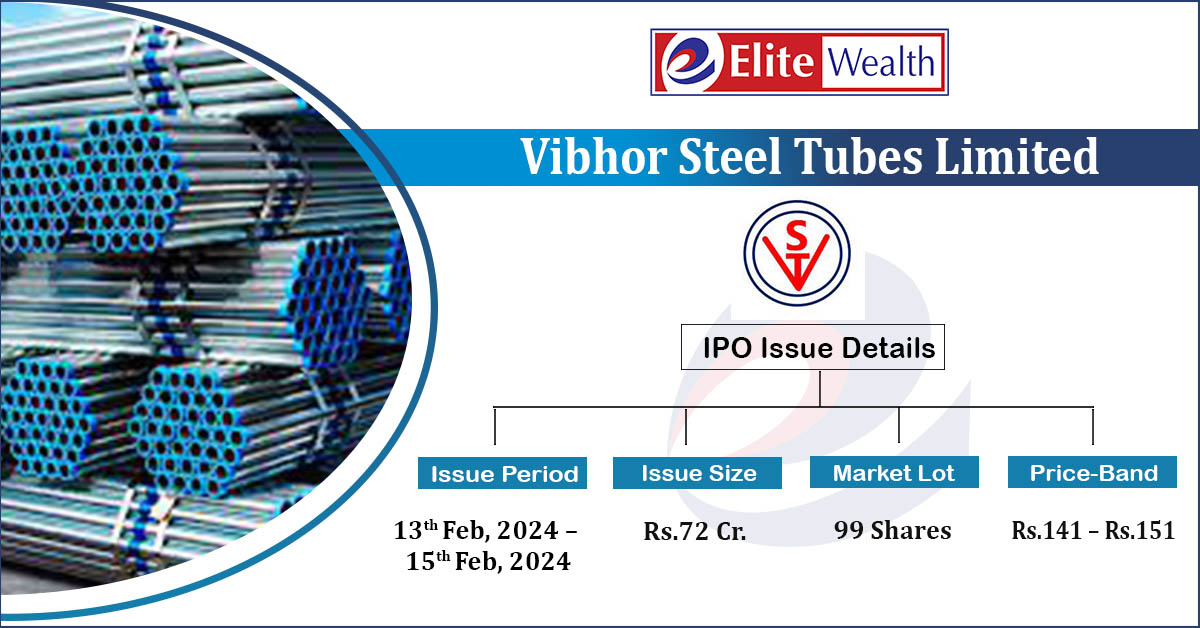

Vibhor Steel Tubes IPO Details:

| Issue Details | |

| Objects of the issue |

· To fund working capital requirements |

| Issue Size | Total issue Size – Rs.72 Cr.

Fresh Issue – Rs.72 Cr. |

| Face value |

Rs.10 |

| Issue Price | Rs.141 – Rs.151 |

| Bid Lot | 99 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | 13th Feb, 2024 – 15th Feb, 2024 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Vibhor Steel Tubes IPO Strengths:

-

VSTL has a long standing relationship with Jindal Pipes Limited.

-

Company has a strategic placements of ports which allows it to manufacture its goods for export in Unit 1 itself.

-

It exports to over 10 countries across world under the brand Jindal Star; Company also looks towards expanding these markets in future.

-

It has integrated manufacturing facilities and warehouses with latest technologically advanced tools & machineries.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Vibhor Steel Tubes IPO Allotment Status

Vibhor Steel Tubes IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Vibhor Steel Tubes IPO Risk Factors:

-

Company has high revenue concentration risk as more than 90% of its revenue comes from Jindal Pipes. Cancellation or reduction of Jindal Pipes’ orders could have adverse impact on the company’s financials.

-

If has very low gross and EBITDA margins due to the high raw material cost which is average of ~90% of the revenue of the company.

-

VSTL’s business is largely concentrated in two states i.e. Telangana (38.6%) & Maharashtra (57.59%). Any change in policies, law and regulation in these states can impact company’s business operation.

-

Because of the nature of the business, a significant portion of its current assets, or about 60% of its total assets, are made up of trade receivables and inventories. Failure to manage these could have adverse impact on VSTL’s financials.

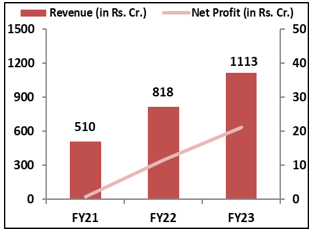

Vibhor Steel Tubes IPO Financial Performance:

Vibhor Steel Tubes IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 98.24% | 93.48% |

| Others | 1.76% | 6.52% |

Vibhor Steel Tubes IPO Outlook:

VSTL is a manufacturer of the attractive steel pipes and tubes industry. The industry is currently benefitting with less competition and maintaining a double digit growth. However, VSTL is significantly reliant on the Jindal Pipes for its revenue and company’s low operational margins remain a concern. Due to its small size, the company lacks the negotiation leverage with steel manufacturers, which eventually reduces its profit margins. Company exports to 10 other countries but under the brand Jindal Star which makes it unable to create a brand name for itself. The PE of VSTL stands at 10.6x on the upper price band which seems attractive when compared to its peer’s average of 45x. However, considering its fundamentals we recommend investors to apply only for listing gains.

Vibhor Steel Tubes IPO FAQ

Ans. Vibhor Steel Tubes IPO is a main-board IPO of [.] equity shares of the face value of ₹10 aggregating up to ₹72.17 Crores. The issue is priced at ₹141 to ₹151 per share. The minimum order quantity is 99 Shares.

The IPO opens on February 13, 2024, and closes on February 15, 2024.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Vibhor Steel Tubes IPO opens on February 13, 2024 and closes on February 15, 2024.

Ans. Vibhor Steel Tubes IPO lot size is 99 Shares, and the minimum amount required is ₹14,949.

Ans. The Vibhor Steel Tubes IPO listing date is not yet announced. The tentative date of Vibhor Steel Tubes IPO listing is Tuesday, February 20, 2024.

Ans. The minimum lot size for this upcoming IPO is 99 shares.