Urban Company Limited IPO Company Profile:

Urban Company ltd is a technology-driven, full-stack online services marketplace offering quality-focused home and beauty solutions. Its platform enables consumers to conveniently access a wide range of services, including cleaning, pest control, electrician, plumbing, carpentry, appliance repair, painting, skincare, grooming, and massage therapy. Expanding into home solutions, the company has introduced water purifiers and electronic door locks under the brand ‘Native’ and is scaling its on-demand home-help service, InstaHelp, across select micro-markets in India. Urban Company partners with a curated network of background-verified service professionals, equipping them with training, standard operating procedures, technology, tools, consumables, financing, insurance, and branding support. This model enhances service quality, ensures consistency, and improves professionals’ skills and earning potential while delivering reliable customer experiences.

| IPO-Note | Urban Company Limited |

| Rs. 98 – Rs. 103 per Equity share | Recommendation: May Apply |

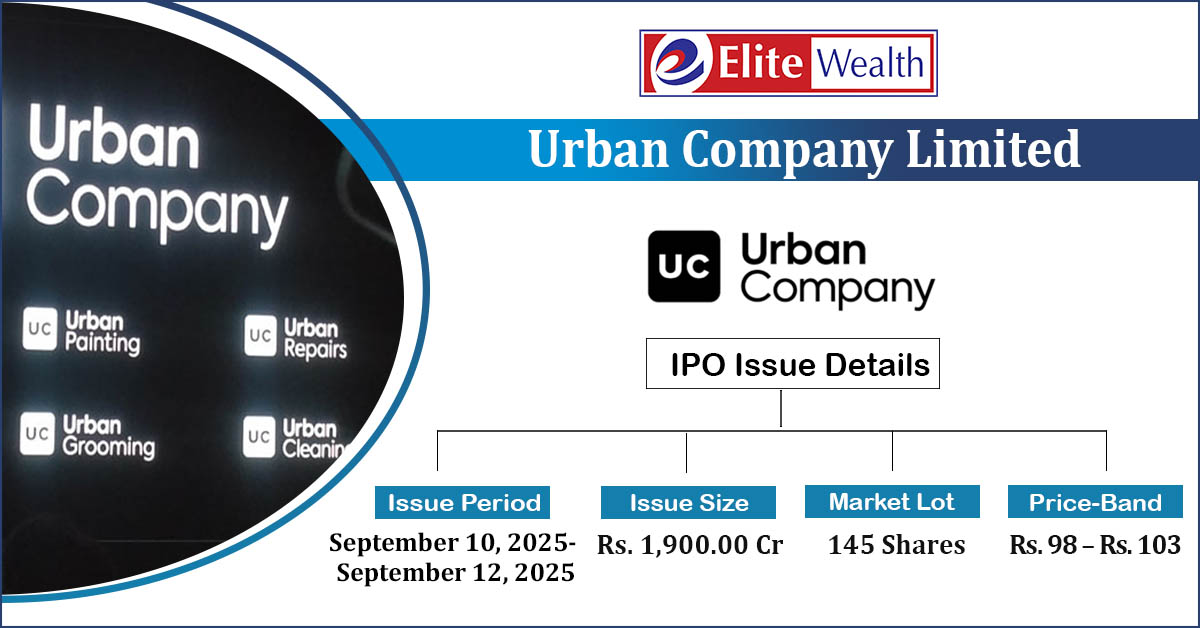

Urban Company Limited IPO Details:

| Issue Details | |

| Objects of the issue | · For new technology development and cloud infrastructure.

· Lease payments for the offices. · For Marketing Activities. |

| Issue Size | Total Issue Size-Rs. 1,900.00 Cr

Fresh Issue Size- Rs. 472.00 Cr Offer for Sale Size-Rs. 1,428.00 Cr |

| Face value |

Rs . 1 |

| Issue Price | Rs. 98 – Rs. 103 per share |

| Bid Lot | 145 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | September 10, 2025- September 12, 2025 |

| QIB | Not Less than 75% of Net Issue Offer |

| HNI | Not More than 15% of Net Issue Offer |

| Retail | Not More than 10% of Net Issue Offer |

| Employee Discount | Rs. 9 |

Urban Company Limited IPO Strengths:

- As of June 30, 2025, the company operates in 51 cities across India, the United Arab Emirates (UAE), and Singapore, excluding those served through its joint venture in the Kingdom of Saudi Arabia (KSA). Of these, 47 cities are located in India.

- It emphasizes trust, reliability, quality, and convenience throughout the consumer service journey. This commitment to consumer excellence has resulted in an average service professional rating of 4.79 out of 5.0 per service delivery for the three months ended June 30, 2025.

- For the three months ended June 30, 2025, the company had an average of 54,347 monthly active service professionals on its platform, defined as professionals who delivered at least one service in a given month.

- The company equips its service professionals with comprehensive training on its technology platform. As of 30th June 2025, the company’s training team is organized into 17 specialized categories. It operates over 247 dedicated training classrooms across 17 cities in India, ensuring widespread and consistent skill development.

- According to the Redseer Report, Urban Company was India’s most searched full-stack online home services platform on Google Trends between January 2024 and March 2025.

- As of June 30, 2025, the platform has facilitated transactions for 14.59 million unique consumers across all operating geographies since inception. Notably, 6.81 million consumers, representing 46.7% of the total, were onboarded between July 1, 2022, and June 30, 2025.

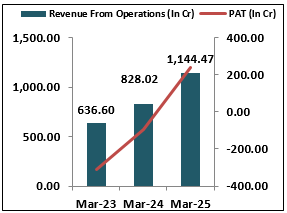

- The company reported revenue from operations of Rs 1,144.47 crore in FY25, reflecting a robust growth of 38% compared to Rs 828.02 crore in FY24. Profit after tax stood at Rs 239.77 crore in FY25, marking a significant turnaround from a loss of Rs 92.77 crore in the previous fiscal, primarily due to deferred tax adjustments. For the quarter ended 30th June 2025, the company recorded revenue from operations of Rs 367.27 crore and a profit after tax of Rs 6.94 crore.

- According to the Redseer Report, India’s home services industry presents a significant opportunity, with a total addressable market (TAM) of approximately US$60 billion in Fiscal 2025. The market is projected to grow at a compounded annual growth rate (CAGR) of 10–11%, reaching around US$100 billion by Fiscal 2030, driven by rising urbanization and increasingly busy lifestyles.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Urban Company Limited IPO Allotment Status

Urban Company Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Urban Company Limited IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Urban Company Limited IPO Risk Factors:

- The company faces intense competition from traditional offline players and online players such as Housejoy, LocalOye, NoBroker Home Services, Helpr and Easy Fix. Additionally, the relatively low penetration of online services in the markets it serves may limit demand on its platform or reduce the number of service professionals joining the platform, potentially impacting both revenues and operational costs adversely.

- Home services pricing is a direct function of the broader labor costs and demand supply dynamics. An increase in the service costs could lead to higher pricing, inversely impacting the demand for home services.

Urban Company Limited IPO Financial Performance:

Urban Company Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 21.10% | 10.78% |

| Others | 78.90% | 89.22% |

Sources: Company Website, RHP.

Urban Company Limited IPO Outlook:

Urban Company ltd is a technology-driven, full-stack online services marketplace delivering quality-focused home and beauty solutions. The company reported growth in FY25, with revenue from operations rising 38% and profit after tax increasing 358%, driven by deferred tax adjustments. It operates across 51 cities in India, the UAE, and Singapore, excluding operations in Saudi Arabia through a joint venture. With no listed peers in this segment, Urban Company enjoys a potential first-mover advantage. Since inception, the platform has facilitated transactions for 14.59 million unique consumers, supported by a strong focus on service quality, reflected in an average professional rating of 4.79/5 for Q1FY26. However, competition from traditional offline players and rising labor costs remain key challenges. At the upper price band of Rs 103, the IPO is priced at a P/E of 59.71x pre-IPO and 61.68x post-IPO based on FY25 earnings. Keeping in mind the valuations and listed factors; we recommend applying only for aggressive investors targeting listing gains and medium- to long-term investment.

Urban Company Limited IPO FAQ:

Ans. Urban Company IPO is a main-board IPO of 18,44,66,018 equity shares of the face value of ₹1 aggregating up to ₹1,900.00 Crores. The issue is priced at ₹98 to ₹103 per share. The minimum order quantity is 145.

The IPO opens on September 10, 2025, and closes on September 12, 2025.

MUFG Intime India Pvt.Ltd. is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Urban Company IPO opens on September 10, 2025 and closes on September 12, 2025.

Ans. Urban Company IPO lot size is 145, and the minimum amount required for application is ₹14,935.

Ans. The Urban Company IPO listing date is not yet announced. The tentative date of Urban Company IPO listing is Wednesday, September 17, 2025.