Udayshivakumar Infra IPO Company Profile:

Udayshivakumar Infra Limited (UIL) is engaged in the business of construction of roads and bridges, construction of Major and Minor Irrigation and canal projects, Industrial Areas, based in the State of Karnataka. The company bid for Roads, Bridges, Irrigation & Canals, Industrial Area construction in the State of Karnataka including various Government Departments. As of 31st Dec, 2022, UIL has completed 30 projects having an aggregate contract value of Rs.684.68 cr., which includes 16 roads, 5 bridges, 6 irrigation and 3 civil construction works. Also the company is executing 30 ongoing projects of an aggregate order book of Rs.853.88 cr. In addition to this, company has new work orders allotted (but work not yet started) with the order book value of Rs.436.51 cr.

| IPO-Note | Udayshivakumar Infra Limited |

| Rs.33 – Rs.35 per Equity share | Recommendation: Listing Gains |

Udayshivakumar Infra IPO details:

| Issue Details | |

| Objects of the issue | · To fund working capital requirements of the company

· For general corporate purposes |

| Issue Size | Total issue Size – Rs. 66 Cr.

Fresh Issue – Rs. 66 Cr. |

| Face value | Rs. 10.00 Per Equity Share |

| Issue Price | Rs.33 – Rs.35 |

| Bid Lot | 428 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 20th Mar, 2023 – 23rd Mar, 2023 |

| QIB | 10% of Net Issue Offer |

| Retail | 60% of Net Issue Offer |

| NIB | 30% of Net Issue Offer |

Udayshivakumar Infra IPO Financial Performance:

Udayshivakumar Infra IPO Strengths:

-

The company has strong order book of roads, bridges, flyovers and irrigation projects from Karnataka state government.

-

It has strong execution capabilities which includes in-house engineering and design team and quality control managers and quality surveyors.

-

The company has well qualified and experienced management team along with promoter having more than 25 years of experience.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Udayshivakumar Infra IPO Allotment Status

Go Udayshivakumar Infra IPOallotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Udayshivakumar Infra IPO Key Highlights:

-

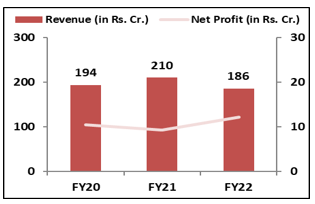

Revenue of UIL has decreased from Rs.194 Cr. in FY20 to Rs.186 Cr. in FY22 while Net Profit has increased from Rs.10 Cr. in FY20 to Rs.12 Cr. in FY22 with CAGR of 5% majorly due to reduction in the construction expenses and Finance cost.

-

Company has EBITDA margin and Net Profit margin of 13.4% and 6.5% respectively for the FY22.

-

ROCE and ROE of the company stands at 20.71% and 17.78% respectively for FY22.

-

Total borrowings of the company has decreased from Rs.33.95 cr. in FY20 to Rs.26.48 cr. in FY22.

- The net cash flow from operating activities has increased from Rs.21.42 cr. in FY20 to Rs.31.99 cr. in FY22.

Udayshivakumar Infra IPO Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoter Group | 100% | 65.93% |

| Others | 0% | 34.07% |

| Total Equity

(In Rs. Cr.) |

Pre- Issue | Post Issue |

| 78.34 | 144.34 |

Udayshivakumar Infra IPO Risk Factors:

-

The company’s business is primarily dependent in the State of Karnataka; it generate average 88% of the total revenue from the projects of Karnataka. Any adverse changes in the central and state govt. policies may lead to adverse impact on the business operations of the company.

-

Top 5 customers of the company contribute to average 67.5% of the total revenue. Loss of any such customers may have an adverse effect on the financial condition and business operations of the company.

Udayshivakumar Infra IPO Outlook:

UIL is in the business of construction of roads, bridges, irrigation & canals industrial area construction, majorly in Karnataka. The company also sale RMC and other construction material required in the construction projects. Sales of Products, Sale of Services and Revenue from Contracts contributed to 9.6%, 3.38% and 86.99% in the total revenue from operations of the company in the FY22. UIL intend to enter into joint ventures with other infrastructure companies in the industry to jointly bid and execute larger projects. Company has strong order book of over Rs.1290 cr. as of 31st Dec, 2022 and is maintaining its focus on roads, bridge and irrigation projects construction. It is also diversifying its business activities in areas of mining and toll collection. Infrastructure sector is going to rise in the country due to the significant increase in the infrastructure capex in various sectors such as roads, railways, urban infra, water supply and sanitation etc. On the basis of FY22 earnings, UIL is offering the PE of 15.95 times on the upper price band against the industry average of 19.28. Hence, we recommend only to apply for the listing gains.

Source: DRHP, EWL Research

Udayshivakumar Infra IPO FAQ

Ans.Udayshivakumar Infra IPO will comprise fresh share issue and new offer share issue. The company aims to go public to accelerate its growth and expansion plan.

Ans. The company will open for subscription on Mar 20, 2023

Ans. The minimum lot size that investors can subscribe to is 428 shares.

Ans. The Udayshivakumar Infra IPO listing date is not yet announced. The tentative date of Udayshivakumar Infra IPO listing is Apr 3, 2023.

Ans. The minimum lot size for this upcoming IPO is 428 shares.