Summary

The investment objective of the scheme is to provide returns, before expenses, that commensurate with the performance of Nifty Midcap 150 Index (TRI), subject to tracking error.

Investment Philosophy

The Tata Nifty Midcap 150 Index Fund seeks to replicate the Nifty Midcap 150 Index (TRI).

Portfolio Positioning and Construction

The index aims to replicate the Nifty Midcap 150 Index with the below methodology:

Index Construct

- Constituents Selection: The Nifty Midcap 150 includes companies ranked 101 to 250 by full market capitalization from the universe of Nifty 500.

- Weighting Methodology: Larger midcap companies have higher weights, while smaller ones have lesser weights.

- Rebalancing Frequency: March & September

Portfolio Positioning

- Midcap Exposure: Investors seeking potentially higher growth than large-caps, with relatively lower volatility than small-caps.

- Sector Diversification: Generally well-diversified across sectors such as industrials, financials, consumer goods, healthcare, IT, etc. No single sector dominates the index significantly, aiding risk management.

- Growth Orientation: Constituents typically represent emerging leaders in their sectors.

(source: https: tatamutualfund.com)

Tata Nifty Midcap 150 Index Fund NFO Details:

| Mutual Fund | Tata Mutual Fund |

| Scheme Name | Tata Nifty Midcap 150 Index Fund |

| Objective of Scheme | The investment objective of the scheme is to provide returns, before expenses, that commensurate with the performance of Nifty Midcap 150 Index (TRI), subject to tracking error. However, there is no assurance or guarantee that the investment objective of the scheme will be achieved. The scheme does not assure or guarantee any returns. |

| Scheme Type | Open Ended |

| Scheme Category | Other Scheme – Index Funds |

| New Fund Launch Date | 02-Jun-2025 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 16-Jun-2025 |

| Indicate Load Seperately | Entry Load: Not Applicable (Pursuant to provision no. 10.4.1.a of SEBI Master Circular on Mutual Fund dated June 27, 2024, no entry load will be charged by the Scheme to the investor) Exit Load: 0.25% of the applicable NAV, if redeemed on or before 15 days from the date of allotment. Goods & Service Tax on exit load, if any, will be paid out of the exit load proceeds and exit load net of Goods & Service Tax, if any, will be credited to the scheme. |

| Minimum Subscription Amount | Rs. 5,000/- |

| For Further Details Please Visit Website | https://www.tatamutualfund.com |

(source: https://www.amfiindia.com/)

Scheme Documents

(source: https: tatamutualfund.com)

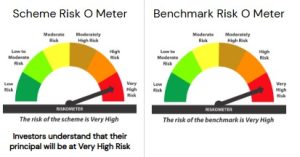

Tata Nifty Midcap 150 Index Fund NFO Riskometer:

(source: https: tatamutualfund.com)