Tanla Platforms Limited Company Profile:

Tanla Platforms Limited is a leading cloud communications provider enabling businesses to communicate with their customers, stakeholders, and intended recipients. The company’s cloud-based platforms provide ease of connectivity to enterprises and aggregators with a plug-and-play approach that shrinks delivery times of their end-user communications and continues to provide quality services that have enabled the company to rise into leadership status in the cloud communication segment of the telecom business.

Tanla Platforms Limited’s platforms are deployed with all major telecom operators in India providing it access to the entire subscriber base of the operators. The company serves enterprise customers spread across a diverse spectrum of businesses including but not limited to BFSI, social media, e-commerce, government sector, and aggregators based on multi-year contracts with an automatic renewal clause unless specified otherwise. The longevity of the contract represents the depth of the business relationship with the customers and their delight with the level and quality of the company’s services. Tanla Platforms Limited continues to add to the bouquet of its services through strategic organic growth (acquisition of Karix and Gamooga in FY 2019-20) and by launching advanced software platforms based on cutting-edge technologies like blockchain and distributed ledger technology.

Tanla Platforms Limited Details:

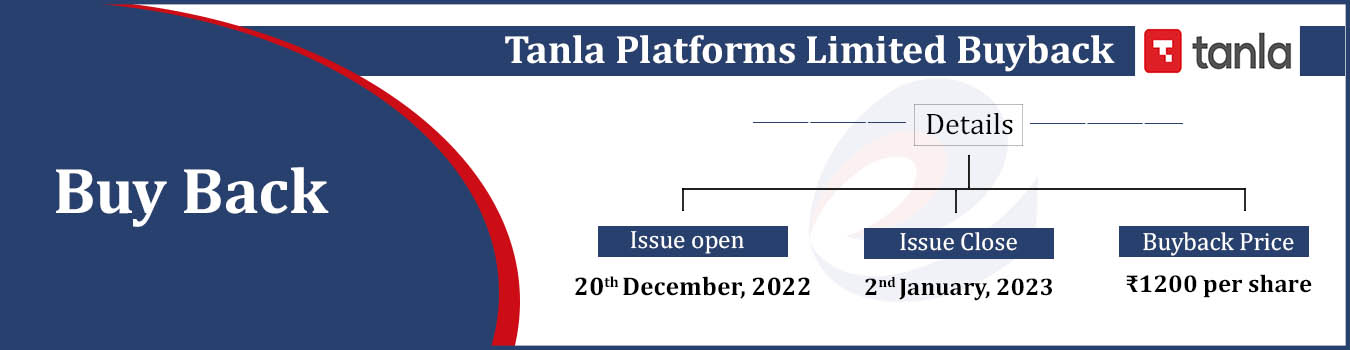

| Issue open | 20th December, 2022 |

| Issue close | 2nd January, 2023 |

| Ex-Date | 24th October, 2022 |

| Record Date | 25th October, 2022 |

| Security Name | Tanla Platforms Limited |

| Issue Type | Tender Offer |

| Issue Size (Shares) | 1,416,667 |

| Issue Size (Amount) | ₹170.00 Crores |

| Buyback Price | ₹1200 per share |

| Face Value | ₹1 per share |

| Listing At | BSE, NSE |

Tanla Platforms Limited Financial Analysis:

| Particulars | Q2 FY-23(in cr.) | Q1 FY-23(in cr.) | Q2 FY-22(in cr.) | YoY | QoQ |

| Revenue from Operations | 851.04 | 800.14 | 841.62 | 1.1 | 6.4 |

| Other Income | 11.07 | 4.49 | 3.14 | 99+ | 99+ |

| Operational Cost | 645.39 | 615.11 | 611.39 | 5.6 | 4.9 |

| Employee Cost | 38.28 | 32.52 | 33.05 | 15.8 | 17.7 |

| Connectivity and Bandwidth charges | 3.00 | 3.50 | 3.51 | -14.4 | -14.3 |

| Other expenses | 24.84 | 18.32 | 14.98 | 65.8 | 35.6 |

| EBITDA | 150.60 | 135.19 | 181.83 | -17.2 | 11.4 |

| EBITDA margin% | 17.70% | 16.90% | 21.60% | ||

| Depreciation | 10.04 | 9.28 | 10.41 | -3.6 | 8.1 |

| Interest | 0.41 | 0.32 | 0.58 | -29.1 | 26.7 |

| Profit / (loss) before tax | 140.16 | 125.58 | 170.83 | -18.0 | 11.6 |

| Total tax | 29.71 | 23.42 | 34.66 | -14.3 | 26.9 |

| Profit / (loss) After tax | 110.45 | 102.16 | 136.17 | -18.9 | 8.1 |

| Profit / (loss) After tax margin% | 12.98% | 12.77% | 16.18% |

Necessity of the Issue:

-

The Buyback will help the Company to return surplus cash to its shareholders holding Equity Shares broadly in proportion to their shareholding, thereby, enhancing the overall return to shareholders;

-

The Buyback, which is being implemented through the tender offer route as prescribed under the SEBI Buyback Regulations, would involve the allocation of the number of Equity Shares as per their entitlement or 15% of the number of Equity Shares to be bought back whichever is higher, reserved for the small shareholders. The Company believes that this reservation for small shareholders would benefit a large number of public shareholders, who would get classified as Small Shareholders;

-

The Buyback may help in improving its earnings per share and return on equity, by the reduction in the equity base and based on assumption that the Company would earn similar profits as in past, thereby leading to a long-term increase in shareholders’ value; and

-

The Buyback gives an option to the shareholders holding Equity Shares of the Company, who can choose to participate and get cash in lieu of Equity Shares to be accepted under the Buyback offer or they may choose not to participate and enjoy a resultant increase in their percentage shareholding, post the Buyback offer, without additional investment.

Profit from Tanla Platforms Limited Buyback on the bases of the acceptance Ratio:

If you Bought 166 shares at a Price of ₹ 836 on the Ex-date:

| Acceptance Ratio | 33% | 50% | 75% | 100% |

| Amount Invested in Buyback | 138776 | 138776 | 138776 | 138776 |

| No. of Shares buyback | 54 | 83 | 124 | 166 |

| Buyback Profit | 19656 | 30212 | 45136 | 60424 |

| Profit | 14% | 21% | 32% | 43% |

Registrar to the buyback:

KFin Technologies Limited

Tel No.: +91 40 6716 2222

Contact Person: M. Murali Krishna

Email: tpl.buyback@kfintech.com

Website: www.kfintech.com